When it comes to managing tax liabilities, understanding and correctly executing the File DRC-03 filing procedure is essential for taxpayers under the GST regime. This guide aims to simplify and clarify the DRC-03 submission process, offering step-by-step instructions to ensure compliance and accuracy in this crucial aspect of tax management.

Staying informed and following the correct procedures as per the tax regulations can save both time and resources, making the process for complying with GST compliances smoother and more manageable. Also, let’s dive deeper into the process of filing a DRC-03 and demystify this important aspect of tax compliance.

What is Form DRC-03?

Form DRC-03 is an important form in the GST regime, facilitating voluntary tax payments. This form becomes pertinent in situations where a taxpayer identifies a shortfall in tax payments after the due date for filing returns. It also serves as a proactive measure to rectify such discrepancies. Moreover, understanding the DRC-03 filing procedure, the DRC-03 submission process, and the steps to file DRC-03 is essential for businesses to maintain compliance and address any inadvertent errors in their GST payments.

Also Read: What is DRC-03?

Applicability of DRC-03

The need to file DRC-03 arises under several circumstances, including post-audit discoveries of tax shortfalls, findings during annual reconciliation processes, or in response to a show-cause notice from the tax authorities. Moreover, it’s a tool for voluntary compliance, allowing taxpayers to address underpayments or erroneous tax claims effectively.

| Situations | Description | Usage of DRC-03 |

| Post-Audit Discoveries | When a taxpayer identifies discrepancies or tax shortfalls during a post-audit process after filing returns. | Use DRC-03 to voluntarily

correct and pay the outstanding tax liabilities discovered during the audit. |

| Annual Reconciliation

Processes |

During annual reconciliation, if discrepancies or underpayments are discovered, DRC-03 can be used for correction. | Utilize DRC-03 to rectify

any discrepancies or underreported tax amounts found during the annual reconciliation process. |

| Response to

Show-Cause Notice |

When a taxpayer receives a show-cause notice from the tax authorities, DRC-03 can be used to address the issues. | Respond to the

show-cause notice by filing DRC-03 to provide explanations and rectify any tax-related concerns raised by the tax authorities. |

Steps to File DRC-03

The DRC-03 e-filing procedure is a key aspect of tax management under the GST regime. Moreover, it’s important to approach the DRC-03 e-filing steps with careful attention to ensure accuracy and compliance. The steps are clear and methodical, and following them correctly is essential for correctly addressing tax liabilities or responding to show-cause notices. Also, here’s a breakdown of the process:

Step 1: Accessing the Portal

The first step in the DRC-03 filing guide is to log into the GST portal. Once logged in, navigate to ‘User Services’ and select ‘My Applications’.

Step 2: Initiating the Process

Depending on your specific situation, you’ll encounter three cases for making a payment:

- 1st Case: No prior payment or Payment Reference Number (PRN).

- 2nd Case: PRN generated but unutilized within 30 minutes.

- 3rd Case: PRN generated but unutilized, and the taxpayer returns after 30 minutes.

