The introduction of Electronic Waybills, or E-waybills, has, consequently, transformed the logistics and transportation industry by providing a digitalized, efficient method of recording the movement of goods.

However, the timely management of E-waybill expirations becomes a very important component of preserving operational effectiveness and regulatory compliance as businesses navigate the complexity of E-waybill compliance.

This comprehensive article explores the various aspects of E-waybill expiry notifications and reminders, thereby clarifying their importance concerning compliance.

Join us on this insightful investigation to see how businesses can improve overall supply chain resilience and promote compliance by integrating E-waybill expiry notifications into their operational framework, thereby enhancing overall supply chain resilience and ensuring strict compliance.

E-waybill expiry notifications and reminders

Reminders and notifications of e-waybill expiration are essential for facilitating efficient and legal goods transit. E-waybills, therefore, serve as electronic documents that act as permission from the tax authority and are necessary for the transportation of goods. Consequently, these notifications play a crucial role in ensuring compliance. Here are the key aspects related to e-waybill expiry notifications and reminders:

1.

#1. Validity of E-Waybill Expiration

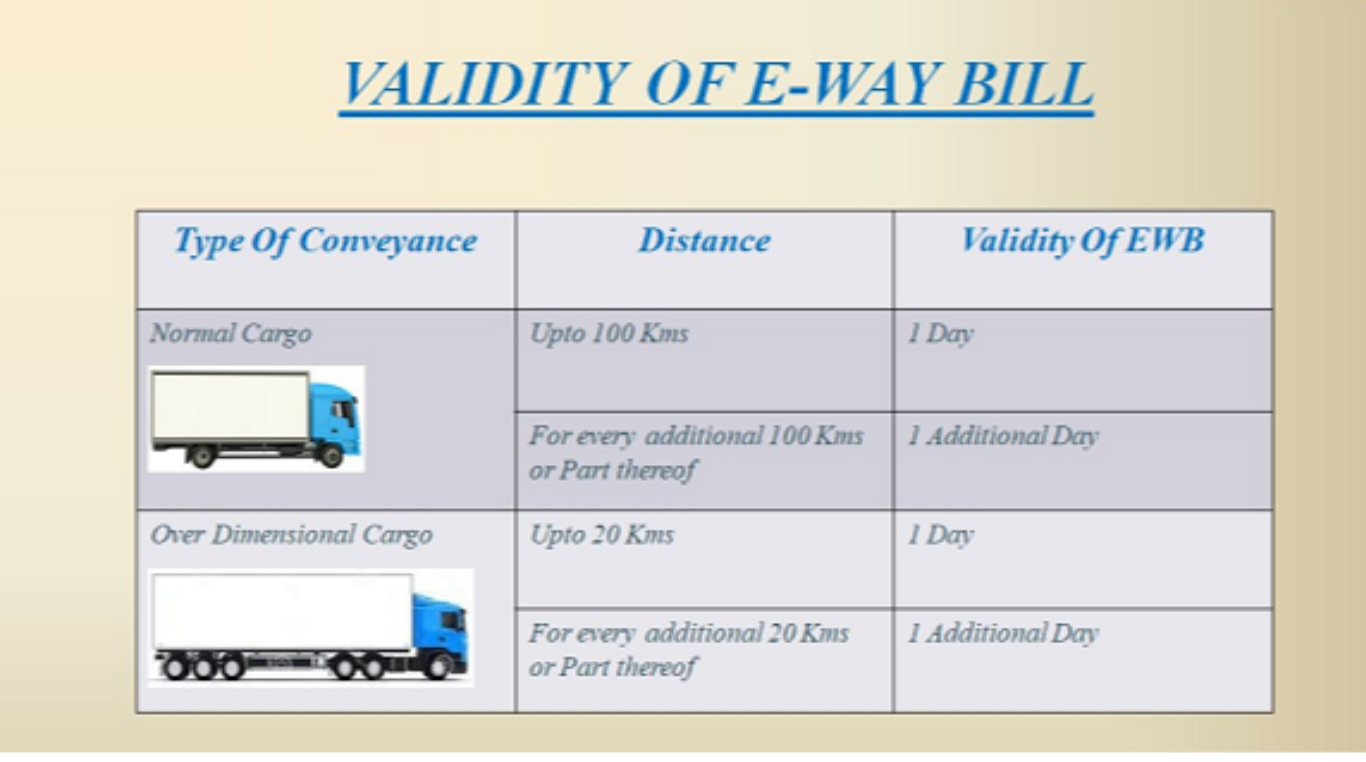

An e-waybill typically comes with a predefined validity period, during which the goods must be transported to their destination. This ensures timely delivery while maintaining compliance with regulatory requirements.

