Introduction

In her sixth union budget, Finance Minister of India, Nirmala Sitharaman, will give an interim budget. It is crucial to note that the interim budget will be presented before the 2025 general elections.

Some of the interim budget 2025 expectations are that it would address some of the most crucial challenges plaguing the industry for many years. Some of the sectors include renewables, power, and the utilities sectors.

The budget may focus on the infrastructure development offered to industries, along with tax relief. Industry experts also anticipate that digital payments, infrastructural expansion, and many green projects, will get some tax relief.

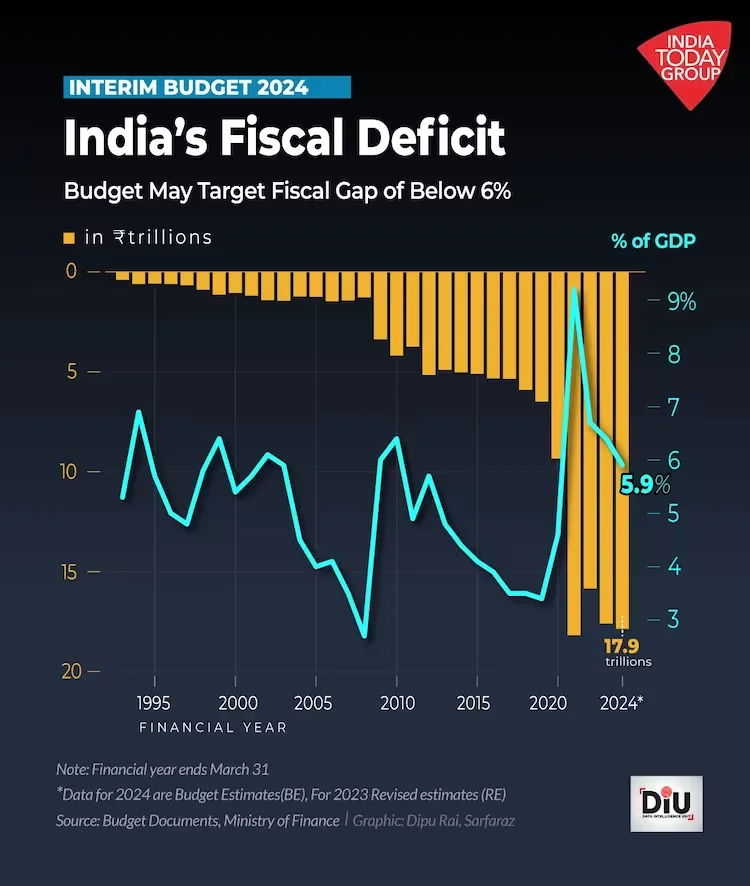

The NDA government understands this budget will be crucial in wooing the voters by providing them with new budget goals and, at the same time, reducing the fiscal deficit increase. Other sectors like the medical, fertilisers, and chemicals, have expressed concerns like dumping, subsidies, and high taxes.

Setting the Stage for 2025

During the interim budget presented in 2019, Piyush Goyal announced individual taxpayers with Rs. 5 lakhs annual income, will not be taxed. Besides, those having Rs. 6.50 lakhs annual income, need not pay any tax, provided they make investments.

V Anantha Nageswaran, who is the Chief Economic Advisor, feels that investments in the private sector could prove crucial at the moment. India has seen several successful start-ups that are doing very well, with a shift from the consumption scale.

The Interim Budget 2025 looks good for the railways, and the healthcare industry. This is in alignment with the various schemes that were started by the government. The budget should play an active role in ensuring that the vision for India is achieved in the next few years.

What is the Difference Between Interim Budget and Vote on Account?

| Feature | Interim Budget | Vote on Account |

| Constitutional Provision | Article 112 | Article 116 |

| Purpose | Financial Statement presented by the government ahead of general elections. | To meet essential government expenditures for a limited period until the budget is approved. |

| Duration of Expenditure | Covers a specific period, usually a few months until a new government is formed and a full budget is presented. | It is generally granted for two months for an amount equivalent to one-sixth of the total estimation. |

| Policy changes | Can propose changes in the tax regime | Cannot change the tax regime under any circumstances |

| Impact on Governance | Provides continuity in governance during the transition period between two governments. | Ensures the smooth functioning of the government and public services until the regular budget is approved. |

Crucial Sectors in Focus

Some sectors require more attention than others. They include the infrastructure, power & utilities, cement, and pharmaceutical industries. The interim budget should focus on these industries to ensure that there is growth & development in the country.

Let us read about the industry impact of interim budget.

