India is the fastest-growing economy in the world today and is poised to become the third-largest economy by 2027, according to economists. Exports are one of the main factors driving this economic growth. Exports help with favorable balances of payments, the creation of employment opportunities, participation in global markets, etc. The government has implemented various policy reforms to encourage exports. Under Section 16 of the IGST Act, the export of goods and services is treated as a zero-rated supply. And exporters can make zero-rated supplies with or without payment of tax.

There are two options for exporters who wish to export goods and services from India.

- He can either supply goods or services, or both, after paying the amount of IGST and claim a refund of the tax paid on such goods or services, or both.

- He can supply goods or services, or both, under a bond or letter of undertaking without payment of the IGST and then claim a refund of the unutilized input tax credit.

What is a Letter of Undertaking in GST?

As per Rule (96A) of the CGST Rules, 2017, exporters who fulfill the requisite eligibility criteria can file a letter of undertaking (LUT) for exporting goods and services without the payment of IGST. They are required to file the LUT in Form GST RFD 11 prior to such exports. Exporters who do not meet the eligibility criteria for filing LUTs are required to submit a bond instead of the LUT for exporting without the payment of IGST.

Important Points to Note

- The letter of undertaking is applicable only for that financial year, from the date of submission. For example, if the LUT was furnished in FY 2021–22, then the date of expiry of the LUT is March 31st A fresh LUT has to be filed for the subsequent year (2022–23).

- A bank guarantee is not required to be submitted for filing the letter of undertaking.

- The LUT must be duly authenticated or signed by the authorized signatory of the company or firm.

- If the exporter fails to export goods within the prescribed time period or receives remittances in convertible foreign exchange for the export of goods or services within the prescribed time period, he is liable to pay IGST along with interest.

Conditions for Filing Letter of Undertaking

As per notification no. 37/2017 dated 4th October 2017, CGST Act, any registered person intending to supply goods or services for export without the payment of IGST can file an LUT in place of the bond if the following conditions are met:

- The exporter has not been prosecuted under the CGST or IGST Act, 2017 for evading tax on an amount greater than Rs. 2.50 crore.

- The LUT must be executed by the working partner, company secretary, managing director, proprietor, or any other person duly authorized by the board or working partner of the company.

- The LUT must be filed in duplicate on the letterhead of the registered person for the specific financial year in the Annexure to Form GST-RFD-11, as mentioned in Sub-Rule 1 of Rule 96A of the CGST Rules, 2017.

Validity of Letter of Undertaking

Circular No. 4/4/2017 of GST, dated 7th July, 2017, states that the validity period of the letter of undertaking furnished by exporters is 12 months. Further, if the registered person opting to file the LUT fails to comply with the conditions of furnishing the LUT, he would be required to file a bond in place of the LUT.

Documents Required for Filing LUT

- KYC documents of witnesses

- Last year’s LUT

- GST login ID and password

- Digital signature of an authorized signatory

Benefits of LUT

A letter of credit is an important document that exporters must file on time so that they can conduct their exports without having to pay IGST. Exporters can export goods and services without having to pay taxes by submitting LUT online in the required format. If the exporter fails to file LUT, he has to pay the taxes and claim the refunds later, as exports are zero-rated supplies. But a lot of time and hassle are involved in the refund process, apart from the fact that the taxpayer’s money will get blocked. All this can be avoided by the timely filing of the LUT.

