Money is one of the most stellar commodities in life. It is a must for humans to be able to survive in a rather volatile market, and more importantly, be able to help individuals lead a respectful life.

Therefore, it is important that the individual invests their money in several schemes that are available in the market for them at the moment. It is vital that the individual knows how to earn, save, and spend money on their requirements.

The saved amount can come in handy during financial emergencies, and help as a backup. There are PF, PPF, and FDs, which are popular investment options for Indians. Though there are other plans like LICs & SIPs, they come with risks. But the PPF and the EPF have nothing of that sort.

In this blog, details about the PF calculator & the PPF calculator are discussed. Besides, information on the PF, PPF, and the EPF are provided.

What is a Provident Fund?

Source: https://cred.club/calculators/ppf-calculator

The provident fund is like a back up fund for the employees. They can be either government or the private employees. The employees stand to receive this amount once they retire from their company, firm or organisation.

The PF scheme is managed by the Employees Provident Fund Organisation (EPFO). The employee & the employer make equal contributions towards the EPF. The fund is also known as the retirement savings fund.

However, when the employee or the individual wants to know how much they have in their provident fund, they can make use of the PF calculator. This online tool can help them understand the amount that they have left during their retirement.

Knowing the balance can be useful for them, as they can plan for their future plans like constructing homes, the marriage of children, and so on. Besides, other details can be obtained through the PPF calculator like monthly PF contribution, PF interest rate, frequency of contribution, and the duration.

Source: https://www.bad-up.de/?b=238279115

If the employee or individual is working in a company or a firm that consists of more than 20 employees, then they are eligible for the EPF. The Employees Provident Fund Organisation (EPFO) comes under three schemes, which are the EPF Scheme 1952, the Pension Scheme 1995, and the Insurance Scheme 1976.

Those who are under the EPF scheme, have to make a monthly contribution of 12%. The EPF interest rates are decided by the EPFO Central Board of Trustees. Today, in 2024, the interest rates are around 8.25%.

From the 12%, 8.3% goes to the pension scheme account, and the remaining 3.6% goes to the employee EPF account. If the individual or the employee earns less than Rs. 15,000 per month, then they have to become a member of the EPF.

What is the EPF Calculator?

Source: https://www.smartpaisa.in/ppf-calculator-with-yearly-chart-graph/

Source: https://www.smartpaisa.in/ppf-calculator-with-yearly-chart-graph/

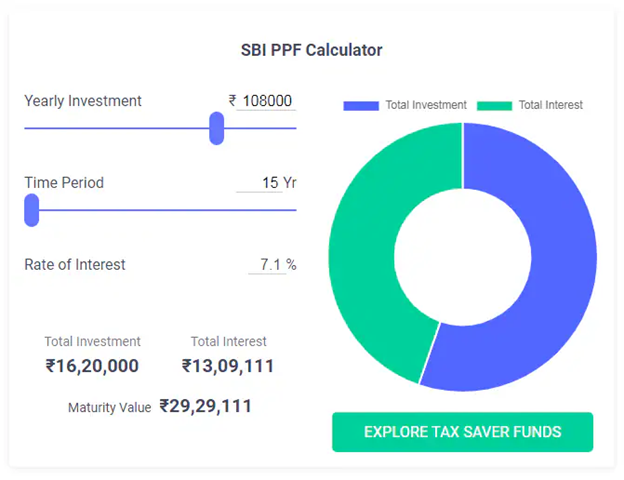

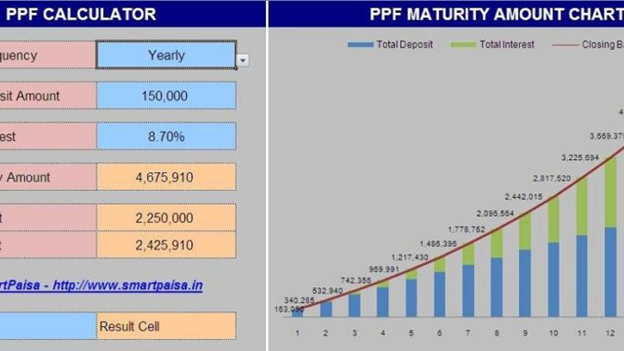

The EPF calculator, PF calculator, and the PPF calculator are online tools that can help the employee calculate & find out the total PF amount or maturity amount. This PF amount is received by the employee or the individual when they retire.

The data required to calculate the PF amount is as follows:

- PF contribution/ investment month every month.

- PF interest rate.

- Duration of contribution.

- Frequency of EPF contribution.