-

Infrastructure

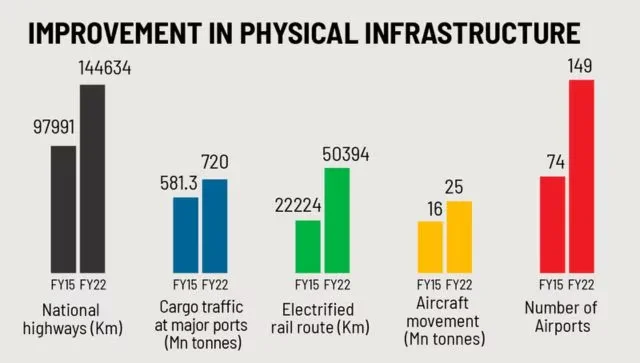

Infrastructure development is important for a country to grow. Asian nations like Singapore and Malaysia are known for their infrastructure. India too, should take some measures to ensure that her infrastructure is on par with these countries.

There are major corridor programmes that will immensely impact the railways, the roadways, and the airways sectors.

-

Cement Sector

The cement sector has also seen massive strides over the last couple of years. That is because of the construction projects at the helm. Several critical structures have come up, and are expected to be constructed, which is causing the cement sector to be in demand.

-

Power and Utilities

Several companies are involved with the power & utilities segment. Besides, there is also clean energy that focuses on green energy. This has seen a demand in the automobile industry, where consumers are keen on driving green-emission vehicles.

-

Consumer Durables

There is the consumer durable industry as well. The capital goods sector engages in distributing, manufacturing, and supplying machinery. This segment is vital for the industry. The tools & machines that are required for the industry to function are produced. That is why the government has to keep this sector in mind.

-

Pharmaceutical

The pharmaceutical industry is the final segment that the government may want to keep an eye on. They have plans to set up several medical colleges & universities throughout the country. The Finance Minister has stressed on the need for vaccination of young girls to prevent cervical cancer.

It was good to note that last year, the government increased the budget for the Promotion of Research & Innovation Programme (PRIP). The Nifty pharma index is up significantly due to the efforts taken by the government.

The interim Budget for 2025-26 has to focus on the above critical industries. These industries hold the key towards the growth & development of the country. Apart from the above, some industries hold key to the nation, they include railways also as it can see a rise in the overall demand.

Also Read: Budgeting for the New Financial Year: Forecasting Tools and Effective Budgeting Techniques