Steps to file LUT in the GST portal

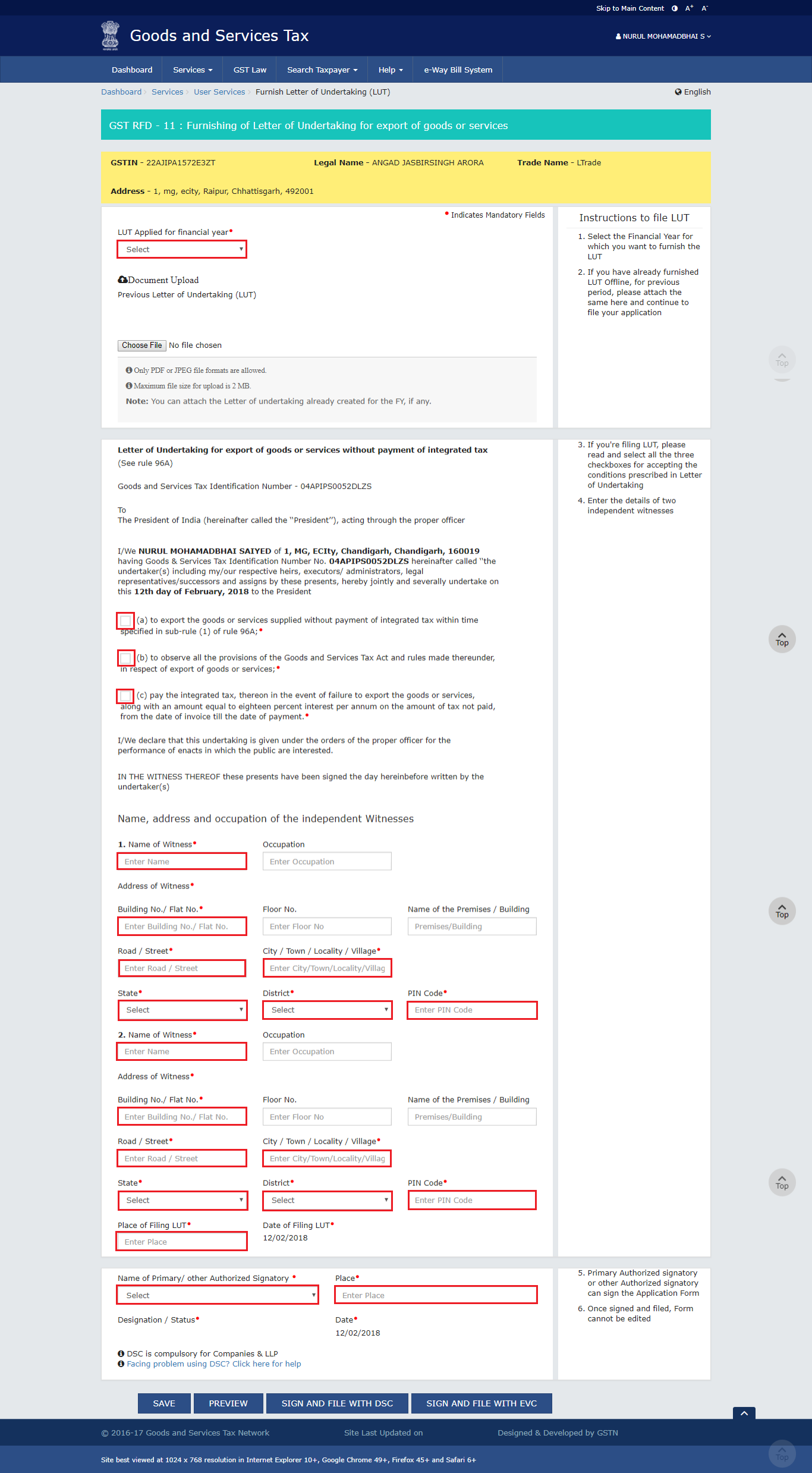

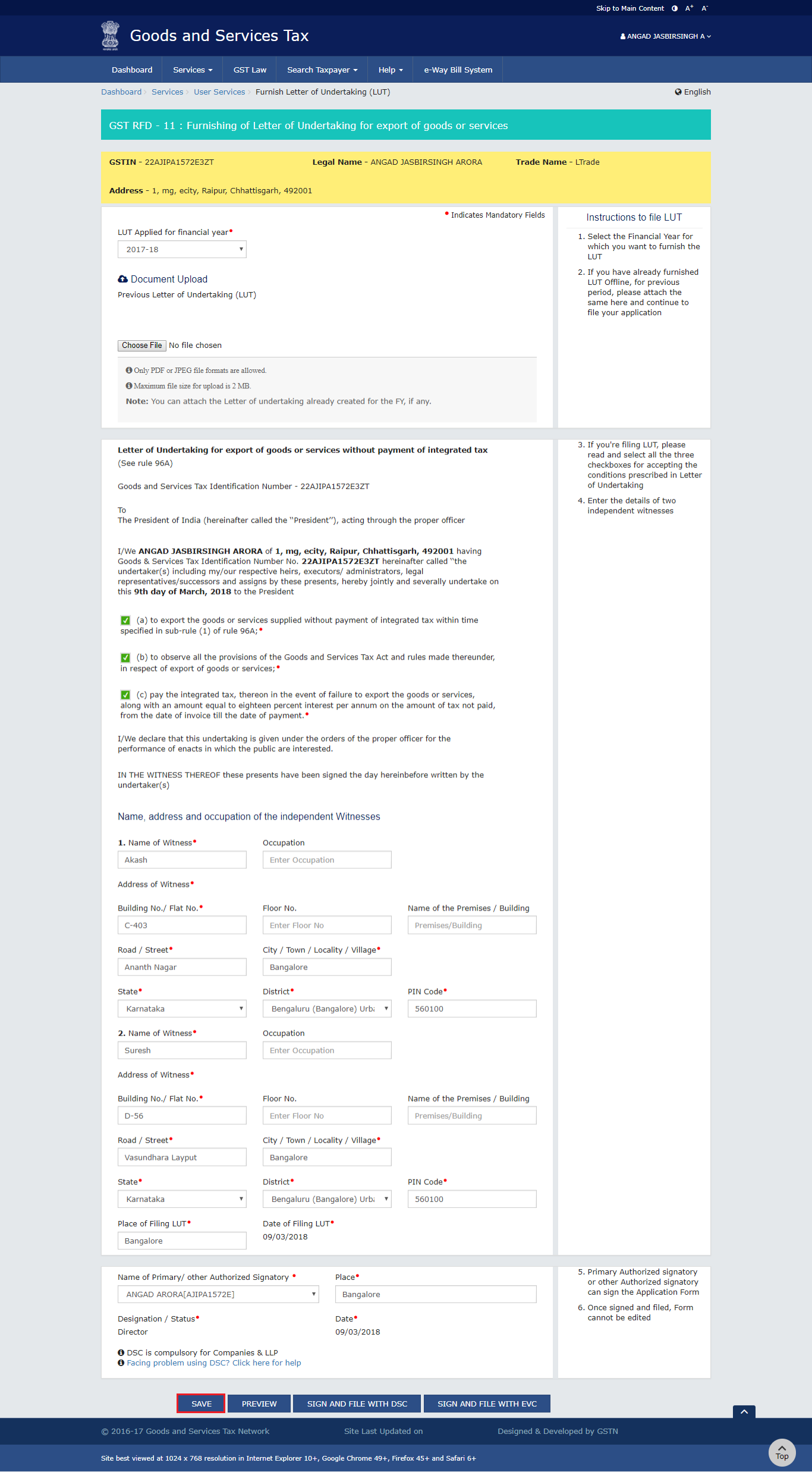

Step 1: The exporter has to login to the GST portal, click the services tab, choose ‘user services’, and select ‘furnish letter of undertaking (LUT)’, from the drop-down menu.

Step 2: When the option ‘furnish letter of undertaking (LUT) is selected, the form GST-RFD 11 will be displayed. Here, the financial year has to be chosen. There is an option to upload the previous year’s LUT, which must be in pdf or jpeg format with a maximum file size of 2 MB.

Step 3: Then the trader has to choose the ‘declaration’ check boxes and fill in the details of witnesses in the ‘independent and reliable witnesses’ section.

Step 4: Next, the exporter has to select the location and click save. The form can be previewed to check its accuracy before submission. It has to be noted that once the form is submitted, it cannot be revised.

Step 5: The applicant has to sign the application with the digital signature of the authorized signatory and submit the form. After clicking the ‘sign and file with DSC’ option, a message box with a warning appears. Upon selecting the ‘proceed’ button, the system-generated unique application reference number (ARN) appears. ‘submit with EVC’ option is also provided, and authentication can be done through the OTP sent to the email and mobile of the authorized signatory. The ARN is then received in the mobile and email of the authorized signatory, and the acknowledgement can be downloaded using the option provided for the same.

Frequently Asked Questions

-

Who is eligible to file LUT?

