Introduction

The Harmonized System of Nomenclature (HSN) designations serve as a standardized product classification system essential to international trade. The World Customs Organization (WCO) created and maintained HSN codes with alphanumeric identities linked to various commodities, enabling a smooth international exchange of traded goods. These identifiers, which usually consist of six digits, facilitate effective communication between commercial partners, improve transparency, and expedite customs operations.

HSN codes are a crucial part of the tariff and customs environment since they help with precise classification, guaranteeing that every product is recognized consistently throughout borders. Businesses involved in international trade must have a basic understanding of HSN codes since they affect regulatory compliance, customs duties, and cross-border operations’ effectiveness.

What is an HSN Code?

HSN code is the short form of the Harmonized System of Nomenclature. It is a system which is applied all across the world for systematic classification of goods. It is a six-digit uniform code for over 5000 products, accepted globally. It has been in effect since 1988 when WCO, or the World Customs Organization, first introduced it.

What is the Importance of HSN Code?

India and other countries globally have been using HSN Codes for an extended period. However, after implementing GST in India, HSN and globally recognized import and export codes have also been embraced. Besides the systematic classification of goods, the HSN code’s most essential purpose is to simplify the customs process and minimize cost.

Moreover, these HSN codes also assist the taxpayers in knowing and understanding the GST rates associated with a particular commodity. Hence, the government has made writing the HSN codes in the GSTR forms mandatory.

HSN Code Current Requirements

Effective the 1st of April 2021, the CBIC has changed how the HSN codes will be reported in the GSTR forms. The table below will help you understand the requirements:

| Sr. no. | Annual Turnover (in the preceding financial year) | HSC Code digits |

| 1 | Up to INR 5 crores | B2B tax invoices – 4 digits (mandatory)

B2CS tax invoices – 4 digits (optional) |

| 2 | More than INR 5 crores | B2B and B2CS tax invoices – 6 digits (mandatory) |

Explanation of HSN Codes – Understanding its Structure

To understand how HSN code works, it is necessary to know its structure. Let’s look at it below:

- There are a total of 21 sections overall in HSN codes.

- These 21 sections are further divided into 99 chapters. These chapters are specific to a category of product.

- All these 99 chapters are later classified as headings, sub-headings and tariff items.

- If the HSN code is for eight digits – the first two digits will be the chapter, 4th digit will be the heading, the sixth digit will be the subheading, and 8th digit will be the tariff items.

Example of HSN Code

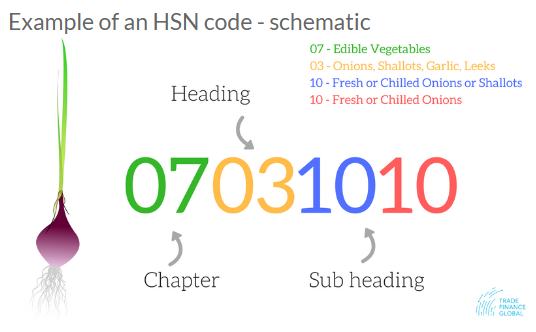

Here is an example of a vegetable identified and classified as per HSN codes:

In the above example, the first two numbers or digits- 07 describe vegetables (chapter). The following two (03) digits describe which vegetable (heading). The following two (10) are the sub-headings referring to the various options within the main heading. Finally, the last (10) refers to the tariff items, which are fresh or chilled onions.

HSN Code and Product Identification

Let’s look at the different HSN Codes associated with the various products for your reference and understanding. These are listed under various chapters, along with their product classification, which will be helpful in the GST filing.

