All goods and services subject to taxation in India are classified using an international classification system. Harmonized System of Nomenclature or HSN is the system that aids in the classification of commodities, thus ensuring goods and services similar in nature are correctly classified.

HSN and SAC System

The HSN system internationally standardizes names and numbers to classify goods for customs purposes. In the system, over 5,000 products are classified using a 6 to 8-digit uniform code, making it easy to define the commodities in a structured manner.

Developed by the World Customs Organization, the classification system removes ambiguity and facilitates international trade and investments between countries. In India, the system is crucial as it helps customs officials determine the applicable tariffs and taxes on imported and exported goods.

Businesses and individuals engaged in service export must understand and apply the correct Service Accounting Code (SAC). The SAC code system is essential when dealing with mixed supply composite supply and contracts for work services. The system lists the code instead of the HSN code when dealing with professional services or rental lease services.

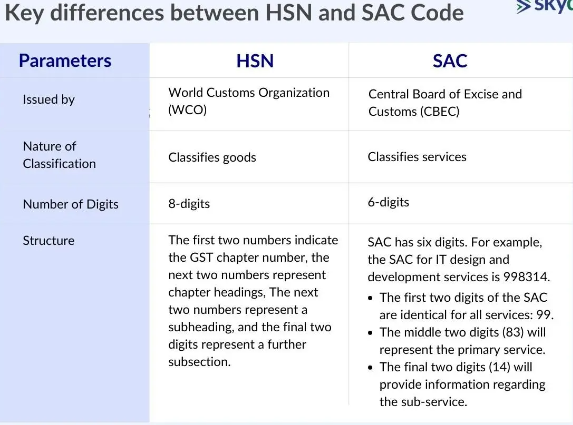

While HSN codes are used in the classification of goods, SAC codes are used for services. The two have distinct differences, which include:

Understanding the Service Accounting Code

The Central Board of Indirect Taxes and Customs (CBIC) introduced the Service Accounting Code as its official nomenclature. This system identifies services and determines the associated GST rates, integrating with the HSN code system for customs purposes. As a result, businesses use SAC codes to classify services and assess GST applicability across India.

Under the SAC system, authorities have set fixed GST rates in five slabs: 0%, 5%, 12%, 18%, and 28%. Additionally, every tax invoice must include the HSN code for sold products and the SAC code for rendered services.

The SAC code has six digits, with the first digit always 99, which details the chapter under which the services fall. The second two digits describe the primary service, while the last two provide information regarding the subservice.

Also Read: GST Rates and SAC Code on Construction Services

To determine the correct HSN code for a service, you need to follow these steps:

Any service provider looking to navigate the complexities of business compliance while rendering services should be able to identify the appropriate HSN or SAC code accurately. The codes are essential for classifying the services, understanding the tax implications and ensuring seamless international trade.

Every tax invoice under GST should have the SAC codes declared by the taxpayer.

Below are some steps for determining the correct SAC code depending on the transacted services.

Identify the Chapter and Section

The HSN classification system has 21 sections and 99 chapters with titles that describe the broad category of foods and services. To identify the chapter and section of a particular good or service, follow the following steps

- Step 1: Log in to the GST portal.

- Step 2: On the dashboard, select ‘Services’, then ‘Registration’, then ‘Amendment of Registration Non-core fields’.

- Step 3: Next, choose the ‘Goods and Services’ tab.

- Step 4: Click on the ‘Goods’ tab.

- Step 5: Search for the relevant HSN chapter by entering the HSN code or item name.

Find the Heading and Subheading

Once you determine the relevant chapter of the item or service, try finding the heading and subheading in more detail. Headings and subheadings with codes of four to six digits are used to divide each chapter

While browsing the headings and subheadings, settling on the SAC code that represents the service’s details in question is essential. For instance, there are specific subheadings for software development services.

Factors to Consider in Determining Appropriate SAC Code

Below are some actors to consider in determining the appropriate SAC code for the services rendered.

Nature of Services

A clear understanding of the core elements and features of services rendered is vital to identify the correct SAC code. For instance, one must recognize the primary services, i.e. software development, IT consulting, cloud computing or software maintenance.

Businesses engaged in software development should detail whether they engage in web development, app development, or enterprise software development.

Analyse Industry Specific Guidelines

Every service comes with categorization depending on the features and applications. Therefore, one must understand the industry-specific guidelines related to the services. Consulting relevant groups, industry forums, and government publications is a sure way of gaining insights on suitable categorization.

Seek Professional Guidance

Getting professional guidance adds a degree of assurance on the appropriate service categorization on the SAC code. One can consult tax advisors, chartered accountants, or specialists in GST legislation and SAC codes.

Understanding the HSN Code

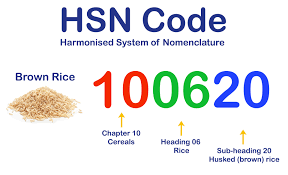

In the HSN classification system, there are 21 sections with 99 chapters, around 1,244 headings, and 5,224 subheadings. Sections are divided into chapters, which are divided into headings, which are divided into subheadings. The sections and chapters come with titles that describe broad categories of products. Heading and subheadings describe the various products in detail.

While the HSN code consists of 6 digits, i.e. (10.06.20), the first two digits detail the chapter number of the product under classification (10). The following two digits (06) detail the heading number for the handkerchiefs. Finally, the last two digits (20) detail the product, in this case, textile handkerchiefs

India has two additional numbers on the HSN code for detailed classification—the final two-digit detail the tariff name for customs purposes. For instance, for a manmade handkerchief, the last two digits will be 10. Therefore, the HSN code will be 10.06.20.

Determining HSN Code by Product Name

Step 1: Log in to the GST Portals Home Page.

Step 2: Navigate to the HSN code in GST Portal homage and sign in with your credentials. Select Services, User Services, and Search HSN from the menu.

Step 3: Type the product name you wish to get the recommendation of the most relevant 4 digit HSN code.

Step 4: If the search result does not contain the right HS code, click on the 4-digit code and 6 codes to get details for export and import purposes.

Also Read: What Is An HSN Code?

How HSN Code Works in India

The HSN code system is designed to bring every Indian trader to par with the international scheme. The system ensures smooth transactions and international exchange of god’s commodities and services.

- If a business turnover is less than Rs. 1.5 crores, there is no need to adopt the HSN codes

- If a business has a turnover of more than 1.5 crores rupees and less than five crores it must adopt the 2-digit HSN code for goods.

- If a business turnover is more than Rs 5 crores, it must adopt the 4 digit HSN code.

- Businesses engaged in imports and exports must adopt an 8 digit HSN code.

Also Read: How Do HSN Codes Work?

Who Needs HSN and SAC Codes

HSN and SAC Codes are designed to make Goods and Services Tax systematic and globally accepted. They do so by removing the need to uphold detailed descriptions for goods and services, saving time and making filling easier. The classification system comes in handy for various people.

- Importers and Exporters rely on the HSN codes for customs declarations during international trade.

- Tax Authorities use the systems in tax assessment and determining applicable rates.

- Businesses rely on the HSN and SAC codes to file tax returns accurately

- Regulatory bodies use the codes to monitor and control specific product and service categories

- HSN Codes come in handy in streamlining inventory management and logistics

- In International Trade Agreements, HSN Codes help standardize the classification of trade agreements