GST was introduced in India to simplify the indirect tax system in the country. It unified a plethora of state and central taxes to form a unified integrated tax that aimed to reduce the burden of the cascading effect of taxes on the consumer.

According to the GST law, all businesses supplying goods and services whose annual turnover crosses a particular limit specified under the law are compulsorily required to register under GST and follow the rules and procedures of compliance as required under the law.

The GST number (GSTIN) is a unique identification number provided to firms registered under the goods and services tax system. The businesses must register and get their GSTIN for compliance and to enjoy the benefits of the GST system. The registration process involves submitting an online application on the GST portal, providing details about the business, and obtaining the unique GST number. This number is mandatory while paying taxes, filing returns periodically, claiming input tax credit, and other compliance-related activities.

What is GST Number (GSTIN)?

GSTIN (goods and services identification number) is a fifteen-digit alphanumeric code that is required for submitting returns, claiming input tax credit, and making payments. It is an identifier for the taxpayer and also helps the tax authorities monitor the transactions of the taxpayer. Businesses can voluntarily opt for the GSTIN even when their turnover does not cross the threshold limit. Taxpayers also have the option to obtain different GSTINs for their multiple businesses, provided certain conditions are satisfied as specified under the law.

Importance of GSTIN

The GSTIN is important and has to be included in every invoice of the supplier. It is required for the following:

- Availing input tax credit (ITC): Input tax credit is the credit received for the tax paid by the supplier on the purchase of goods or input of services in the course of business. This credit helps reduce the tax liability of the supplier on his outward supplies.

- Filing GST returns: Various GST returns are required to be filed as per the GST Act, on a monthly, quarterly, and annual basis. The GST number is mandatory to file the returns.

- Claiming Refunds: Refunds need to be claimed under various provisions, such as exports, supplies to SEZ units, etc. A GST number is mandatory for claiming such refunds.

- Mentioned in tax invoices, debit notes, and credit notes: The GSTIN of suppliers and recipients must be mentioned in tax invoices, debit notes, and credit notes. It will help the receiver of the goods and services avail the input tax credit.

- Mandatory requirement: Businesses supplying goods and services are required to register under GST as specified under the law, and non-registration can lead to legal consequences. GSTIN is mandatorily required for all compliance activities, and all traders registered under GST must obtain the GST number after registering in the portal.

- Enjoy the benefits of registration: Businesses registered under GST gain trustworthiness and competitive advantage. They gain a wider customer base and a credible online presence, apart from the main advantage of a reduction in tax liability due to input tax credit.

Also Read: Do I Need a GST Identification Number for Udyam Registration?

Time limit to get GST number in India

As per Notification Number 94/2020, Central tax, dated December 22nd, 2020, the timeline for GST registration and to get the GST number is:

- The time limit normally depends on the type of taxpayer, the accuracy of the details submitted, the completion of the application, and the submission of the documents..

- After filing the application accurately and uploading the documents correctly, the ARN is generated and received by the applicant. It usually takes 3 to 7 days for the registration to be processed and the GST number and registration certificate to be obtained.

- This time limit can extend to 30 days if the applicant fails to complete Aadhar authentication, or does not opt for Aadhar authentication, or if the authorities consider it necessary to carry out physical verification of the place of business.

- As per this notification, the time limit for the issue of notice in form GST REG-03, that is, notice for seeking additional information, or clarification, or documents pertaining to the application for registration, is extended to seven working days.

Steps to apply for a GST Number in India

Step 1: Visit the GST portal

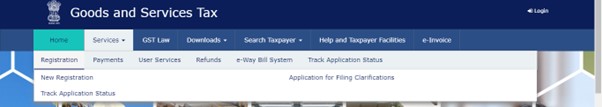

The applicant has to visit the GST portal at https://www.gst.gov.in/, click on the’services’ tab on the home page, and select ‘Registration’ from the drop-down menu.