Answer: As per GST rules, any registered supplier intending to supply goods and services abroad or to SEZs without the payment of the integrated goods and services tax can file LUT online in the prescribed form.

-

What is the time limit for the processing of the LUT?

Answer: The LUT is processed within 3 working days. If any notice for clarification is not received within that time, it is deemed to have been processed.

-

Where can the exporter access the order copy?

Answer: When the application is deemed approved, an order copy is generated through the GST portal. This order copy is available and can be downloaded from the taxpayer’s dashboard under the download>services>user services>view additional notices>orders option.

-

How can a taxpayer respond to a notice received from the tax officer?

Answer: The taxpayer has to login to the GST portal, go to the dashboard in his login, then services>user services>view additional notices and orders, and post his reply.

Conclusion

Exporters must be aware of all the rules and regulations related to exports, including registration and compliance with regard to taxes. Not adhering to the rules and non-compliance can lead to difficulty in exporting or the loss of precious incentives or benefits. Exports that are zero-rated supplies can be done with or without payment of tax. A letter of understanding is an important document that helps exporters export goods and services outside the country without paying IGST. If the exporter fails to file the LUT on time, it will lead to blockage of funds, delay, and difficulty in claiming refunds. So exporters must be well versed in the procedure of filing the letter of undertaking to avoid loss and non-compliance.

Demystifying GST Registration Limit, Types, and Compliance, Consent Letter for GST Registration: Format and Requirements