Introduction:

In the world of GST, Digital Signature Certificates (DSCs) are like electronic stamps that make sure all online transactions are secure. But sometimes, these DSCs can cause problems on the GST portal, making it hard for businesses to do their taxes smoothly. This guide will help you understand why these problems happen and how to fix them. We’ll talk about common errors, like when your DSC isn’t found, or when it’s expired. Then, we’ll give you tips on how to troubleshoot these issues and some best practices to keep your DSC working well. By the end, you’ll know how to tackle DSC troubles like a pro and keep your business running smoothly.

Understanding the Role of DSC in GST

When you’re doing business and dealing with taxes, especially GST, it’s important to know about Digital Signature Certificates (DSCs). These certificates are like special electronic stamps that verify and secure your online transactions.

So, when you file your GST returns or do any other important task online, the DSC acts as your digital signature. It tells the GST system that it’s really you who’s doing the transaction, making sure everything is safe and authentic. Without DSCs, it would be much riskier to do business online, especially when it comes to taxes.

So, in simple words, DSCs are like your digital ID cards for the GST world, ensuring that all your online transactions are secure and legitimate.

Common DSC-Related Errors

Error Message |

Description |

| “DSC Not Found” | This error occurs when the GST portal can’t find your DSC. It could be because it’s not properly linked to your account or there’s a technical issue. |

| “Invalid DSC Certificate” | When your DSC certificate is expired, revoked, or not configured correctly, you’ll see this error. It means the GST portal can’t verify your digital signature. |

| “Server Error, Please Try Again Later” | Sometimes, the GST portal may experience technical problems, leading to this error. It’s usually temporary and resolves on its own after a while. |

| “DSC Token Not Recognized” | If the DSC token, which stores your digital signature, is not recognized by the system, you’ll encounter this error. It could be due to connectivity issues or a malfunctioning token. |

| “Mismatched DSC Configuration” | This error occurs when the settings or configurations of your DSC don’t match the requirements of the GST portal. Double-checking and adjusting configurations usually resolves this issue. |

Also Read: How To Remove DSC Error From GST: A Comprehensive Guide

Unpacking DSC Not Working Error

Sometimes, when you’re trying to use your Digital Signature Certificate (DSC) on the GST portal, things don’t go as planned. You might see an error message saying “DSC Not Working.” Let’s unpack what this means in simple terms.

When you encounter the “DSC Not Working” error, it means that there’s a problem with your DSC, and the GST portal can’t use it properly. This could happen for a few reasons:

- Linking Issue: Your DSC might not be connected or linked correctly to your GST account.

- Technical Glitch: Sometimes, there could be a temporary issue with the GST portal or your internet connection, causing the DSC to not work.

- Configuration Problem: Your DSC settings or configurations might not match what the GST portal needs, causing it to fail.

Overall, this error means that your DSC isn’t doing its job properly on the GST portal. If you face this issue again and again you need to consult with a technical guy.

Also Read: Know Everything About GST DSC Error And How To Fix It?

Reasons Behind DSC Malfunctions

Reason |

Description |

| Expired Certificate | When your DSC certificate’s validity period has ended, it’s like an expired ID card – it won’t work anymore. Make sure to renew it before it expires. |

| Incorrect Configuration | Sometimes, the settings or configurations of your DSC might not match what the GST portal needs. Double-check and adjust them if necessary. |

| Connectivity Issues | If there are problems with your internet connection or the GST portal’s servers, your DSC might not work properly. Check your connection and try again. |

| Hardware Malfunction | Issues with the hardware storing your DSC, like a malfunctioning token or card reader, can prevent it from working. Try using your DSC on a different device to see if the problem persists. |

| Revoked Certificate | If your DSC certificate has been revoked due to security concerns or other reasons, it won’t be trusted by the GST portal anymore. Contact the issuer to resolve this issue. |

Troubleshooting DSC Not Working

- Check Certificate Validity: Ensure your DSC is within its validity period.

- Update Software: Install the latest drivers and software compatible with your DSC.

- Verify Configuration: Double-check DSC settings and configurations on the GST portal.

- Test on Different Device: Attempt DSC authentication on another device to rule out hardware issues.

- Contact Helpdesk: Reach out to GST portal support for assistance with persistent issues.

Best Practices to Ensure DSC Functionality

-

Regular Certificate Renewal:

- Keep your DSC certificate up to date by renewing it before it expires. This ensures uninterrupted functionality and compliance with GST regulations.

-

Secure Storage:

- Store your DSC in a safe and secure location, such as an encrypted USB drive or smart card. Protect it from unauthorized access to prevent misuse or tampering.

-

Backup Certificates:

- Maintain backup copies of your DSC certificates in case of loss, damage, or technical issues. Having a backup ensures you can still access your DSC even if the original is unavailable.

-

Periodic Checks:

- Regularly verify the functionality of your DSC by performing test transactions or authentication processes on the GST portal. This helps identify any potential issues early on and ensures smooth operations when needed.

