GST was introduced to unify and simplify the complex indirect tax system in the country. It subsumed a variety of central and state taxes and reduced complex regulatory compliance, thereby helping numerous small businesses in the country. GST law made it mandatory for any entity wishing to engage in the supply of goods and services in the country with an aggregate turnover of forty lakhs per annum and twenty lakhs for north-eastern states to register in the GST portal and obtain the 15-digit GST registration number (GSTIN). This helped the government monitor tax payments and compliance. Registration also helps businesses collect tax on their supplies and claim input tax credits.

Many amendments and advisories have been passed by the authorities to streamline the process of GST registration for businesses. Previously, furnishing bank account details was mandatory during registration. So, they had to wait till the bank account was opened and then register for GST. But normally, a bank account cannot be opened before the commencement of business. This was causing a lot of inconvenience to the businesses. So, one of the significant changes that helped taxpayers was the implementation of Rule 10A. As per this rule, new businesses that register with GST can furnish their bank details in the portal after registration. Bank details are mandatory and have to be furnished by the taxpayer within a specified time. Here we discuss in detail this rule and the consequences of not adhering to it by the business entities.

What is Rule 10A?

Vide Notification In No. 31/2019, dated 28th June 2019, the Central Board of Indirect Taxes and Customs (CBIC) introduced Rule 10A, which contains provisions relating to the furnishing of bank account details after registration in the GST portal. Not furnishing the same would amount to non-compliance, resulting in business-facing consequences leading to suspension or cancellation of registration.

Provisions of Rule 10A

The provisions of Rule 10A have made it mandatory for registered taxpayers to furnish their bank account details after receiving their GSTIN and certificate of registration in form GST REG-06. They are required to furnish the bank details by the following dates:

- Within 45 days of registration in the GST portal

- Within the due date of filing the return under Section 39 of the CGST Act

Exemptions under Rule 10A

But certain entities are exempted from Rule 10A. They are:

- Taxpayers registered as tax deductors (section 51) or tax collectors (section 52) at source

- Persons registered according to the provisions of Rule 16, that is, those who are granted Suo-moto registration by the appropriate tax officer,

Objective of Rule 10A

The main objective of the introduction of Rule 10A was to prevent fraudulent GST registrations and the generation of fake invoices. Verification of the bank account details of new GST registrants ensures that only genuine businesses are registered under the regime. This helps the authorities curb tax evasion and improve compliance. It is also needed to ensure that the refunds are credited to the correct account furnished by the taxpayer in the GST portal.

Consequences of Non-Compliance Under Rule 10A

If the taxpayers for whom the provisions of Rule 10A are applicable fail to comply with the rule, their registration is liable to be cancelled. A new subclause (d) has been inserted in Rule 21 of the CGST Act, which deals with the rules for cancellation of registration. As per this new subclause (d), the registration of the taxpayer who fails to comply with Rule 10A within the stipulated time is liable to be cancelled.

Steps to Furnish Bank Account Details in the GST Portal

The taxpayer has to furnish their bank account number, type of account, bank branch address, and IFSC code. The bank branch name gets automatically populated when the taxpayer enters the IFSC code and clicks on the ‘get address’ option in the non-core amendment. Also, a copy of the cancelled check leaf, bank statement, or passbook extract in jpeg or pdf format is required to be uploaded.

Bank account details can be furnished by new entrants in the following steps:

Step 1: The taxpayer has to log in to the GST portal.

Step 2: The taxpayer then has to go to services->registration.

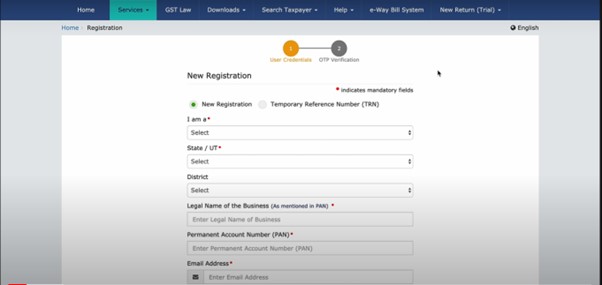

Step 3: Select ‘new registration’ and enter the required details.