| Chapter | Product Classification |

| Chapter 1 | Live animals and poultry |

| Chapter 2 | Animal meat and edible offals |

| Chapter 3 | Fish, filets, and other aquatic animals meat |

| Chapter 4 | Honey, eggs, and dairy products |

| Chapter 5 | Inedible animal products |

| Chapter 6 | Flowers, live trees and plants |

| Chapter 7 | Vegetables |

| Chapter 8 | Fruits |

| Chapter 9 | Tea, coffee, spices |

| Chapter 10 | Cereals and grains |

| Chapter 11 | Milling industry products |

| Chapter 12 | Medicinal plants, seeds, and fruits |

| Chapter 13 | Lac, gums, resins, vegetable SAP and other extracts |

| Chapter 14 | Vegetable products and materials |

| Chapter 15 | Oils, fats, vegetables, and animal products |

| Chapter 16 | Fish and aquatic vertebrates meat (Prepared/Preserved) |

| Chapter 17 | Sugar, sugar confectionery, and bubble gums |

| Chapter 18 | Cocoa and cocoa products |

| Chapter 19 | Pastry, waffle, pizza, breads |

| Chapter 20 | Fruits, jams, juices, and jellies |

| Chapter 21 | Tea, coffee, and other edible preparations |

| Chapter 22 | Spirit and vinegar, non-alcoholic beverages |

| Chapter 23 | Residual starch products, meals, and pellets |

| Chapter 24 | Tobacco and its products |

| Chapter 25 | Salts and marbles |

| Chapter 26 | Mineral ores and concentrates |

| Chapter 27 | Coal, petroleum, and other fossil fuels |

| Chapter 28 | Gasses and inorganic chemicals |

| Chapter 29 | hydrocarbons |

| Chapter 30 | Blood and pharma products |

| Chapter 31 | Fertilizers and unspecified products |

| Chapter 32 | Coloring and Tanning products |

| Chapter 33 | Cosmetics and oils |

| Chapter 34 | Soaps and waxes |

| Chapter 35 | Glues and enzymes |

| Chapter 36 | Industrial explosives and fireworks |

| Chapter 37 | Photographic and cinematographic goods |

| Chapter 38 | Chemical and clinical waste |

| Chapter 39 | Plastic products |

| Chapter 40 | Rubber and rubber products |

| Chapter 41 | Skins and rawhides |

| Chapter 42 | Leather products – bags, handbags and wallets |

| Chapter 43 | Raw and artificial fur products |

| Chapter 44 | Wood products and wood charcoal |

| Chapter 45 | Natural and shuttlecock cork |

| Chapter 46 | Basketware of esparto or other plaiting materials; wickerwork and manufacturers of straw |

| Chapter 47 | Wood pulp |

| Chapter 48 | Paper, newsprint, paperboard |

| Chapter 49 | Newspaper, printed books, and postal goods |

| Chapter 50 | Silk |

| Chapter 51 | Fine wool or coarse animal hair; woven fabric and horsehair yarn |

| Chapter 52 | Cotton |

| Chapter 53 | Paper yarn and it’s woven fabrics and other vegetable textile fibers |

| Chapter 54 | Man-made filaments |

| Chapter 55 | Man-made staple fibers |

| Chapter 56 | Cables, ropes, felt and nonwovens, cordage, wadding, special yarns, twine, and articles thereof |

| Chapter 57 | Textile floor covering and carpets |

| Chapter 58 | Lace, fabric and tufted textile, trimmings, tapestries, embroidery |

| Chapter 59 | Special woven fabrics, coated and laminated textile fabrics |

| Chapter 60 | Knitted or crocheted fabrics |

| Chapter 61 | Accessories of clothing knitted or crocheted and articles of apparel |

| Chapter 62 | Clothing accessories that are not knitted or crocheted & articles of apparel |

| Chapter 63 | Other textile articles, sets, worn clothing and rags, worn textile articles |

| Chapter 64 | Footwear, gaiters, and parts of such articles |

| Chapter 65 | Headgear parts |

| Chapter 66 | Walking sticks, umbrellas, and accessories |

| Chapter 67 | Artificial flowers, wigs, and false beards |

| Chapter 68 | Plaster, cement, construction materials, and mica |

| Chapter 69 | Ceramic products and bricks |

| Chapter 70 | Glass and glassware products |

| Chapter 71 | Silver, gold, diamonds, and other valuable metals |

| Chapter 72 | Steel, iron, iron rods, and non-alloy products |

| Chapter 73 | Iron tubes, railway tracks, nails, containers, needles, and sanitary wares |