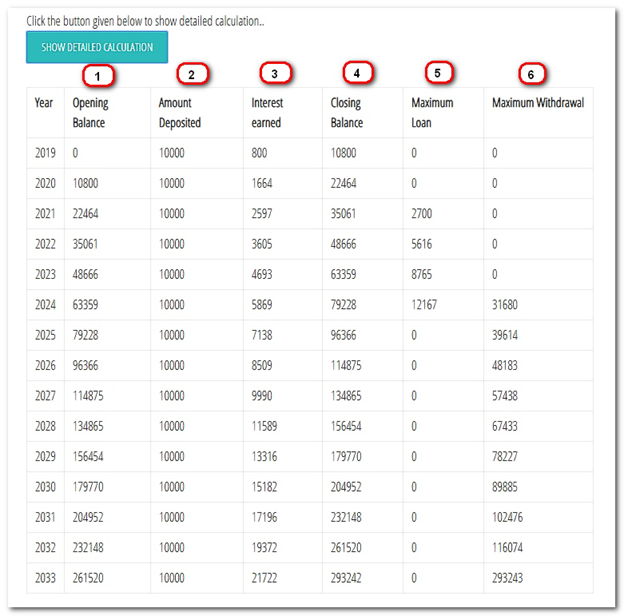

Below is an example to understand how to calculate EPF.

- Employee basic salary + dearness allowance = Rs 14,000

- Employee contribution towards the EPF = 12% * 14,000 = Rs 1,680

- Employer contribution towards the EPF = 3.67% * 14,000 = Rs 514

- Employer contribution towards EPS = 8.33% * 14,000 = Rs 1,166.

- The total contribution by the employer and employee towards the EPF account of the employee = Rs 1,680 + Rs 514 = Rs 2,194.

If the interest rate is 8.25% p.a, then monthly earned interest will be; 8.25%/12 = 0.679%. Supposing the employee joined the company in April 2022. The total EPF contribution for April will be Rs 2,194.

The EPF scheme will not pay any interest for April. The total amount in the EPF account in May 2022 = Rs 4,388 (Rs 2,194+ Rs 2,194). The employee stands to receive an interest of Rs 4,388 * 0.679% = Rs 29.79.

The calculation will be continued until the retirement age (60-65 years) of the employee. The calculator will show the PF final amount.

Benefits of using the EPF calculator

Source: https://www.insurancefunda.in/ppf-calculator/

The EPF calculator shows the balance amount that is left in the EPF fund. This amount can be received during retirement. It is also known as the retirement corpus, which can help the employee manage other investments in an efficient way.

- Increase contributions: The PF calculator can be used to increase contributions towards the retirement. When the employee or the individual feels that their corpus amount is quite less or for some reason wants to increase it, then they can increase the percentage of their contribution to get a larger corpus during retirement.

- Better financial planning: The calculator helps the employee or the individual to plan their retirement by offering a clear picture of the projected PF balance during retirement. This helps them to know how much they need to save to meet their financial goals.

- Seamless tracking: The calculator can automate the calculation of the contributions and interest gained over time. This eliminated the hassle of manual calculations.

- Instant updates: The employee can receive instant updates on the changes to the PF policies. It could include adjustments in interest rates or contribution ratios. This helps them to have a good understanding of their investments and savings strategy.

What are EPF contributions?

Source: https://planmoneytax.com/ppf-scheme-calculator-kitna-milega/

The good thing about the EPF contributions is that both the employee & the employer make equal contributions. For example, if an employee has Rs. 10,000 taken for the PF, then the employer also makes the same contribution for the PF amount.

- The EPF account can be nominated to anybody in the family like a partner, parents, or kids, which comes in handy in case of death.

- The nominee can be changed by submitting Form 2 to the company’s finance department or the EPFO department.

- Around 8.3% of an employee’s monthly contribution is transferred to the Employee Pension Scheme (EPS), which returns as a monthly pension upon retirement.

- When the employee or the individual quits working, and wants to withdraw the balance, then they can remove a portion of the amount. This depends on the purpose of withdrawal. Valid reasons can be unemployment, retirement, or purchase of land.

- When the individual has retired, but had continuous employment for a minimum of 10 years, then they can withdraw 100% of the EPS account balance.

- If there was no continuous employment, then they can withdraw money, according to the slabs based on their previous drawn salary.

Read More : How to Stay Organised with An Internet Bill Receipt Generator?

Conclusion

From the above, it is quite obvious that the PF calculator can provide individuals and employees with sufficient data regarding their funds. It can show the corpus amount in the EPF fund during retirement.

This offers the individual a greater understanding of the retirement fund, which can help them plan their other investments. Using the calculator, retirement funds can also be enhanced. Moreover, the calculator is simple to use for the calculation of EPF corpus in retirement, total contribution, and interest income.