Case 1: Fresh Payment

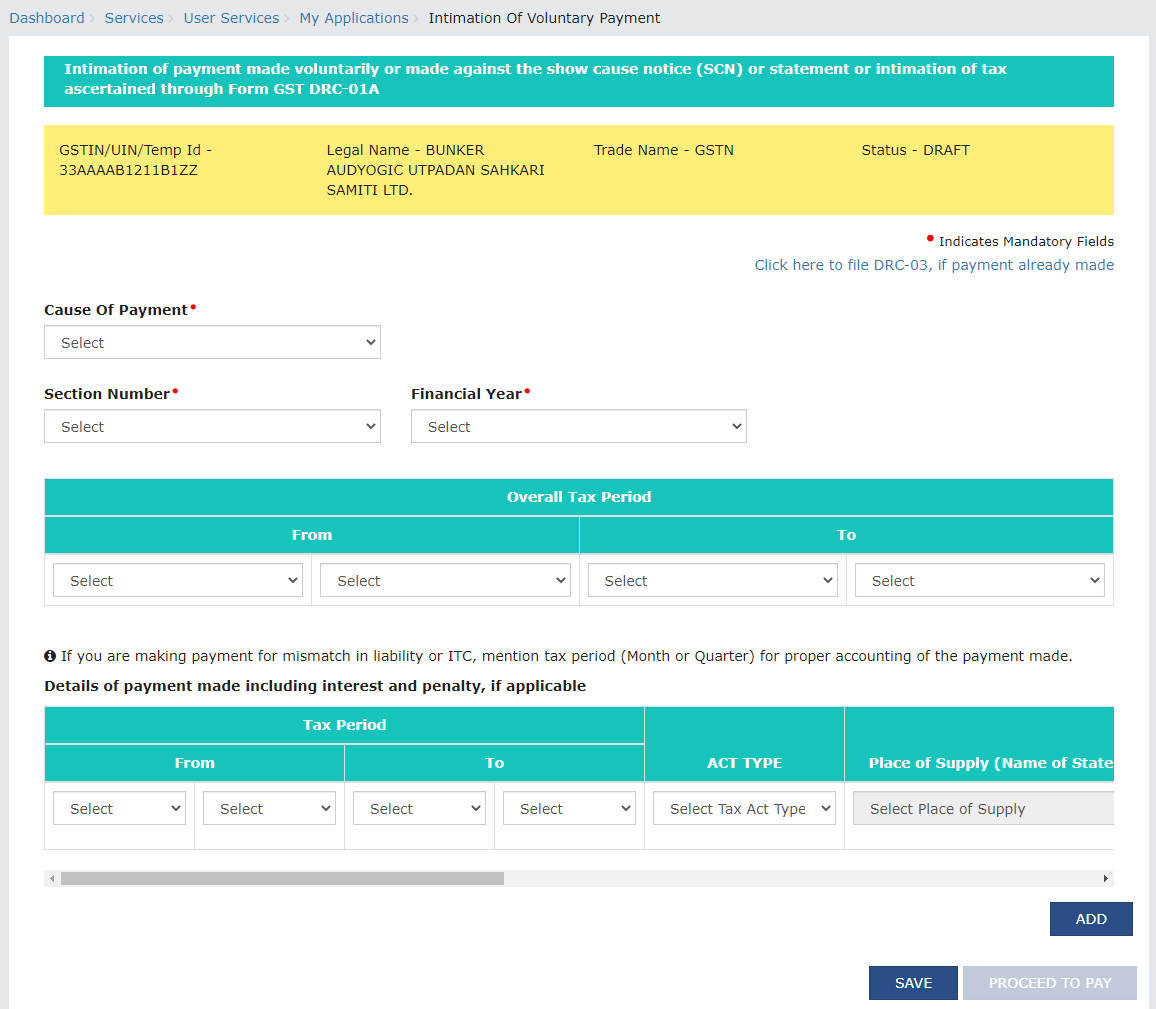

(a) Choose ‘Intimation of Voluntary Payment – DRC-03’ and start a new application.