| Chapter 74 | Copper and copper alloy products |

| Chapter 75 | Nickel and nickel alloy products |

| Chapter 76 | Aluminum and aluminum products |

| Chapter 77 | Not specified and reserved for future |

| Chapter 78 | Sheets, lead, and lead foils |

| Chapter 79 | Zinc dust, bars, and sheets |

| Chapter 80 | Tin bars, tin, and profiles |

| Chapter 81 | Cobalt, magnesium, bismuth, and other base metals |

| Chapter 82 | Cutlery, agricultural tools, knives and razors |

| Chapter 83 | Padlocks, bells, safe deposit lockers, and base metal products |

| Chapter 84 | Industrial tools and machinery |

| Chapter 85 | Electronic and electrical products |

| Chapter 86 | Locomotives and railway machinery |

| Chapter 87 | Motor vehicles |

| Chapter 88 | Satellites, aircraft, and parachutes |

| Chapter 89 | Ships, boats, and cargo vessels |

| Chapter 90 | Artificial organs, medical equipment, monitoring systems, photographic and cinematographic accessories, lenses, and optical fibers |

| Chapter 91 | Clocks and watches |

| Chapter 92 | All musical instruments |

| Chapter 93 | Army and military weapons |

| Chapter 94 | Furniture, lighting, and household products |

| Chapter 95 | Sports goods, electronic toys, and gaming consoles |

| Chapter 96 | Pencils, pens, educational equipment, and smoking pipes |

| Chapter 97 | Arts and antiques |

| Chapter 98 | Passenger bags, project imports, and laboratory chemicals |

| Chapter 99 | Services |

Bottom Line

In summary, the smooth operation of customs and international commerce operations depends on the functionality of HSN codes. HSN codes facilitate unambiguous communication about the type of commodities being exchanged by offering a defined, hierarchical classification system. These standards’ methodical approach streamlines the customs process, improves openness, and guarantees uniformity in calculating taxes and charges.

Companies that do business internationally need to understand the importance of HSN codes since proper categorization helps with regulatory compliance and speeds up cross-border transactions. As a developing system, HSN codes are still essential for enabling practical and transparent international trade and encouraging a uniform method of classifying commodities in the world market.

Also Read:

Reporting HSN Codes In GSTR – 9: Procedure Requirements And Penalties

New GST Rates 2023 – List Of Latest Goods And Service Tax Rates Slabs

GST Rates And SAC Code On Construction Services

FAQs

-

Is there any rule regarding the HSN code?

All taxpayers with a turnover of INR 5 crores must write 4-digit HSN codes in the GSTR forms.

-

What will happen if someone enters an incorrect HSN code?

Every taxpayer must record the correct HSN code on their tax Invoices and GSTR-1. It is essential to mention the HSN correctly in GST returns and tax invoices to avoid a penalty of Rs 50000 (Rs 25000 under CGST and Rs 25000 under SGST).

-

What does the eight-digit HSN code mean?

An HSN code’s chapter is determined by its first two digits, headings at the four-, subheadings at the six-, and tariff items at the eight-digit positions.

-

How are the different products classified as per HSN codes?

Every chapter has an HSN number that is two digits long. Every two-digit HSN number is subclassified to produce a four-digit HSN code. These four-digit HSN codes are subsequently further subdivided into six-digit HSN codes.

-

Who needs to use HSN codes?

Every taxpayer with an annual turnover of over five crores must use HSN codes in their GST returns.

-

Are there any HSN codes that are GST-free?

Yes, many HSN codes are free under GST.

-

Can there be two products with the same HSN code?

Indeed, it is feasible for two objects to share the same codes under the HSN code system.

-

Is it a mandate for taxpayers to mention the HSN code in their GST invoice?

All taxpayers with B2B invoices of more than Rs. 5 crores must mention the HSN code in their GST invoice.

-

Is the ITN and HSN code the same?

ITN, or the Indian trade classification or Indian tariff code, are the last two digits of the 6-digit HSN code.

-

Who assigns the HSN code?

The World Customs Organization (WCO) updates and manages the HSN every five years.