Sustainable Development Initiatives

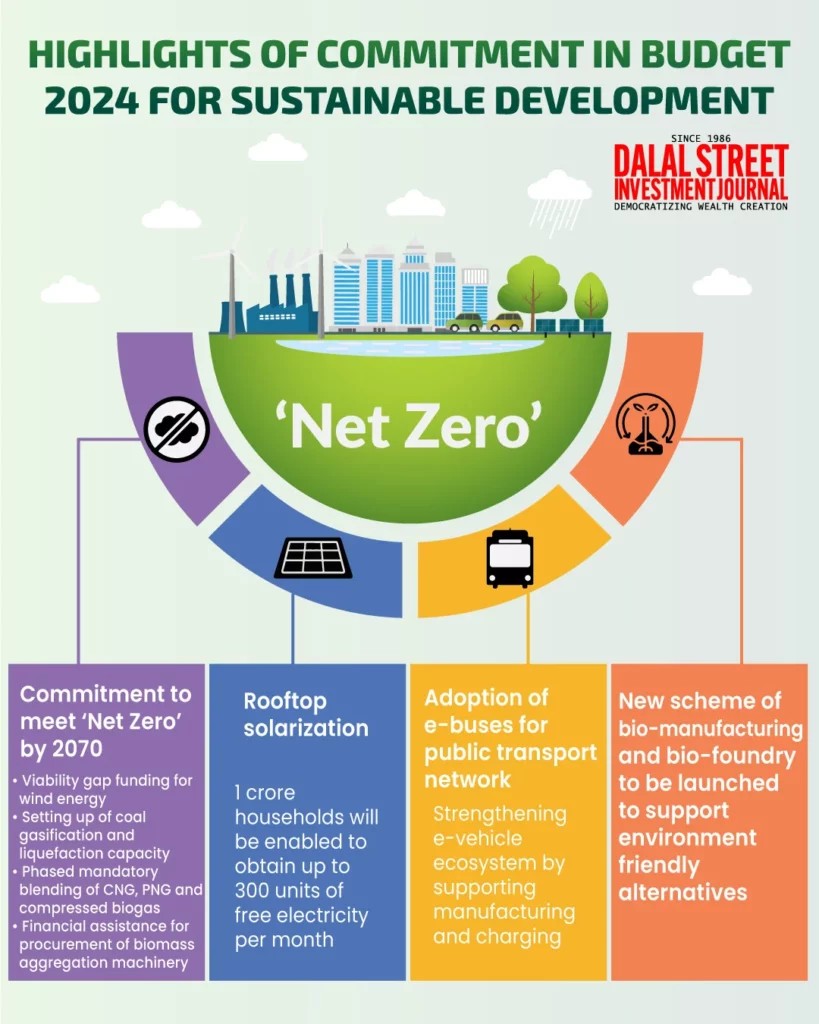

The government has taken serious note of the green revolution, and they have implemented certain goals that should be achieved before 2060. The budget has come up with a comprehensive plan that can make India sustainable in green energy.

Being the most populated country in the world, unless India starts planning now, it will become a now-or-never strategy. Perhaps, it may be too late to even implement anything for that matter. This thought approach showcases a good commitment to foster a clean nation.

The main initiatives involve offering gap funding to establish 1 GW of offshore wind energy capacity. This can be done through the production of several machines & equipment so that the dependence on fossil fuels is reduced significantly.

Some of the sustainable development initiatives in budget 2025 have been discussed below:

-

Empowering homes through the “Muft Bijli”

The “Muft Bijli” (free electricity) has been introduced by the government. The plan is to provide crores of homes with the rooftop solarization initiative. They want to provide at least a minimum of 300 units of power to a home.

The main advantage here would be providing adequate financial aid to the families. That means free solar electricity can be provided for both personal & professional use. If they are working as farmers or in the small-scale industry, then the power can be used there as well.

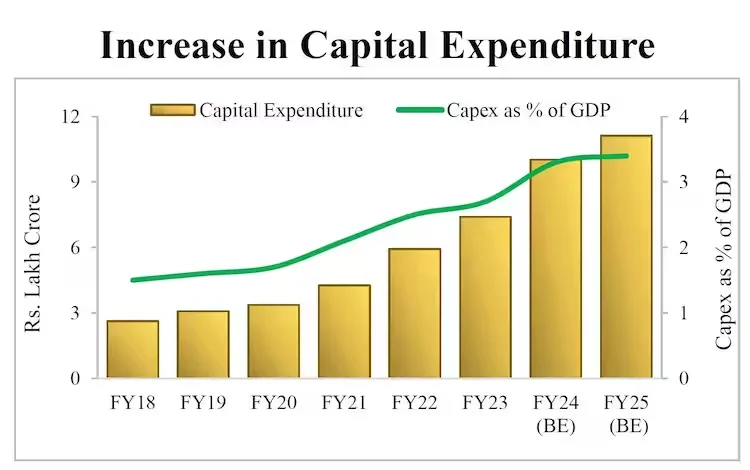

This can help families reduce the power burden by almost Rs. 18,000/month. Not to mention, it helps in the increase of the usage of energy-efficient consumption. According to Satyam Vyas, who is the CEO and founder of Climate Asia, “Budget 2025 should bring the focus of sustainable energy. It is pivotal in shaping the economic future of the country.” He also said, “India is investing more than 2% of GDP in FY 2023-24.”

-

Green Transportation

While providing solar energy through power to homes is a good initiative, offering other means of use is notable. For example, the government is also providing for the green revolution through transportation.

They want to ensure that the country becomes net zero in 2060-2070. To do that, they have to start supporting the cause of the usage of green energy on the road. It is commendable to see that several thousand vehicles, both two-wheelers & four-wheelers have been sold in the market.

Consumers don’t mind spending Rs. 10 lakhs more than the traditional gas vehicles, to ensure that their country is safer in their hands. Besides, the government is providing these users with tax benefits.

Some states have also begun the production & development of e-buses to address public transportation. This ensures that the efficiency caused in the public charging stations can be compromised until new alternates are found out.

Overall, it is commendable that the interim budget has focused on providing a greener future for the nation. India is slowly but steadily progressing towards a greener future that can be sustainable as well.

The budget has a good outlook towards environmental impact, and causing economic growth too. There is a commitment to have net-zero emissions by 2060 & beyond. They have also worked to ensure that other sectors follow suit like renewable energy and transportation.

They are encouraging entrepreneurs to make use of the opportunities for green development for the nation. entrepreneurship. The government has taken several initiatives in environmental conservation, reducing carbon emissions, and promoting eco-friendly mobility solutions.

Employment and Skill Development

The main objective of the interim budget was generating employment and skill development. India’s unemployment scenario presents a grim figure, and unless the government provides some fast remedy, things may not improve.

