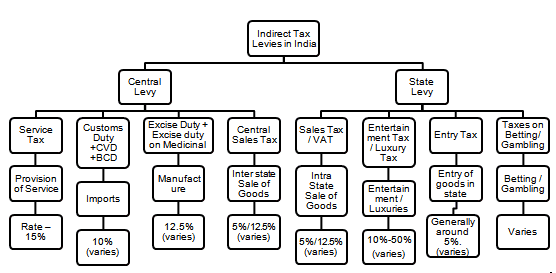

The Goods and Services Tax, or GST, is imposed on goods and services sold in India. The implementation made it a comprehensive indirect tax across India. GST registration is a process in which a taxpayer gets themselves registered. Without registration, businesses cannot collect tax from their customers or collect back an amount if they have submitted any. The Goods and Services Act took effect on July 1, 2017. It has replaced several indirect taxes in India, like local body tax, VAT, service tax, central sales tax, central excise duty, etc. Any reform will indeed have advantages and disadvantages, and so will GST. Let’s understand some features, types, drawbacks, and more about this revolutionary taxation system.

Common Features of GST

- The key feature of this system is the input tax credit. Under this process, businesses can claim credit during the production of goods and services. The primary aim is to eliminate the tax-on-tax or cascading effect.

- The Goods and Services Tax is a dual system, i.e., state and central governments levies it.

- Under GST, one experiences uniformity in the system. As a result, the compliance cost has significantly reduced, leading to ease of doing business.

- GST is a destination-based tax. IGST is implied in all interstate transactions.

- Each good and service, including alcohol, is subject to GST.

Checklist For Types of GST Registration

There are four specific GST types:

CGST

The Central Goods and Services Tax, or CGST, is levied on intrastate transactions. The central government is responsible for receiving this tax.

SGST

The State Goods and Services Tax, similar to the CGST, is applied to intrastate trades, i.e., within the same state. Both state and central GST are charged during intrastate trades. Governed by state legislation, the state implies a tax on goods and services distributed or purchased within a state.

IGST

When goods or services are traded between two states, the Integrated Goods and Services Tax, or IGST, is applied. It is implied in both exports and imports. The central government is responsible for collecting the taxes under IGST. The tax is divided among the concerned states post-collection.

UTGST

As the name goes, the Union Territory Goods and Services Tax is implied for the Union territories of India. It is equivalent to the SGST. This GST type is applied in Andaman and Nicobar Island, Dadra and Nagar Haveli, Chandigarh, Daman and Diu, and Lakshadweep during the supply of goods or services.

Drawbacks of Different GST Registration Types

While GST registration offers several advantages to its stakeholders, it also brings with it some drawbacks. Here are a few GST registration drawbacks:

Increased Expenses

Businesses have two options: either to update their existing accounting system or get a new one that is GST-compliant. Both methods require businesses to increase their spending and invest in purchasing new software and training their employees regarding the latest developments.

Purchasing, implementing, and receiving training about the GST-compliant system can sometimes be expensive. It significantly increases the cost of conducting business for both small and large enterprises. A business may also need to hire a tax professional in some cases, which is among the major types of GST registration disadvantages.

Rise In Tax Load on SMEs

There has been a rise in the tax load on small and medium-sized enterprises due to GST. Under the previous taxation system, firms with more than Rs. 1.5 crore in annual sales were obligated to pay excise. However, under the new structure, any business with an annual turnover of Rs. 20 lakhs must pay the taxes.

However, a composition scheme exists for small and medium enterprises with less than Rs. 1.5 crore turnover. Under this scheme, they will only have to pay 1% of their annual sales. However, they cannot claim tax input credits under this scheme.

Non-Compliant To GST Can Be Penalizing

SMEs may take more time to understand the limitations of different GST registration types. From issuing GST-compliant invoices and keeping digital records to filing returns on time, there is much more. Besides, the invoices must also include significant details like GSTIN, destination, HSN codes, and more.

With limited resources, it can be challenging for SMEs to quickly grasp each It can lead to penalties and a halt in regular business operations.

Online Migration Can Be Difficult for Small Enterprises

With the new tax structure in the country, almost every task has been handed out digitally. From the GST registration to the return filing, everything is being done online. While the growth of modern technology has made the migration process easier, some smaller enterprises may find it challenging. The government’s online system has been extremely convenient, but tiny businesses may need more assistance and knowledge.

The switch from pen and paper to filing returns online is among the major cons and drawbacks of various GST registration options. Small businesses may find it tougher to adapt to them.

