Introduction

Transfer of business either through Demerger, Amalgamation, sale of business, transfer through succession etc. is a very common business transaction which takes place not only in small business entities but also in a very large business entity. In certain cases, transfer of business is also required in case of change of constitution of business, e.g., a sole proprietorship wants to continue his business in a partnership firm, conversion of partnership firm to Company, dissolution of partnership firm and conversion into a partnership firm etc. In these cases, both forms of business are separate legal entities and require transfer of business from one entity to another entity.

In case of transfer of business, all assets and liabilities can be transferred through a legal agreement and regular book entries. But what about the Input Tax Credit lying in the electronic Credit ledger (ECL) of the transferor? How can the same be transferred under GSTIN of transferee on the GST portal itself? GST Law contains a detailed provision related to implication of transfer of business and manner of transfer of Input Tax credit from one GSTIN to another GSTIN.

This article contains a detailed discussion of transfer of Input Tax Credit in case of transfer of business.

1. What happens in case of transfer of Business?

- In case of transfer of business from one entity to another entity, the entire business is transferred to another entity on a going concern basis alongwith all assets and liabilities of such business for a consideration. The business is continued by the transferee under his own name.

- Transfer can be done through amalgamation, demerger, sale or conversion from one form of business to another, succession etc..

- All assets and liabilities are removed from the books of transferor for a consideration and recorded in the books for transferee.

2. What is ITC-02 and when it is required to be filed?

- In case of transfer of business, a major issue arises is how to transfer the ITC lying under one GSTIN to another GSTIN.

- Detailed provisions related to transfer of ITC in case of transfer of business is given under Section 18 of CGST Act, 2017 read with Rule 41 of CGST Rules, 2017.

- As per Section 18(3) of CGST Act, If constitution of a registered person changes, i.e., LLP to Company, Proprietorship to Partnership etc, on account of sale, merger, demerger, amalgamation, lease or transfer of the business then transferor is allowed to transfer balance lying in Electronic Credit Ledger of the transferor to transferee.

- Transfer of ITC is allowed with the specific provisions for transfer of liabilities. Therefore, in case of transfer of business, liabilities should be transferred alongwith assets.

- Such ITC can be transferred through filing of Form GST ITC-02 on the common GST portal.

Also Read: INPUT TAX CREDIT UNDER GST

3. What are the conditions for filing of GST ITC-02 ?

As per Section 18(3) of CGST Act, 2017 read with Rule 41 of CGST Rules, transfer of Input Tax Credit is allowed subject to fulfillment of following conditions:

- The transferor as well as transferee of business should have a valid GST registration.

- The transferor is allowed to transfer ITC only if Liabilities are also transferred alongwith Assets.

- Transferor should have a balance in the Electronic Credit Ledger for the purpose of transfer. If the transferor is not having any balance lying in the electronic credit ledger then he can’t transfer any credit.

- A certificate is required to be obtained from a Chartered Accountant or Cost Accountant in practice certifying that a transaction of sale, merger, transfer etc. has been carried out in accordance with GST Law.

- In case of sale, transfer of complete business, the transferor is allowed to transfer complete balance lying in the Electronic Credit Ledger. However, in case of demerger, where only a segment of business is transferred, input tax credit shall be apportioned in the ratio of the value of assets of the new units as specified in the demerger scheme.

- ITC can be transferred through filing of GST ITC-02.

- The inputs and capital goods transferred shall be recorded by the transferee in his books of accounts.

4. What is the time limit for filing of GST ITC-02?

There is no time limit specified under GST Law for filing of GST ITC-02. However, it is suggested to file the same in reasonable time. If GST Registration of transferor is cancelled due to transfer of business, GST ITC-02 still can be filed post cancellation of GST Registration.

5. What is the action required at the part of Transferee with respect to GST ITC-02?

Input Tax Credit of transferor does not get transferred merely on the filing of GST ITC-02. Such a form is required to be accepted by the transferee as well. Procedure of filing and acceptance is discussed below in detail.

6. What Information is required to be furnished in Form GST ITC-02

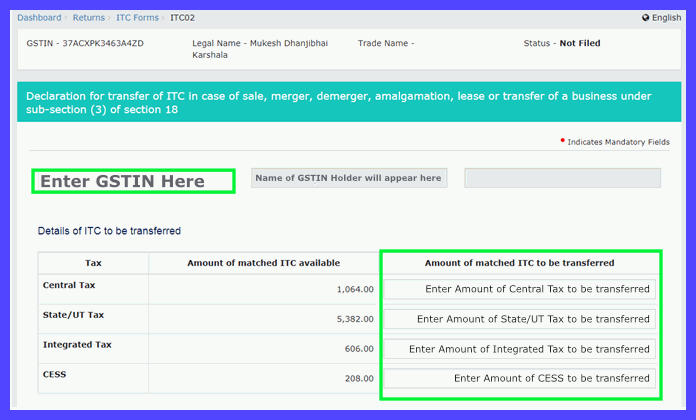

GST ITC-02 is not a very detailed form and most of the information is already pre filled such as Name of transferor, GSTIN of transferor etc. Transferor is required to furnish following information manually:

- Basic details of the transferee, i.e, GSTIN. Trade name and Legal name shall auto-populate after filing GSTIN.

- ITC to be transferred under the head of IGST, CGST & SGST. System will display the balance appearing under all heads.

- Following Detail of Chartered Accountant or Cost Accountant certifying correctness of transaction:

- Name of firm issuing the certificate

- Name of the Certifying Professional

- Membership Number

- Date of Certificate

7. What Documents are to be attached to GST ITC-02?

Transferor is required to attach a Copy of certificate chartered accountant or cost accountant. GST ITC-02 can not be filed without attaching GST ITC-02.