Step 4: Next, in the bank account tab, the taxpayer has to enter the account number, IFSC code, and bank name of the taxpayer.

Step 5: Then the relevant documents, like a cancelled check leaf or bank statement, are required to be uploaded.

Step 6: Then the taxpayer has to submit the application and wait for the verification.

GST Registration for Services: Documents Required

Consent Letter for GST Registration: Format and Requirements

How To do GST Registration Online

Frequently Asked Questions

What is the new rule on bank validation status on the GST portal?

Answer: A new advisory from GSTIN has been passed on 24th April 2023, directing all taxpayers to check bank validation for their GSTIN in the portal. This was implemented so that there is seamless online processing of GST refunds into the correct bank accounts submitted by the taxpayer on the portal.

Can the bank account details be modified or deleted?

Answer: Yes, the new advisory passed on 24th April 2023, allows taxpayers to add or delete bank accounts in the portal after registration. Adding or modifying bank accounts after registration is considered a non-core amendment.

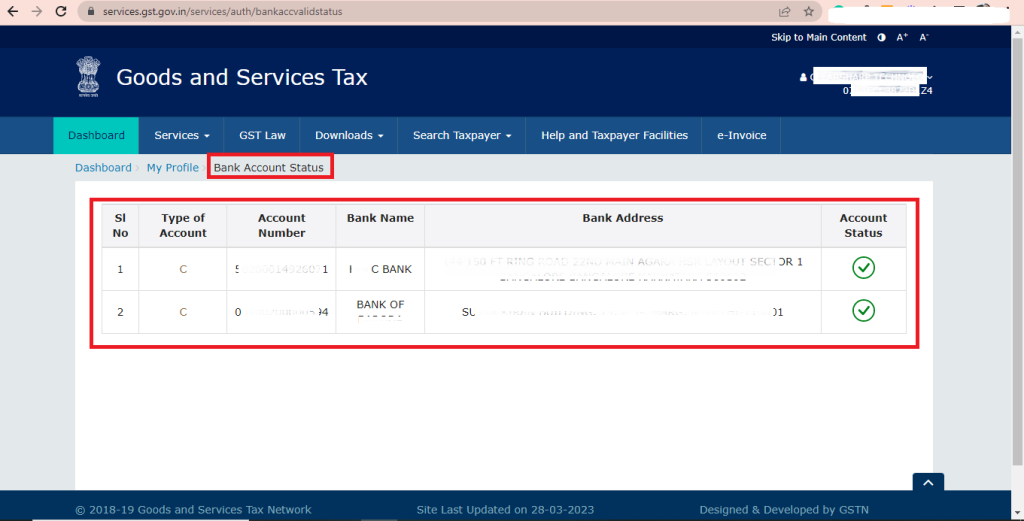

How can the taxpayer check the status of his bank account in the GST portal?

Answer: The taxpayer has to login and go to his profile. There, when he clicks on the ‘bank account status’ tab under the quick links section, the ‘bank account status’ screen will be displayed with the list of bank accounts added by the taxpayer. There, the taxpayer can view the validation status for every bank account added by the taxpayer. The validation status can be’success’, ‘failure’,’success with remark’, or ‘pending for validation’. Depending on the status shown, the taxpayer has to take suitable action.

Conclusion

Rule 10A was introduced to ensure compliance and check tax evasion under the GST regime. New businesses that register with GST must ensure that they furnish their correct bank account details in the portal to avoid delays in registration, timely credit of refunds, and the consequences of non-compliance. By knowing all the rules pertaining to registration and following the guidelines properly, businesses can enjoy the various benefits of GST and also help create a transparent and efficient tax system in the country.