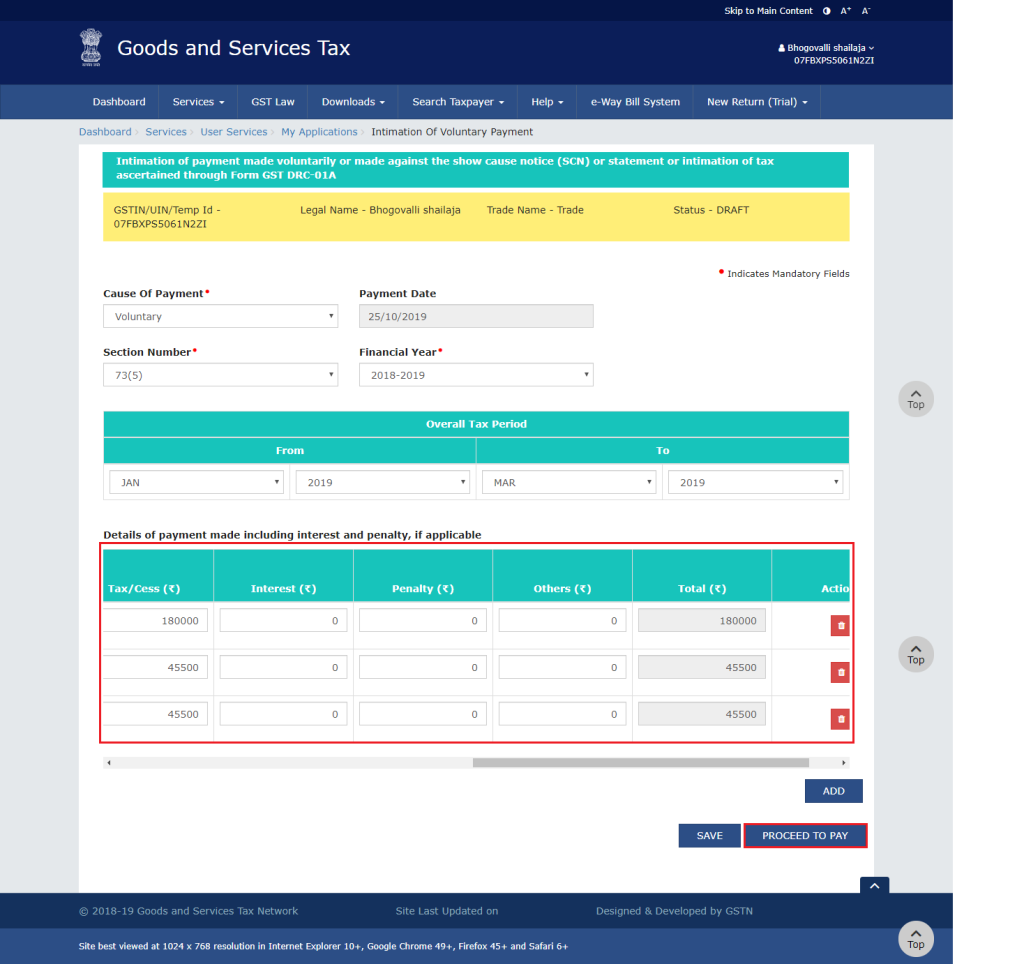

(b) Decide if the payment is voluntary or against a Show Cause Notice (SCN).

(c) Specify the relevant section, financial year, and tax period.

(d) Enter payment details, including interest and penalties if applicable.

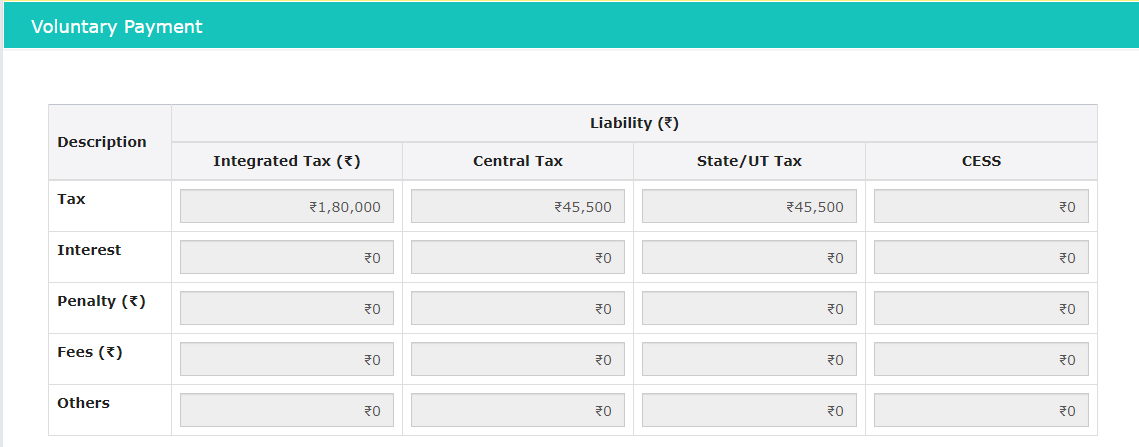

(e) Review the voluntary payment page, detailing liabilities, cash, and credit ledger balances.

(f) Confirm the payment, generating a PRN.

(g) Preview the draft DRC-03.

(h) Provide reasons, attach documents if necessary, and complete the verification.

(i) Choose your filing method (DSC or EVC) and submit.

Case 2 and 3: Continuing with PRN

(a) Follow the initial steps as in Case 1.

(b) Confirm payment and enter the PRN.

(c) For Case 2, payment details auto-populate. For Case 3, enter them manually.

(d) Preview, verify, and file the DRC-03 as in Case 1.

By following these steps, taxpayers can confidently manage their tax obligations under the GST regime. It’s important to remember that each step in the DRC-03 filing process is designed to facilitate transparency and accuracy in tax reporting, reflecting the taxpayer’s commitment to compliance and financial responsibility.

Reporting Cash Payments in GST Returns

Once the DRC-03 is submitted, the payments reflect in various GST returns:

- GSTR-3B: These are monthly returns where cash/bank payments are recorded in the electronic cash ledger. It is crucial for taxpayers to ensure that the details of any payments made via DRC-03 are accurately reflected here. This helps in maintaining a consistent and transparent record of all transactions made during the month.

- GSTR-9: This involves annual returns that may require additional tax payments, utilizing the electronic cash ledger. The payments made through DRC-03 should be reported here to reconcile annual tax liabilities. It’s important for taxpayers to review these entries carefully to ensure that all tax payments are accounted for in the annual summary.

- Demand Notices: In cases where demand notices are issued, taxpayers can utilize available Input Tax Credit (ITC), with any additional liability being paid in cash. Reporting these payments correctly in response to demand notices is crucial for compliance. This ensures that we settle all liabilities as per the notice and update the records on the GST portal accordingly.

These steps are crucial for maintaining accurate and compliant GST records, and the correct reporting of DRC-03 payments in these returns is a vital part of this process.

Also Read: Understanding The Components Of GSTR-9

What Happens After Filing DRC-03?

After you have successfully filed DRC-03, several important steps follow to ensure the resolution of the tax-related matters:

- Status Update: Once you have submitted DRC-03, the status of the form typically changes to “Pending for approval by Tax officer.” This status indicates that your submission is under review by the tax authorities.