-

Stay Informed:

- Stay updated on any changes or updates related to DSC usage and GST portal requirements. Regularly review guidelines and regulations to ensure compliance and avoid any surprises or issues with your DSC.

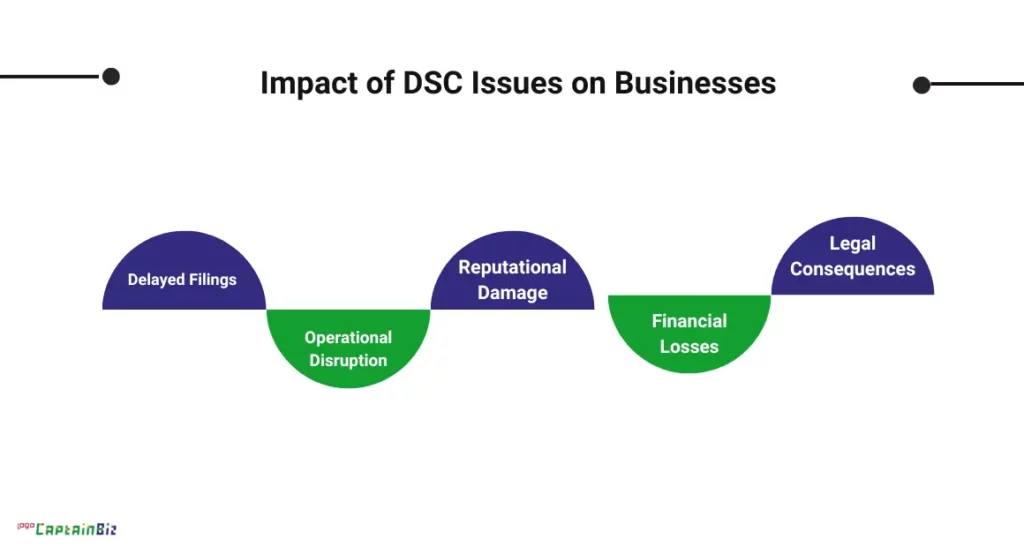

Impact of DSC Issues on Businesses

- Delayed Filings: DSC issues can lead to delays in filing GST returns and other important documents, potentially resulting in penalties and fines for non-compliance.

- Operational Disruption: Business operations may be disrupted if DSC-related errors prevent transactions or approvals from being processed on time, affecting cash flow and productivity.

- Reputational Damage: Persistent DSC issues can tarnish a business’s reputation, leading to loss of trust among customers, suppliers, and partners who rely on timely and accurate transactions.

- Financial Losses: Incorrect or delayed filings due to DSC errors can result in financial losses through penalties, interest charges, and missed opportunities for tax credits or refunds.

- Legal Consequences: Non-compliance with GST regulations due to DSC issues can expose businesses to legal risks, including audits, investigations, and potential litigation.

Overall, the impact of DSC issues on businesses can be significant, affecting not only financial stability but also reputation and legal standing in the marketplace. It’s essential for businesses to address DSC issues promptly and implement preventive measures to mitigate their impact.

Conclusion

In the complex landscape of GST compliance, ensuring seamless DSC functionality is paramount. By understanding common errors, troubleshooting effectively, and adopting best practices, businesses can navigate DSC issues with confidence, safeguarding their operations and compliance.

Frequently Asked Questions (FAQs)

-

What is a Digital Signature Certificate (DSC), and why is it essential for GST filings?

- A DSC is an electronic signature that authenticates GST transactions, ensuring security and compliance.

-

How do I resolve the “DSC Not Found” error on the GST portal?

- Verify DSC registration and ensure it’s correctly linked to your GST account.

-

What should I do if my DSC certificate has expired?

- Renew your DSC certificate promptly to prevent disruptions in GST filings.

-

Why am I encountering a “Server Error” when using my DSC on the GST portal?

- This error usually indicates a temporary technical issue on the GST portal. Wait and try again later.

-

Can I use the same DSC for multiple GSTINs (Goods and Services Tax Identification Numbers)?

- Yes, a single DSC can be used across multiple GSTINs, simplifying authentication for businesses with multiple registrations.

-

How can I ensure the security of my DSC?

- Store your DSC in encrypted devices, keep backups, and avoid sharing it with unauthorized individuals.

-

What are the consequences of using an invalid or revoked DSC for GST filings?

- Using an invalid DSC can lead to rejected filings, penalties, and compliance issues, impacting business operations.

-

Is there a specific software requirement for using DSCs on the GST portal?

- Ensure you have compatible software installed, and keep it updated to avoid compatibility issues.

-

Can I troubleshoot DSC issues without contacting the GST helpdesk?

- Yes, you can perform basic troubleshooting steps like checking settings and configurations before seeking help from the support team.

-

How often should I renew my DSC certificate to ensure uninterrupted GST filings?

- Renew your DSC certificate before it expires to prevent disruptions. Check the validity period and plan renewal accordingly.