However, the Finance Minister has stressed that the government is taking this matter seriously. There is a rise in employment opportunities that have been provided due to the various government schemes.

The interim budget 2025 expectations for the criteria are given below:

-

Encouraging Entrepreneurship

The government through the interim budget has allocated funds that can be used for encouraging entrepreneurship. Several startups have begun and flourishsed abundantly in India. They have generated lakhs of jobs and provided employment for people of all ages as well.

The program offers opportunities for entrepreneurs to take part in the green energy revolution, and other sectors as well. They can foster a surge in installing solar panels and their equipment. Entrepreneurial growth can expand the renewable energy landscape.

-

Green Growth Through Biomass

Bio-manufacturing and bio-foundry sectors have received a shot in the arm due to the various government schemes. They can now provide eco-friendly alternatives that can be used for the industry.

Besides, through the Blue Economy 2.0, climate-resilient activities can be promoted to be used for restoration and adaptation. Through the increase in the coal and other fossils, India, no longer, has to depend on foreign inputs.

The government also wants to mandate biogas blending with CNG. This may immensely cut emissions and biomass aggregation. The agricultural waste management can be enhanced through this process.

-

Skill India Mission

Through the ‘Skill India Mission’, 1.4 crore youth have been trained & upskilled. Besides, there have been 3000 new ITIs formed that can deliver vocational training for one or two-year skill courses.

This will be done with the help of the Craftsman Training Scheme (CTS). There is the PM Mudra Yojana that has provided more than 40 crores in funds, for more than 1000 entrepreneurial candidates throughout the country.

The government wants to work through the principle of ‘Reform, Perform, and Transform.’ Besides, timely and adequate finances will be provided for worthy startups that actually need financial aid and appropriate training will be provided to compete globally.

Infrastructure and Connectivity

The Interim Budget for 2025-26, has been inspired by “Viksit Bharat.” They want to ensure that they have a smoother approach to economic growth, social development, and inclusivity. There has been an allocation of close to Rs. 47,65,768 crore.

This is a massive increase of 2.8% from the previous year for funds provided to the infrastructure management. Moreover, approximately Rs.2.78 lakh crores have been allocated to the Ministry of Road, Transport and Highways, the second highest budget allocation.

-

Viability Gap Funding

The viability gap funding has been provided to the developing states of Gujarat and Tamil Nadu. They want to facilitate the development of offshore wind energy. Besides, a plant that has a capacity of 100 million tonnes will be ready.

This comes under the “PM Gati Shakti Scheme,” where the energy, mineral and cement sectors are benefited. Likewise, the aviation sector will see several airports getting expanded through the UDAN scheme.

A notable factor about the interim budget is also the increase in the Telecom sector. This could be due to the revival of BSNL. In conclusion, the government has taken the infrastructure and connectivity seriously. They want to ensure that the country sees massive strides in these areas.

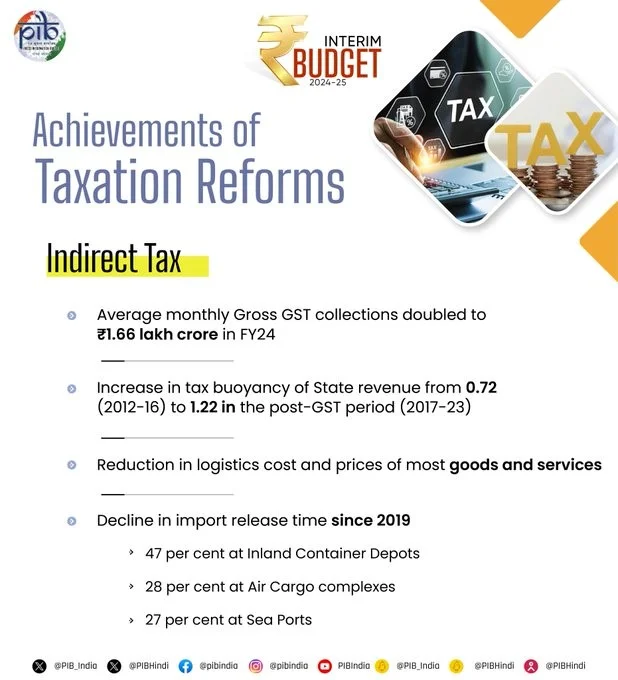

Taxation Reforms

Source: https://pendulumedu.com/blog/major-highlights-of-interim-budget-2024

Some of the various taxation reforms and business impact have been discussed below:

- The GST collection was at Rs. 1.6 crore in December 2023. The gross GST revenues have crossed 1.6 lakh crore.