Finally, the current EPF interest rate is taken to calculate the interest earned and maturity amount.

FAQs

1. What is an EPF?

EPF is a provident fund that can be claimed when the employee of a company or firm retires. Besides, the EPF is provided for both the government & private company employees. All are eligible for this fund. The Employees Provident Fund Organisation (EPFO) is provided for any firm that has more than 20 employees.

The employer & the employee make a similar contribution every month towards the EPF. An employee contributes around 12% of their basic salary and dearness allowance. From the 12%, 8.33% goes towards the Employee Pension Scheme Account.

2. What are the benefits of EPF?

There are several benefits of using EPF. It helps the employee or the individual after retirement, by offering them a lump sum that can be used for various purposes. That may include education of the child, marriage of the child, and so on.

There is also a Voluntary Provident Fund (VPF) that is provided in the life insurance covered under the EPF. Up to Rs. 1.5 lakh is tax-free annually. Likewise, the employee can nominate somebody who can receive the financial benefits in case of death.

3. How to check the PF balance online?

The PF balance can be checked online by using the government portal. Once you are logged in to the government website, the location of the PF office needs to be chosen. Then the application form has to be filled with the personal details.

Then the application can be submitted after cross-verifying. If all the information provided is fine, then the applicant receives an SMS on the registered mobile number with the latest balance.

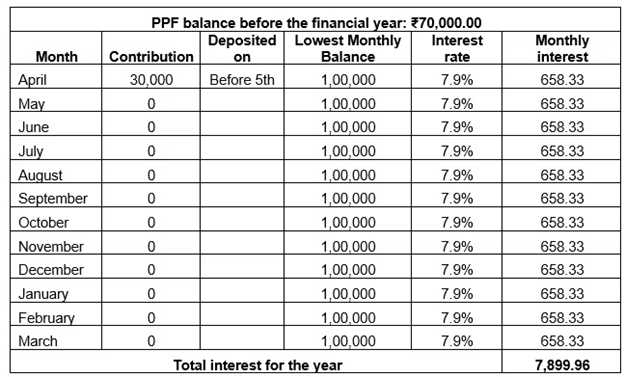

4. How is PPF calculated?

The PPF is calculated on a monthly basis. The lowest balance is taken for the calculation, between the 5th and the final day of the month. Then the interest rate is credited to the account balance at the end of the financial year.

5. What is the PPF for Rs 1000 per month?

If the individual deposits Rs. 1000 per month, then the total PPF deposit amount will be Rs. 12,000 for that year. This is then taken & calculated by the PPF calculator. The PPF amount per month can vary according to the capability of the individual. The higher the monthly PPF amount, the higher the EPF amount will be at the end of retirement. However, the individual can deposit as per the deposit frequency.

6. Which is better, PPF or FD?

Both the PPF & the FD come with a few benefits. However, it is important to know that the FD or fixed deposit can provide the individual with a low-risk investment option with assured returns. Moreover, the FD is a short-term investment plan for 10-15 years.

But when the individual wants to deposit an amount as a long-term investment for 30-40 years, with higher returns, then the individual may want to make use of the EPF option. However, both are guaranteed amounts for the individual.

7. Can the individual withdraw PPF after 5 years?

No. The PPF requires a high maturity period of 15 years. Only then the individual can withdraw the entire amount from the PPF account. However, partial withdrawals can be done, only after the sixth year due to unforeseen circumstances. They may include death, divorce, accidents, and so on.

8. Is PPF better than LIC?

Both the PPF & LIC have their own benefits. The PPF is a long-term investment plan that matures only after 15-20 years. The PPF amount is a large amount that can be used for constructing homes, marriages, and so on.

However, the LIC plans provide smaller amounts of Rs. 5 lakhs to Rs. 15 lakhs. They can mature after a shorter period of time like 10-15 years. This depends on the policy or plan that the individual has put forth. But, LIC policies can be taken on children who are aged 2 years onwards.

So, if the parent has taken an LIC policy on the child when they are 2 years of age, then it can mature to Rs.10 – 12 lakhs when the child reaches 18 years of age. This is beneficial, as they can make use of the amount when they reach 18 years of age for their studies and future.

9. Where does the EPFO invest the money?

The EPFO money is invested in the Government Securities and related instruments. The individual has to invest 35%-45% of the EPF money in debt and related instruments. Besides, if required, the individual can invest in short-term debt instruments. This comes to 5% -15% in equities and related investments.

10. Does the EPF offer a high rate of interest?

The EPF currently provides around 8.2% for the financial year 2023-24. This is the highest interest rate that can be found in the fixed-income investment amounts.