GST was introduced to streamline the indirect tax system in the country. In this system, all entities involved in the buying and selling of goods and services with aggregate turnover above a specified threshold limit or that satisfy certain stipulated conditions are required to register under GST.

They also need to obtain the GST certificate and GST number after registration, as these are important for fulfilling the compliance requirements of the businesses. The GST Certificate is a valid proof of registration for a business and has to be displayed at the premises of the company as per Rule 18 of CGST. Non-compliance with this rule can attract penalties. This certificate has to be downloaded from the portal and will not be provided by the government after registration.

Manage Your GST Compliance & Billing with Ease. Try Our Software Free!

What is GST certificate?

A GST certificate is an essential document as it allows companies to collect taxes on supplies of goods and services. It is required for all taxpayers with a turnover above the threshold limit and for some mandatory businesses, irrespective of the threshold limit, for compliance requirements under GST. The process of applying for a GST certificate involves the submission of an online application through the GST portal and providing the required details. includes the following information:

- GST Registration Number (GSTIN): It is a unique 15-digit number that is required for all GST-related procedures like submitting returns, availing input tax credit, and making payments.

- Legal name of the business: The legal name under which the business is registered.

- Trade name: The trade name or any other name of the business, if applicable.

- Address of the principal place of business: The primary location from which the business is conducted.

- Nature of business: A brief description of products and services offered by the business

- Date of registration: The date on which the registration was done in GST

- Validity period: The validity period of the registration, which can vary by jurisdiction

- Category of registration: The category of registration, like regular, composition scheme, etc.

- Details of authorized signatory: Information about the person or persons authorized to sign on behalf of the business.

- Jurisdiction details: Information about the jurisdiction under which the business falls

How to download the GST Certificate without Logging in?

The GST Certificate is a legal document issued to registered taxpayers and cannot be downloaded without logging in to the GST portal. Downloading the certificate is quite easy and involves the following steps:

Step 1: The taxpayer has to visit the GST website (https://www.gst.gov.in/) and login using his valid credentials.

Step 2: The next step is to go to ‘services’, then ‘user services’ and then ‘view, download certificate’. A list of all the certificates issued will be displayed in the order of newest to oldest.

Step 3: The user has to click on the download button for the required certificate.

Step 4: The GST registration certificate will be downloaded in PDF format.

Manage Your GST Compliance & Billing with Ease. Try Our Software Free!

Benefits of GST Registration

- The person or business entity will get recognition as a legal supplier of goods or services.

- Input tax credit can be availed on the input supplies used in the business, which can be offset by the output tax liability, which considerably reduces the tax for the taxpayer.

- The business is legally permitted to collect tax from customers and credit the tax collected.

- It provides eligibility to avail a variety of perks and benefits provided by the government.

Read More: Unlocking the Benefits of GST Registration

Important points regarding GST registration

- Businesses without a valid registration certificate and GSTIN cannot collect GST from their customers or claim ITC on the taxes paid on their purchases used in the business.

- The GST Certificate, when issued to regular taxpayers, does not have an expiration date. That is, the registration is valid until it is surrendered or cancelled by the taxpayer.

- For casual taxable persons, the validity period of registration is 90 days, but it can be extended or renewed before it expires.

- Eligible businesses must register with GST within 30 days of the date when the entity is liable to register or their turnover exceeds the threshold limit specified under GST.