- The average monthly gross GST collection has doubled to Rs. 1.6 crore in FY24.

- There has been an increase in the tax buoyancy of state revenue from 0.72 to 1.22 post-GST period.

- A Rs. 75,000 crore for a 50-year free interest has been proposed for state governments.

- There is a tax exemption for IFSC units up to March 31st, 2025.

- The outstanding direct tax of Rs.25,000 will be withdrawn.

Also Read: Interim Budget 2024 Highlights

Financial Sector Revisions

The economic trends in interim budgets were void of any significant tax relief or tax adjustments.

- There is an estimated nominal GDP growth of 10.5%.

- The mop-up from central public sector enterprises (CPSEs) disinvestment is at Rs. 50,000 crore.

- The gross tax revenue target is hiked 11.46% to Rs. 38.31-lakh crore.

- The direct tax collection target has been set at Rs. 21.99-lakh crore.

- The white paper on mismanagement will be released by the government before 2014.

- The next-generation reforms will be unveiled.

- They will form a high-powered panel to address population growth challenges.

Also Read: Navigating the 2024 Budget: Impact, Expectations, and Economic Insights

Conclusion

The interim budget 2025 expectations are immense. Several industry leaders, analysts, and statisticians, are excited with the awaited breath about the interim budget. The budget for the last few years has been just about average.

Most of the tax slabs have been increased, this interim budget has a lot hanging in the balance. We expect to see a budget that can play a multifaceted economic strategy. The Finance Minister may want to plan for cleaner energy, infrastructure, and goals to enhance financial growth.

Several industry leaders & analysts anticipate crucial support for major sectors. However, the Finance Minister may also want to give attention to some of the crucial public sectors like the railways, and power & utilities.

The Finance Minister will also concentrate on the progress of various schemes that were initiated by the government. As we look forward, we sincerely hope that the interim budget satisfies the needs of the middle class, which serves as the backbone of the country.

Also Listen: The Impact of GST on Tax Revenue

FAQs

-

What is an “Interim Budget”?

An interim budget is a financial budget that is temporary. This budget is set only for a few months until the new government is formed at the centre. The budget is created for the country, till the new budget is given by the new government.

-

What can be expected from the budget in 2025?

There are a wide range of expectations from the budget in 2025. Some of them include an increase in the interest limit for home loans, relaxation of the ESOP taxation, and also the inclusion of a new tax regime.

-

What industries will benefit from the budget 2025?

The interim Budget for 2025 can benefit some sectors. Some of them include renewables, infrastructure, cement, capital goods, and the medical industry. Besides, railways, power, utilities, and the pharmaceutical industries stand to benefit from the interim budget.

-

How the interim budget can impact the stock market?

The interim budget can impact the stock market. It controls the mood of the functioning of the market. The market sentiment is directly proportional to the announcement of the budget before a few days. The last few years have seen the market perform according to the budget.

-

Which stock to buy after the 2025 budget?

There are some stocks that one can consider after the 2025 budget. The Finance Minister has graciously lowered allocation for fertiliser subsidy by 13% to ₹1.64 lakh crore. This is in comparison to ₹1.89 lakh crore. Some of the stocks to invest in would be Kalyan Jewellers, Titan Company, PCJ Jewellers, and Tanishq.

-

What to expect from an interim budget?

The Finance Minister will provide the current financial status of the country. Besides that, the fiscal status for the estimated growth in the next year will be presented in the budget. The planned and non-planned expenditures will be provided in the interim budget.

-

What could be the highlights of the 2025 budget?

According to reliable sources, the same tax rates may apply to direct taxes. This is for those who are below 60 years old, new income slabs will be provided for senior citizens and super senior citizens, and it may have a “Strategy for Amrit Kaal”.

-

What can the common man expect from the budget in 2025?

For the common man, it is expected that the Finance Minister may freeze the fuel duty rates. There may be a small cut in the fuel duty rates, and the difference between road fuel gas and diesel duty rates, following review, may remain the same.

-

What is the interim budget for agriculture in 2025?

Agriculture is one of the most crucial sectors of the Indian economy. The Indian economy thrives on it. According to sources, they may allocate around Rs. 1,27,469.88 crore to the Ministry of Agriculture. Besides, Rs. 1,17,528.79 crore, may be allocated to the Department of Agriculture.

-

What is the budget allocation for 2025?

The estimated interim budget has been allocated at around Rs. 47,65,768 crore. This number is quite large, and more than 6% of that of the previous budget that was allocated in 2023-24. The revenue expenditure may grow at 3.2%, and capital expenditure may grow at 16.9%.