- Acknowledgment in GST DRC-04: You will receive an acknowledgment in the form of GST DRC-04. This acknowledgment serves as confirmation that your voluntary payment or rectification request has been received by the tax authorities. It acknowledges the initiation of the process.

- Tax Officer Review: The tax officer will review the details provided in DRC-03. This review includes a thorough examination of the reasons for the voluntary payment or rectification, as well as any supporting documentation you may have provided.

Further Matters

- Further Communication: Depending on the nature of your submission and the findings during the tax officer’s review, there may be additional communication between you and the tax authorities. They may seek further clarifications or documentation to support your case.

- Order in Form DRC-05: The process concludes with the issuance of an order in Form DRC-05. This order outlines the decision made by the tax authorities based on the information and documentation provided in DRC-03 and any subsequent communications. If your voluntary payment or rectification is accepted, the order will confirm the resolution of the matter. In cases where further actions are required, the order will provide instructions or decisions accordingly.

It’s important to note that the timeline for this process can vary depending on the complexity of the case and the workload of the tax authorities. Timely communication and cooperation with the tax officer can help expedite the resolution of the matter. Moreover, after receiving the order in Form DRC-05, it’s essential to carefully review it and take any necessary actions as per the instructions provided. This also ensures that we effectively address and resolve your tax-related issues in compliance with GST regulations.

Conclusion

Understanding the DRC-03 filing procedure is also crucial for maintaining compliance within the GST framework. Moreover, this guide provides a clear roadmap for the DRC-03 submission process, ensuring that taxpayers can fulfill their obligations with confidence and accuracy. Remember, staying informed and proactive in tax matters is the key to hassle-free compliance.

Frequently Asked Questions (FAQs)

-

What is the DRC-03 filing procedure?

The DRC-03 filing procedure involves voluntarily declaring and paying tax liabilities through the GST portal. Taxpayers use it when they identify tax discrepancies post-return filing or in response to a show-cause notice. This procedure is also crucial for maintaining compliance with GST regulations and avoiding potential penalties.

-

How to submit DRC-03?

The DRC-03 submission process requires logging into the GST portal, selecting ‘Intimation of Voluntary Payment – DRC-03’, and following the steps to declare and pay the tax due. This process is streamlined to ensure ease of use for taxpayers, allowing them to manage their tax liabilities effectively.

-

What are the essential steps to file DRC-03?

To file DRC-03, log into the GST portal, select ‘Intimation of Voluntary Payment – DRC-03’, input payment details, and submit. Also, ensure accuracy in declaring the tax period, the amount of tax, interest, and penalty, if applicable. Moreover, the process concludes with the generation of a Payment Reference Number (PRN).

-

Is there a comprehensive DRC-03 filing guide available?

A comprehensive DRC-03 filing guide is available on the official GST portal. This guide also offers detailed instructions, including how to navigate the portal, fill out the form, and understand various payment scenarios, ensuring a smooth and accurate filing process.

-

What are the DRC-03 e-filing steps?

The DRC-03 e-filing steps start with logging into the GST portal, selecting ‘DRC-03’ under ‘User Services’, filling in tax details, and completing the payment. Ensure you choose the correct reason for payment, whether voluntary or in response to an SCN, for accurate processing.

-

How do I submit DRC-03 online?

To submit DRC-03 online, access the GST portal, navigate to ‘User Services’, select ‘DRC-03’, and complete the form with all necessary details. Therefore, confirm the tax period and tax liability, and make the payment through the electronic cash ledger or credit ledger, as applicable.

-

Can DRC-03 be filed for voluntary tax payments?

Yes, DRC-03 is primarily for voluntary tax payments, enabling taxpayers to rectify any discrepancies in tax liabilities discovered after the return filing deadline or in cases where a show-cause notice has been issued by tax authorities.

-

What should I do if I receive a show-cause notice for tax underpayment?

In response to a show-cause notice for tax underpayment, you should also promptly file DRC-03 through the GST portal. This also involves declaring the tax due, including any applicable interest and penalties, and making the payment to comply with GST regulations.

-

Are there different cases for DRC-03 payment submission?

Yes, the DRC-03 payment submission can vary based on the taxpayer’s situation. These also include scenarios like making a payment without a PRN, with an unutilized PRN within 30 minutes, or after 30 minutes of PRN generation. Moreover, each scenario has specific steps to follow on the portal.

-

What happens after I file the DRC-03 form?

After filing DRC-03, the form’s status updates to “Pending for approval by Tax officer”. The taxpayer then receives an acknowledgment in GST DRC-04. Moreover, the tax officer usually concludes the process by issuing an order in Form DRC-05, finalizing the payment and the compliance process.