Transporting consignments via rail, air, or ship demands meticulous coordination and compliance with specialized regulations. E-waybill systems play a crucial role in facilitating the smooth movement of goods across these diverse transport modes.

However, each mode presents unique challenges and intricacies that necessitate special provisions within e-waybill frameworks.

This article delves into the nuances of e-waybill usage for consignments transported by rail, air, or ship, exploring the specific provisions, regulations, and operational considerations essential for seamless logistics management across these varied transportation channels.

E-waybill for Rail Consignments

While transporting goods by rail, one should include the following information in the E-waybill:

| Transport document number (RR Number) |

| Date of the Transport document number |

| Approximate distance to be covered in km |

You will receive a receipt known as a Railway Receipt or RR from the railways as an acknowledgment that your goods will be transported by rail. It consists of an 11-digit number called FNR in the top left corner, which transporters use to track the status of goods.

Goods that are transported by rail are basically brought via road to the railway station. For this transportation, an e-way bill would have been already generated. Part B of the e-way bill can be updated with the RR number either before or after the journey. The update should be done before final delivery, else it will be considered invalid.

E-waybill for Air Consignments

In order to generate a valid e-way bill, the supplier or the recipient of goods has to submit part A of the form EWB 01 on the common portal i.e. Airway bill login. The following documents are needed to generate an E-waybill for goods transportation by air:

| Invoice |

| Delivery Challan |

| Airway bill number |

| Details of the supplier |

| Details of the recipient |

| Details of the transporter |

The Air India GST Invoice bill must be generated before the goods leave the airport. If the supplier has not generated the e-way bill when applicable, the transporter must generate it. Once the transport documents are received, part EWB 2 has to be updated.

E-waybill for Ship Consignments

An E-way Bill Number must be generated when there is any movement of goods. In the Bill-to and Ship-to case, although there are two invoices, the physical movement of goods takes place only once.

Thus the E-way bill is compulsory only once and could be based on either of the invoices. In the Bill-to and Ship-to, there are mainly four places and parties. The following persons and places information are required to generate an E-waybill on the portal:

| Party / Place | Meaning |

| Bill – from party and place | The person who supplies the goods |

| Dispatch- from party and place | The person from where the goods are dispatched. |

| Bill – to party and place | The person placing the order is supposed to make the payment. |

| Ship – to party and place | The person/ place who is supposed to receive the goods. |

Special Provisions of e-way bill as applicable to Railways

Below is the curated list of the special provisions of e-way bills that are applicable to railways-

- As per provisions of Rule 138 (2A), where the goods are transported by railways (whether goods train or passenger train), the e-way bill shall be generated by the registered person, being the recipient or the supplier, who shall, either before or after the commencement of movement, furnish, on the common portal, the information in Part B of FORM GST EWB-01.

- The railways are not allowed to deliver the goods unless the e-way bill required under these rules is submitted during the time of delivery.

- As per the provision of Rule 138A, a copy of the e-Way Bill is not mandatory to carry when goods are in movement by rail. However, a copy of the Invoice or Bill of Supply or Delivery Challan is to be carried for the movement of goods by rail.

- E-waybill is not required if the Railway is transporting its own goods by rail i.e. when the Railway is the Consignor of goods {Rule 138 (14)(l)}.

E-waybill for Air Freight Documentation

The below-mentioned documents are needed to generate an E-way bill for transporting goods by air:

| Invoice |

| Delivery Challan |

| Airway Bill Number |

| Details of Supplier of Goods |

| Details of Recipient of Goods |

| Details of Transporter of Goods |

Compliance Obligations for Ship Consignments in E-waybill

Below are some of the compliance obligations for ship consignments in E-waybill-

- The e-way bill portal has clarified that a suspended GSTIN cannot generate an e-way bill.

- ‘Ship’ has now been updated to ‘Ship/Road cum Ship’ so that the user can enter a vehicle number where goods are first moved by road and a bill of lading number and also the date for movement by ship.

- This aids in availing the ODC benefits for movement using ships and benefits the updating of vehicle details.

Legal Requirements for E-waybill in Multimodal Transport

Below is the list of the legal requirements for E-waybills in Multimodal transport-