#2. Improving Communication and Efficiency

During the e-waybill generation process, the system meticulously establishes a specific time frame. This process ensures not only timely compliance but also, more importantly, smooth coordination among all parties involved. Furthermore, it promotes effective communication, thereby reducing the likelihood of delays or errors. Additionally, the predefined time frame allows for better planning, which ultimately contributes to streamlined operations and enhanced efficiency.

#3. Significance of Expiration Notifications

To avoid any delays in the transportation process, e-waybill expiry notifications are crucial. Moreover, notifications about upcoming expirations proactively alert relevant parties, thereby enabling them to take the necessary precautions to prevent compliance issues.

4. Automated Notification Software Systems

A lot of E-Waybill software systems come with automated alerting systems. These systems send out alerts to important parties well in advance of the impending expiry via-

|

|

|

#5. Advance Reminders

Notifications need to be sent out well in advance of the e-waybill expiration date. By providing this advance notification, firms, therefore, may effectively plan and carry out their transportation activities.

#6. Details Included in Notifications

Notifications typically include essential details such as the e-waybill number, its expiration date, and a prompt to take necessary actions, such as renewing it or completing the transit before the deadline. This proactive approach helps minimize disruptions, ensures that all parties stay informed, and supports seamless operations throughout the transportation process.

#7. Transport Management System (TMS) Integration

The TMS Integration feature enables smooth communication between transportation workflows and e-waybill systems. As a result, this guarantees that the entire logistical strategy and expiry notifications are in balance. Moreover, this integration helps maintain synchronization between transportation schedules and e-waybill expiration timelines.

#8. Compliance Management

E-waybill expiration notifications play a critical role in the overall compliance management process, as they help ensure timely actions, prevent potential legal issues, and maintain seamless operations. Businesses that monitor the status of their e-waybills and take prompt corrective action can avoid fines and legal problems.

Automated alerts for E-waybill expiry compliance

Automated alerts for E-waybill expiry must abide by several compliance rules to guarantee accuracy, reliability, and legal validity. Some of the key compliance considerations for implementing automated alerts for E-waybill expiry are as follows:

- Timeliness and Prior Notice: Alerts have to be generated early enough to allow enterprises to take corrective action before the e-waybill expires. In addition, timely notifications are necessary for compliance to prevent delays in the transportation process.

- Precise Information: Automatic notifications must provide precise and detailed information, including the exact e-waybill number, the expiration date, and any additional relevant details so that clarity and compliance. Consequently, notification errors may cause misunderstandings and non-compliance.

- Safe Communication: To avoid unwanted access and manipulation, alerting systems need to have safe communication routes. In addition, compliance standards necessitate encryption and other security measures to protect sensitive data.

- Integration with E-waybill Systems: Automatic alert systems need to connect to databases and E-waybill systems with ease. Moreover, this integration makes sure that the data displayed in alerts is up-to-date and in compliance with the most recent e-waybill status.

- User Authentication and Authorization: Only authorized personnel should be able to access the automated alert system. For instance, passwords and usernames are two instances of user authentication procedures that help ensure that only authorized users may manage and receive notifications.

- Data Confidentiality and Privacy: Adhering to data protection laws is crucial. Furthermore, automated alerts must adhere to data privacy rules when handling and transmitting sensitive data or obtaining user consent.

- Compliance with E-waybill Regulations: The E-waybill system’s unique rules and specifications must comply with automated alerts. Moreover, this includes considering any regional variances in regulations and the guidelines relevant to the duration of validity of e-waybills.

Legal requirements for notifying E-waybill expiry

Notification of E-waybill expiry is necessary for the smooth transportation of goods and to know the validity period of an existing e-waybill. If the e-way bill’s validity expires without any notification, it will lead to a delay in goods transportation since a new e-way bill will need to be generated.

Failure to renew e-waybills on time may lead to additional costs and effort for both the consignee and consignor. Moreover, the e-way bill expiry notifications aid in making the goods arrive at the consignee on time. As a result, this can support managing client satisfaction and establishing credibility and trust with the client.

Additionally, these notifications help prevent tax avoidance, which is another significant benefit. An electronic way bill may contribute to tax evasion if its validity continues beyond the limitation.