8. What is the procedure of filing Form ITC-02?

Detailed procedure alongwith screenshots is attached herewith for filing of Form GST ITC-02:

8.1 Form filing by transferee

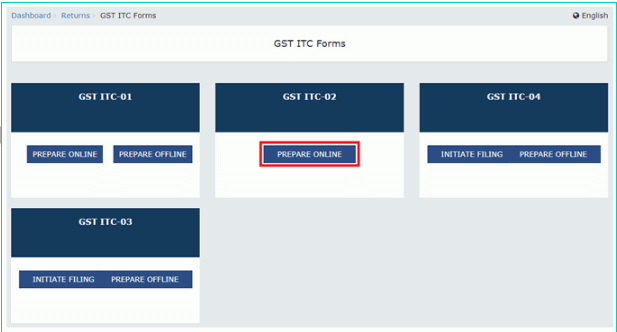

- Option to file form GST ITC-02 is available post login at the GST portal at following path:

Services>Returns>ITC forms > ITC-02 form

- click on the prepare online button on the ITC-02.

- Provide the GSTIN of the transferee and amount of ITC to be transferred under CGST, SGST, IGST and Cess. Amount available in the Electronic Credit Ledger will display under “Amount of matched ITC available”.

- Update information of the professional certifying correctness of the transaction alongwith copy of certificate.

- After entering complete information and attaching required documents, Click on the save button.

- Complete the filing process with the help of DSC or EVC and check the declaration of authorised signatory and click the button of declaration.

8.2 Acceptance by Transferee

After filing of form by the transferor, GST ITC-02 is required to be accepted by the transferee through following process:

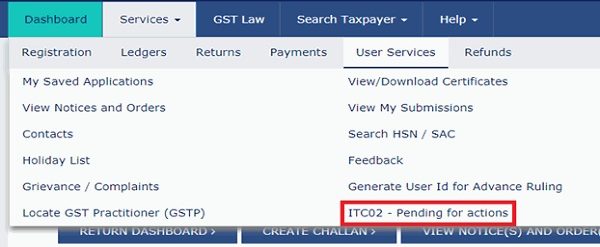

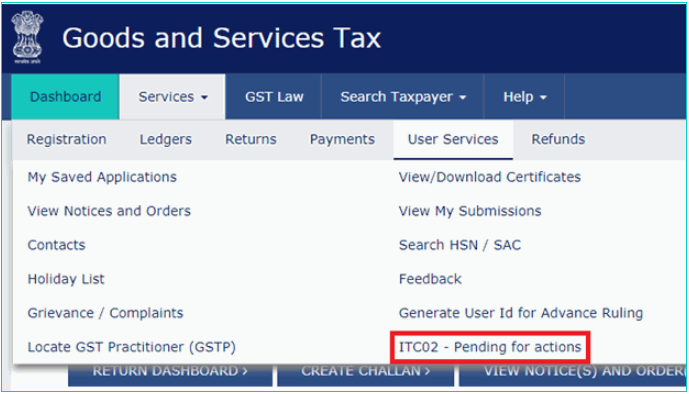

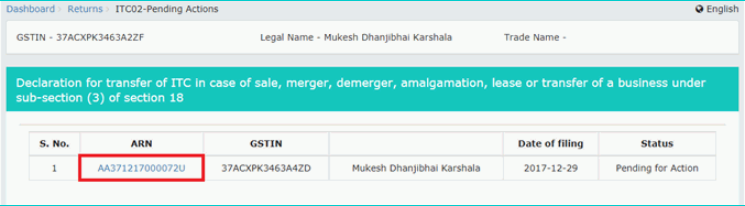

- The transferee can check the Form GST ITC-02 which is pending for his acceptance post login at GST portal at following path:

User service>ITC-02 pending for actions.

- Select the ITC-02 pending for action and system will display the ITC-02 pending for action alongwith following details:

- ARN

- GSTIN of transferor

- Legal Name

- Date of Filing

- Status

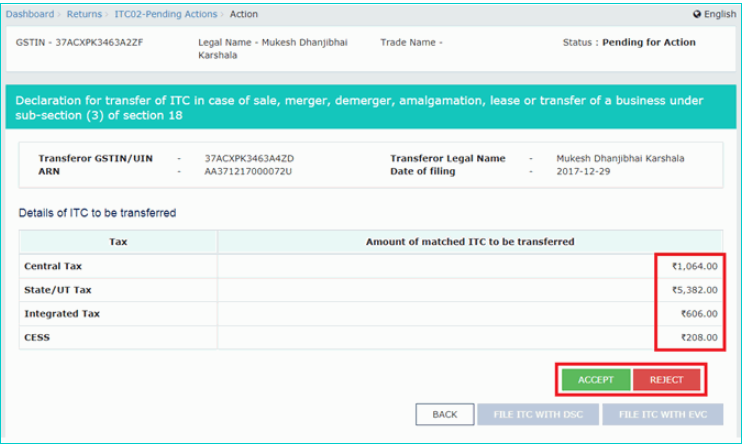

- Detailed form can be accessed by clicking on ARN.

- Post clicking, the system will show the ITC to be transferred.

- The Transferee can accept or reject the transfer.

- Upon clicking on the “Accept” button, the system will show the message about acceptance of transfer of ITC-02.

- Transferee can file the same by clicking on the declaration form and complete the filing process with EVS or DSC.

- After completion of the process, transferred ITC will start appearing in the electronic Credit ledger of the transferee and will no longer be available in the Electronic Credit ledger of the transferor.

Also Read: How to report ITC to the government?