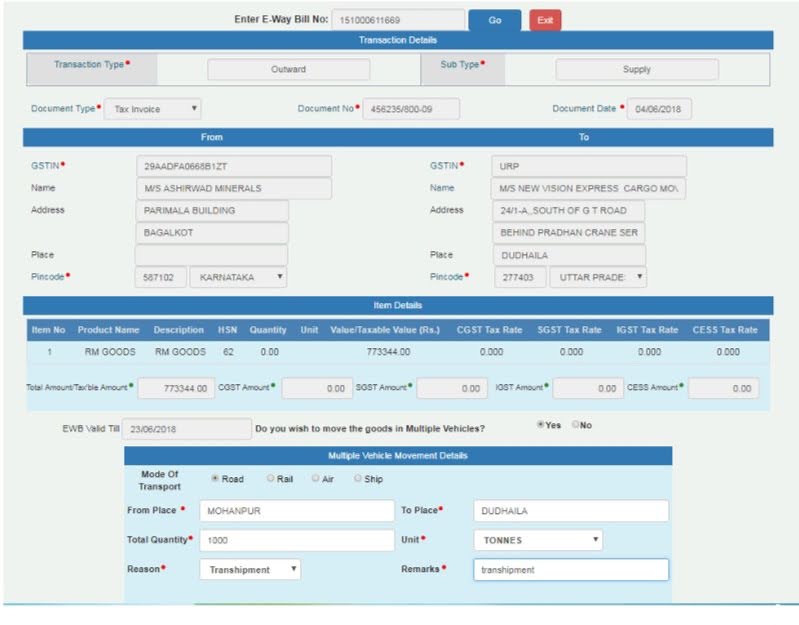

- The e-way bill is generated at first with source and destination according to the document/invoice.

- The first step is that movement is continued out from the consignment to the transshipment.

- Next, select the ‘Change to Multi-vehicle’ option, and then you must update the e-way bill for multi-vehicle movement. Here, the total quantity of the consignment and movement from and to place for the multiple vehicles requirement has to be entered.

- When the consignment has been loaded to the smaller vehicle, update the ‘Part B’ of the e-way bill with the vehicle number, with the quantity that is loaded, and move the consignment.

- Step No. 4 might be iterated until the total quantity is loaded and moved. The system doesn’t allow the quantity to be shipped in various vehicles more than what is declared while marking the e-way bill for multi-vehicles.

E-waybill for International Shipping

An E-way Bill is generated based on an invoice or any document showing the movement and the details of this document are provided in Part A along with the item details. The transportation details are included in Part B. In order to have an export transaction, the Part A and B information should be provided as given below:

Challenges in E waybill for Rail, Air, or Ship Transport

Given below is the structured list of the challenges faced in E-waybills for Rail, Air, or Ship Transport-

- Numerous invoices/delivery challans cannot be put together to generate one e-way bill. Each invoice will be taken as one consignment to generate e-way bills.

However, after generating all these EWBs, one Consolidated EWB may be prepared by the transporter for transportation purposes, if all such goods are going in one vehicle.

- Where goods are transported for a purpose other than supply, where the invoice cannot be issued, the e-way bill can be raised against any other document like delivery challan, bill of supply, etc. The value of such goods may have to be confirmed as per valuation provisions under GST.

- An e-way bill would be applicable even for the movement of goods as the courier provided the consignment value exceeds INR 50,000/-. There could be different business practices followed in the case of courier industries which need to be suitably considered for generating an eway bill.

- If the e-way bill once generated cannot be edited or changed. In such a situation, e-way bills generated with wrong information need to be canceled and generated again. The cancellation is required to be done within twenty-four hours from the time it is generated.

- If the e-way bill is once generated it cannot be deleted. If it is verified by any proper officer within 24 hours, then it cannot be canceled. Moreover, e-way bills can be canceled if either goods are not transported or are not transported as per the details given in the e-way bill.

- If the consignor fails to generate the eway bill, it may be generated by the transporter also. In case of the supply of goods by an unregistered person to a registered person, the responsibility to generate e–way bill is on the recipient.

- E-way bill must be generated even in case of movement of goods within 10 km.

Exemptions for Certain Consignments in E-waybill

E-Way Bill is not compulsory for goods of value less than Rs. 50,000 (except in cases of mandatory e-way bill provisions like the movement of Handicraft goods and movement of goods for Interstate Job work):

- If goods are transported by a non-motorized conveyance (Ex. Horse carts or manual carts).

- In case goods are transported:

- Goods transported within the notified area.

- Goods transported are transited from/ to Nepal/ Bhutan.

- If goods are being transported to a weighbridge within 20 km and again return to the place of business under a Delivery Challan (DC).

- Where Government or local authorities transport goods by rail as a consignor.

- Goods transported to/from the Ministry of Defence.

Audit and Verification of Multimodal E-waybill

Steps involved in the verification of the Multimodal E-Way bill:

Step 1: The officer appointed begins with verification of documents and/or inspection of goods.

Step 2: The person in charge of the conveyance must then produce the documents related to the goods and conveyance.

Step 3: Then the officer in charge will verify such documents, if no discrepancies are found, the conveyance is allowed to move further.

Discrepancies during verification of Multimodal E-way Bill:

Action 1: A statement of the person in charge of conveyance is recorded

Action 2: An order, needing the person in charge of conveyance to station conveyance at the place mentioned in such order and allowing inspection of goods, will be issued.

Security measures for E-waybill in Consignments by Rail, air, or Ship

Below given are some of the security measures for E-waybill in Consignments by rail, air, or Ship-

- Encryption: Make sure that e-waybill data is encrypted during transmission and storage. This protects it from unauthorized access to sensitive information.

- Digital Signatures: Execute digital signatures to authenticate the e-waybill sender and make sure the integrity of the data is maintained. This helps in verification and checks that the document has not been tampered with during transit.