Consequently, the government can stop tax evasion and guarantee correct GST collection by closely monitoring the validity of the e-way bill. In addition, expiry notifications are very important in this process, ensuring compliance and minimizing risks.

Documentation for E-waybill expiry notifications

Depending on the platform or system used for E-waybill management, the details may vary. However, to handle e-waybill expiration effectively, maintaining accurate documentation is crucial.

- E-waybill Details: E-waybill number and related details, including the date of issue and the expiration date, are necessary for creating precise notifications.

- Transportation Details: Transportation, such as the mode of transport, vehicle number, and expected delivery date, helps in generating comprehensive notifications.

- Consignor and Consignee Details: Effective interaction requires the consignee’s and consignor’s contact and identification information.

- Notification Settings: It is necessary to configure any preferences or settings regarding the delivery method (e.g., email, SMS) and the timing of the alerts.

- Authentication Information: The necessary permission details or login credentials are vital if the notification system requires user authentication.

- Emergency Contact Information: Having the contact details for accountable parties or support services on hand can be helpful if there are any problems or issues.

Compliance obligations for timely renewal

Ensuring the continuous flow of goods in the supply chain requires the timely renewal of E-waybills. The validity of e-waybills, which act as electronic licenses for transporting goods.

This includes details like expiration dates, renewal steps, and compliance requirements. It reduces extra expenses by enabling firms to plan and carry out logistics operations effectively.

Timely renewal promotes dependability and trust in the supply chain by supporting regulatory compliance and facilitating the efficient operation of the entire logistics process.

Reporting requirements for E-waybill expiry compliance

Reporting requirements for E-waybill expiry compliance include keeping track of instances in which an e-way bill’s validity expires along with the steps necessary to handle unusual circumstances or transshipment scenarios.

Standard protocol states that goods should not be transported in the event of an expired e-way bill. Yet, the carrier may choose to prolong the validity period in the event of extraordinary events or the requirement for a reshipment.

You must update the justification and submit information in PART-B of FORM GST EWB-01 for e-waybill validity extension. To ensure transparency and adherence to legal requirements, the reporting procedure must precisely convey the reasoning behind the extension.

Renewing e-waybills before their expiration is essential to avoid legal consequences, maintain regulatory compliance, and minimize transportation delays.

Challenges in manaxpiry notifications

Transportation procedures may become less efficient due to various challenges associated with managing E-waybill expiry notifications. Some of the most common challenges, for instance, include the following:

- Integration Issues: The smooth integration of the notification system with the E-waybill system and other relevant databases may take time and effort. Compatibility problems could occur and compromise the precision and dependability of notifications.

- Data Accuracy: It is essential to keep the data regarding E-waybills accurate and up-to-date. Data inaccuracies may lead to incorrect notifications, which may confuse people and interrupt the supply chain.

- Communication Channels: It could be difficult to choose suitable and efficient notification channels. It is important to consider the various communication preferences of the intended recipients to guarantee that alerts are received on time.

- Exception Handling: Handling unusual situations, including situations involving transshipment, requires close attention. The reporting procedure must be transparent and compliant, and the system must have the ability to handle exceptions.

- Security Concerns: It is essential to guarantee the notification system’s security to safeguard sensitive data. The integrity of notification processes can be affected by unauthorized access or data breaches.

- Technology Dependencies: A reliance on technology brings the risk of technical problems, updates, and system outages. Maintaining the notification system’s ongoing operation is essential to delivering accurate and timely notifications.

Exemption considerations for specific cases

In some specific cases, e-waybill can be extended after the expiration of validity without any penalties or legal issues.

Some exemption cases allow for extending e-waybill validity.

|

|

Best practices for E-waybill renewal reminders

Reminders for e-waybill renewal are essential for guaranteeing adherence to transport laws and avoiding fines. To effectively handle E-waybill renewals, consider implementing the following recommended procedures:

- Set up an automatic method to remind people to renew their subscriptions. This can be done via SMS, email, or other means of contact. For instance, set automated systems to remind users well in advance of the expiration date, ensuring they have sufficient time for renewal.

- Integrate your enterprise resource planning (ERP) software with the E-waybill system. Moreover, by using pre-established criteria, this integration may automate the renewal process and send out reminders.

- Give consumers the option to personalize the reminder settings. Some companies may prefer receiving reminders more frequently to stay updated, whereas others might opt for less frequent notifications that provide more detailed information.

- Establish an organization-wide centralized monitoring system to keep tabs on the progress of E-waybill renewals. This enables prompt detection of past-due renewals and proactive handling.