Also Read: How to Register for GST India Online

Procedure to amend or change the GST registration

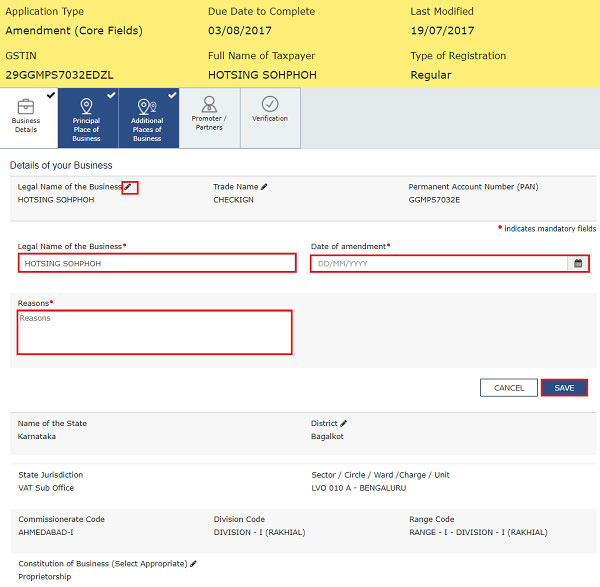

In the event of any incorrect details reflected in the GST registration, the taxpayer can edit or modify the details in the core fields, and a modified certificate can be downloaded. The important fields that can be modified in the GST certificate are:

- Legal name and trade name of the company without changes in PAN

- The main and additional location addresses of the business

- Addition or removal of partners, Karta, Managing Directors, Board of Trustees, members of the association management committee, CEO, etc.

Steps to amend the GST registration certificate

The following steps are involved in modifying or amending the registration certificate:

Step 1: The taxpayer has to navigate to the GST portal and login with valid credentials.

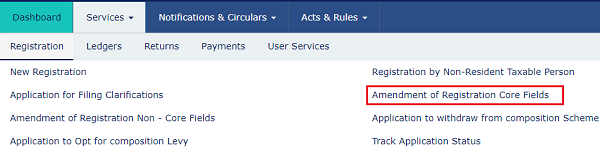

Step 2: Then click on the link Services>Registration>Modification of Registration Core fields.

Step 3: The taxpayer has to make the required changes in the core fields.

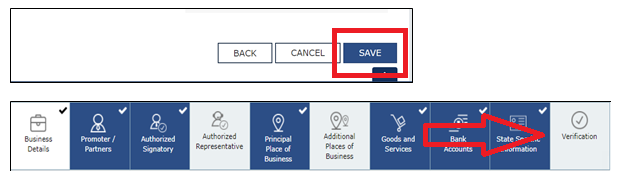

Step 4: The verification checkbox has to be selected from the verification tab.

Step 5: The authorized signatory’s name has to be selected from the drop-down list and the location name in the place box.

Step 6: After completion of modifications or amendments, the taxpayer must digitally sign with a DSC or EVC.

After the changes are approved by the GST authorities, the taxpayer is notified whether the application has been approved or declined. If approved, the new registration certificate can be downloaded.

Conclusion

The GST Certificate is an important legal document that every person or business entity registered under GST needs to download after registration. It is mandatory to display the certificate at the principal place of business and other additional locations mentioned during registration. Non-compliance can result in a fine of up to twenty-five thousand rupees. The taxpayer has to login to the GST portal with his credentials and download the certificate, as it is not provided in physical form by the government after registration. It can be easily downloaded with a few simple steps. Where there is a change in the core details, they can be modified in the portal and a new registration certificate downloaded.

Frequently asked questions

What is the turnover threshold limit for mandatory registration in GST?

The threshold limit of aggregate turnover of a business to mandatorily register in GST is Rs. 40 lakhs per annum for the supply of goods and Rs. 20 lakhs per annum for the supply of services.

Is there any fee for GST registration?

No, there is no fee for GST registration in India. It is completely free of charge and can be done online.

Is GST registration compulsory for all businesses in India?

No, registration is not compulsory for all businesses in India. GST registration is compulsory for businesses whose aggregate turnover crosses the threshold limit, casual taxable persons, non-resident taxable persons, interstate suppliers, persons making taxable supplies on behalf of other taxable persons, whether as agents or otherwise, input service distributors, providers of OIDAR services in India, TCS and TDS deductors, persons selling through e-commerce operators, and e-commerce operators who are required to collect taxes at source.