Compliance Overburden

Under the new tax structure, businesses must register in all the states where they are operating. They are required to issue invoices that are GST-compliant and more. The strain on small and medium enterprises has increased with it, as many states are not ready for e-governance.

Multiple CESS Rates

There are five standard rates as per the GST Council – 0%, 5%, 8%, 12%, and 28%. Experts say that it has made the system more complicated rather than simplifying it. With so many states in India, each wants to pay a smaller amount for specific items. Hence, the council was obligated to follow multiple rates.

Hurried Application

Among other GST Registration drawbacks is its hurried application. It was implied on 1st July 2017, in the middle of a financial year. It was challenging to abide by a new tax reform in such a scenario.

There were several compliance challenges as enterprises followed the old taxation structure for the first quarter and the new one for the following quarters. It also resulted in several enterprises following both structures simultaneously.

Dual System

While the Goods and Services Tax is referred to as a single tax, it is dual in reality. The central and state governments collect separate taxes on a single trade.

Mismatch In Income Tax Credit

With the change in tax guards, there will be large tax-paying occurrences during the initial applications. However, a business can utilize the tax credit input once the loophole is found. Therefore, an ITC mismatch can occur during the initial GST tax implications.

Loss In the Real Estate Sector

The application of the Goods and Services Tax had a significant impact on the real estate market. There was an 8% increase in real estate rates. It eventually led to a drop in property demand by 12%. However, it was seen as a short-term trend during the initial implication and was believed to change over time.

Impact On Discounts and Rewards

The GST impacts discounts and rebates as the items are charged at the pre-discounted rates. The taxes were charged at the final rates after implementing the discounts under the earlier taxation structure.

Also Read: The Benefits Of Each Type Of GST Registration

Items That May Be Costly Under GST

- Renewals For Life Insurance Policies

- Mobile Bills

- DTH and Online Services

- School Fees

- Healthcare

- Residential Rent

- Metro or Rail Commuting

- Courier

- Cigarettes and Tobacco Items

- Aerated Drinks

Centre-State & GST Financial Relations

There has been a fundamental shift in the financial relationship between the center and the state with the implication of GST. Both governments share the responsibility of levying and collecting taxes on the sale of goods and services. It has led to the promotion of economic integration and enhanced harmony and uniformity in the tax structure.

In to the revenue distribution, the GST council has a significant role. It consists of representatives from different states, Union Territories, and the Finance Minister of India. The council is responsible for deciding on the taxation rates, exemptions, and revenue distribution between the center and the state.

A compensation mechanism was also developed to address revenue losses experienced by the state. It was done to ensure smooth GST implications. The central government compensated for any losses to the state during the initial years.

Also Read: How To Choose The Right Type Of GST Registration

Conclusion

Each GST registration type has advantages and disadvantages that can impact a business. Businesses must evaluate their needs and choose a registration type that fits their needs best. Besides, periodic reviews and adjustments are necessary considering the ever-evolving business scenarios.

Today, we are at a critical point in our country’s GST journey. Despite certain drawbacks and limitations, the advantages look strong with the economy on its way to recovery. If the Indian government responds adequately to the industry demands, our economy can be favourable for business.

FAQs

-

What are the various drawbacks of GST?

Increased operational costs, tax burden, compliance issues, difficulty in online migration, loss in real estate, dual control, multiple CESS rates, etc. are a few drawbacks of GST registration.

-

Who is eligible for GST?

Any business with at least a turnover of Rs. 40 lakhs must register under GST. The GST registration threshold for North-eastern states is up to Rs. 10 lakhs.

-

What is the fine for not filling out a GST return?

A penalty of Rs. 20 per day for Nil returns applies to non-filing GST returns. For other filings, it is Rs. 50.

-

Does it cost anything to open a GST account?

There are no charges applicable for opening a GST account.

-

What do you mean by GST number?

GSTIN, or Goods and Services Tax Identification Number, is a distinct identifier. It is given to a registered individual or firm under the GST Act. It helps keep track of the dues and payments made by the registered.

-

Who is liable to pay GST?

The supplier of any goods or services is liable to pay GST. The liability might fall on the recipient for certain notified supplies and imports.

-

What is the full form of EVC in GST?

EVC, or Electronic Verification Code, helps authenticate the identity of a user at the Goods and Services Portal by initiating an OTP.

-

Who can claim a refund in GST?

Registered taxpayers can claim a refund if they paid more than their liability.

-

Who is the chairman of the GST Council in 2023?

The chairman of the GST Council is Nirmala Sitharaman in 2023.

-

What is zero-rated supply in GST?

Supplies or exports that don’t attract GST are considered zero-rated. They are advantageous for the economy as they promote foreign exchange and help produce the same.