- Keep a compliance calendar with all of the important dates for renewing E-waybills. In addition, this calendar should be made available to the appropriate parties to facilitate better planning. As a result, it ensures that all stakeholders are aware of deadlines and can take proactive actions.

- Make routine audits to ensure that the proper execution of the E-waybill renewal procedure is occurring. Determine any areas that require improvement and take immediate action to rectify them.

- Provide a feedback option so that users may offer suggestions for the reminder system. This can assist in improving the procedure and resolving any problems that consumers could run across.

- Stay aware of any modifications to E-waybill laws and promptly update your reminder system to reflect these changes. This ensures that your reminders remain compliant with the latest legal standards and helps maintain adherence to regulatory requirements.

Audit and verification of E-waybill expiry notifications

Audit and verification of E-waybill expiry notifications involve meticulously scrutinizing the effectiveness of the notification system to confirm that timely and accurate reminders are consistently sent to users regarding the expiration of E-waybills. Moreover, to ensure a comprehensive evaluation, consider the following key aspects in the audit and verification process:

|

|

|

|

|

Conclusion

Effectively managing e-waybill expiry notices and reminders is critically important for businesses, as it not only ensures smooth transportation operations but also helps maintain adherence to tax regulations and avoids potential legal complications. So additionally, by staying proactive with these processes, businesses can minimize disruptions, reduce delays, and uphold regulatory compliance seamlessly.

Utilizing technology advancements and putting in place a strong documentation system are essential tactics for companies looking to boost productivity and effectively negotiate the evolving field of e-waybill management.

By adopting best practices, companies can achieve operational excellence while meeting regulatory requirements.

Also Listen: CaptainBiz Ke Sath Apne Reports Ko Generate Karein

FAQs

Q1: When should I expect to receive E-waybill expiry notifications?

E-waybill expiry notifications are typically sent well in advance of the expiration date, therefore providing users with ample time for renewal. However, the exact timing may vary based on your organization’s settings and preferences.

Q2: What happens if I ignore or miss an E-waybill expiry notification?

Ignoring or missing an E-waybill expiry notification can lead to non-compliance, and may result in penalties. Therefore, it is crucial to address these notifications promptly to ensure the timely renewal of E-waybills.

Q3: Can I customize the frequency of E-waybill expiry reminders?

Yes, many systems allow users to customize the frequency of expiry reminders based on their specific preferences. Furthermore, this flexibility ensures that businesses can seamlessly adapt the notification schedule to align with their unique operational needs. Consequently, this tailored approach enhances overall efficiency and helps prevent any potential compliance issues.

Q4: How can I ensure that my E-waybill renewal process is legally compliant?

Stay informed about the latest legislative changes related to E-waybills and update your renewal process accordingly. Furthermore, regularly review and adjust procedures to align with current legal requirements.

Q5: Are there consequences for late E-waybill renewals?

Yes, delays in E-waybill renewals can result in significant penalties and disruptions to transportation operations. Therefore, it is important to prioritize timely renewals to mitigate legal risks and ensure smooth logistical processes.

Q6: Can E-waybill expiry notifications be integrated with my ERP system?

Many E-waybill systems provide robust integration options with ERP software. By seamlessly integrating these systems, businesses can not only ensure smooth data synchronization but also significantly improve the accuracy of expiry notifications. Moreover, this integration streamlines compliance processes, minimizes errors, and enhances overall operational efficiency.

Q7: What information is included in E-waybill expiry notifications?

E-waybill expiry notifications typically include details such as the expiration date, steps for renewal, and any other relevant information necessary for compliance. Therefore, clear communication is a priority.

Q8: What happens if my EWAY bill expires?

Generally, the GST Authorities, in such cases where the valid period of the e-way bill has expired, take action under section 129 of the CGST Act. As a result, they pass the order of detention and penalize accordingly.

Q9: How can technology help improve E-waybill management and notifications?

Technological advancements, such as automated reminders and ERP integration, further enhance the efficiency and accuracy of e-waybill management. As a result, businesses can significantly reduce the risk of non-compliance while improving overall operational efficiency.

Q10: What steps can I take to ensure continuous improvement in E-waybill expiry notifications?

To enhance the effectiveness of your notification system over time, it is important to regularly conduct audits, actively gather user feedback, and promptly implement corrective actions based on the findings. Furthermore, embracing technological advancements and fostering a culture of continuous improvement will ensure long-term success and adaptability.