- Access Control: Restrict access to e-waybill systems and data to authorized persons only. Use strong authentication processes like passwords, two-factor authentication, or biometrics.

- Tracking and Monitoring: Implement tracking systems to check the movement of consignments in real time. This comprises GPS tracking for vehicles or RFID for containers, allowing constant oversight.

- Audit Trails: Always maintain detailed logs of e-waybill activities, including who accessed the data, when, and if any changes are made. This aids in tracing any discrepancies or security breaches.”

Conclusion

In summary, e-waybill systems tailored for rail, air, or ship consignments offer vital provisions addressing specific challenges. These provisions ensure compliance, security, and efficient logistics across diverse transportation modes. Embracing these tailored measures fosters smoother operations, heightened transparency, and better regulatory adherence, crucial for enhancing the reliability of e-waybill management in modern supply chains.

FAQs

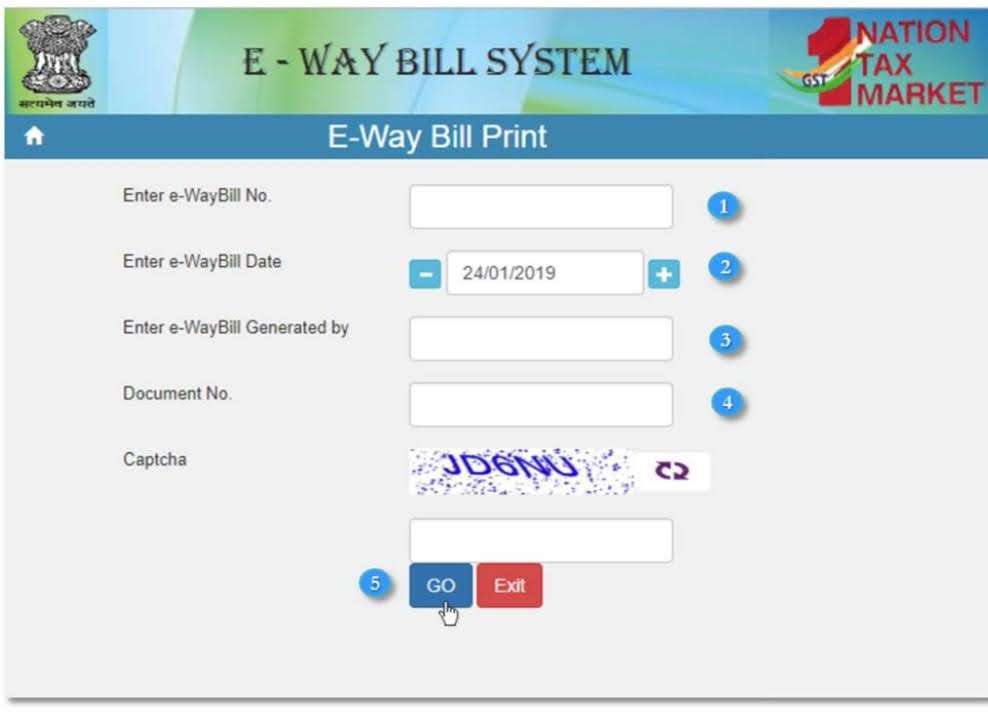

Q1.How can I generate the e-way bill?

You can generate an e-way bill through – https://ewaybillgst.gov.in/.

Q2.What is the time limit for e-way bills?

If there are regular transportation modes, for every 100 km or part of its movement, a 1-day limit has been provided.

Q3. If I have registered in the GST Portal, is it necessary to register in the eWay Portal?

Yes, need to register on the e-way Portal although you have registered on the GST portal.

Q4.What if there is a wrong entry or mistake in the e-way bill?

Rectification cannot be made on the e-way bill once it is generated. If there is a mistake you must cancel the e-way bill and generate a new one.

Q5.How long is the e-way Bill valid?

If it is less than 100 Km the validity is 1 Day and For every added 100 Km or part there is an additional 1 Day.

Q6.Is e-way Bill printout mandatory?

It is not compulsory to carry e-way bills printed out.

Q7.What is the URP in the e-way Bill?

URP means Unregistered Person. In the e-way bill, you must mention URP if a party is not registered.

Q8.What if I am unable to receive the OTP on my registered mobile number while generating the e-way bill?

If you have not received the OTP on your registered phone number, you can access the OTP sent on your registered email ID.

Q9.In which case is e-Waybill not required?

You need not generate an E-Way Bill when the value of your goods is less than ₹50,000. However, while moving handicraft goods or moving goods interstate the generation of E-Way Bills is compulsory. When the goods are transported within the state or the mentioned arena.

Q10.What is the distance rule for the eWay bill?

The e-Way bill limit period starts when the first entry is made in Part-B (Vehicle entry) or the first transportation document number entry in rail/air/ship. The time limit is not re-calculated for the following entries in Part B. The distance that can be entered in the e-way bill is 4,000 km.