Step 2: Select ‘New Registration’

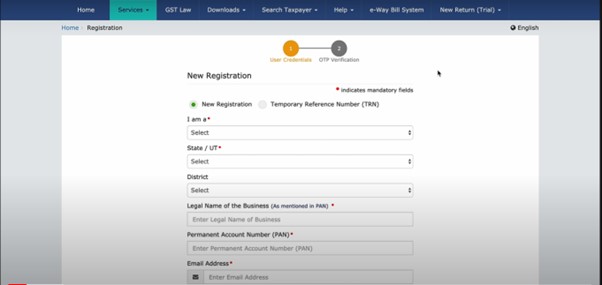

On the registration page, the applicant has to select ‘New Registration’ under the ‘I am a’ dropdown menu and choose the taxpayer as an individual, company, partnership firm, or others.

Step 3: Fill in the required data

The applicant has to fill in the basic details, such as name, address, PAN, and email ID. He also has to provide details about his business, like the type of goods and services, the annual turnover, etc.

Step 4: Verify the details

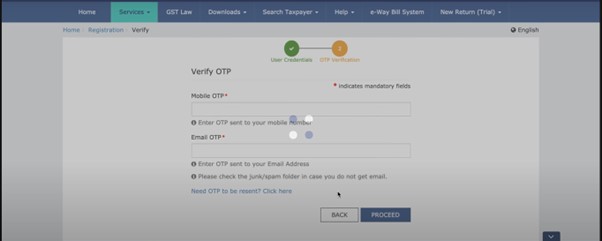

After filling in the required details, the applicant has to click on the ‘proceed’ button. He will receive an OTP on his registered mobile number and email address. After entering the OTP and clicking the proceed button, the details get verified.

Step 5: Upload the required documents

The applicant has to upload the required documents, like PAN, address proof, ID proof, bank details, and photographs. All the documents should be in the required format.

Step 6: Submit the application

After uploading the required documents, the applicant has to click on ‘the submit’ button. An application reference number (ARN) is sent to the registered mobile number and email.

Step 7: Wait for approval

After completion of the application process, the applicant has to wait for approval. The status of the application can be tracked using the ARN.

Also Read: What Are The Requirements Of A Regular Taxpayer Under GST?

Verification and approval of the registration

On completion of the filing of the application for registration, the concerned officer will check the application along with the documents and, if everything is in order, will approve the registration within seven working days from the date of submission of the application.

Pending processing of registration

Depending on the accuracy of the application, the documentation, and the volume of applications received by the portal, it can be pending for up to 15 days. If any additional information or clarifications are required, the processing can extend further. The applicants can check the status of their application on the GST portal if it is not processed within an expected timeframe. They can also reach out to the GST helpdesk for assistance or lodge a complaint in the grievance section on the portal.

Reasons for the non-processing of registration

The reasons for the non-processing of the registration application of an applicant may be many, like incomplete details in the application, non-submission of the related documents, mismatch in the information provided, errors in the details in the application, large volume of applications, etc. The applicant can monitor the status of his application and seek the assistance of the help desk, if required.

Conclusion

The GST authorities are required to respond to the application for registration after the applicant submits the clarifications whenever necessary, within 7 working days, unless a site visit is notified. In such cases, it may extend to 15 days. If the officer is satisfied with everything and Aadhar authentication is successful, the registration is approved, and the applicant receives the GST number. If the officer fails to approve or reject within 7 working days, the GSTIN gets automatically approved.

Frequently asked questions

What is the time limit for registering under GST?

Any person who is liable to take registration should do so within thirty days from the date on which he becomes liable for registration, subject to such conditions as may be prescribed.

Can a person who operates in different states with the same PAN conduct business under a single GSTIN?

As per Section 25(2) of the CGST Act, 2017, a person operating in different states with the same PAN has to get registered separately with separate GSTINs in different states where he has business operations when his aggregate turnover exceeds the applicable threshold limit.