Introduction

GST, or Goods and Services Tax, is a single tax that simplifies the previous complicated tax system by combining various taxes into one. When you buy things or use services, a small part of your payment is the GST, which also applies to businesses on their purchases. This unified approach replaces many different taxes, making the system fairer and more straightforward. The money collected goes to the government to support the country. In the context of sales order management, the impact of GST on sales orders is notable. The introduction of GST has transformed the sales order process under GST, requiring businesses to adapt to new regulations for creating GST-compliant sales orders. This shift ensures that sales orders adhere to the specific guidelines set by GST, promoting an organized and transparent system. Businesses that implement GST-compliant sales orders experience an improvement in overall efficiency. The effect of GST on sales order efficiency is significant, as the unified tax structure streamlines processes, reduces the overall tax burden, and ensures fairness and transparency for everyone involved in the sales order cycle. This simplicity not only enhances operational efficiency but also contributes to a more equitable and transparent business environment.

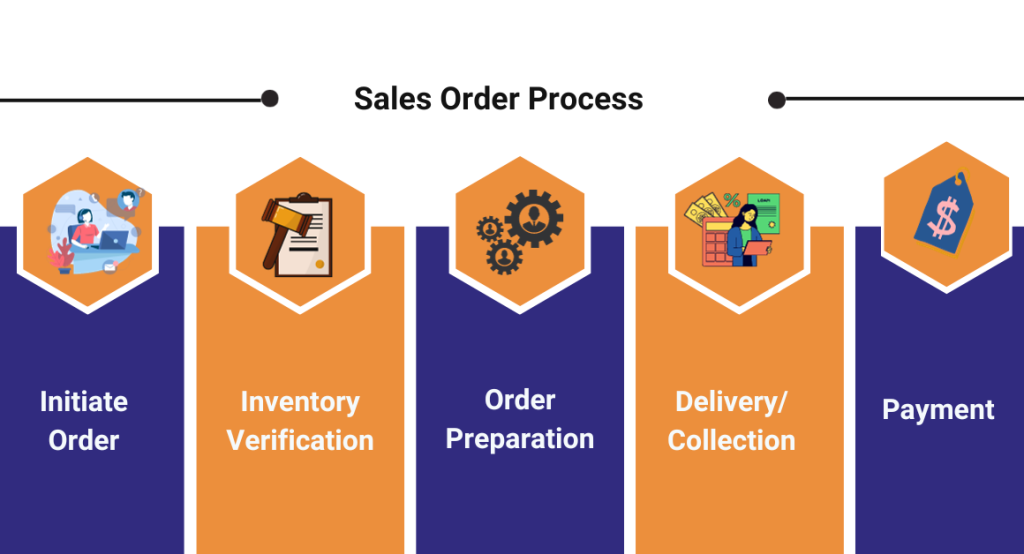

Basics of Sales Order Process

The sales order process is like telling a store what you want to buy and how much. It’s similar to going to a shop and making a request. The store then checks if they have the items, prepares them for you, and when ready, you get what you bought and pay for it. This process ensures that both you and the store benefit – you get what you want, and the store ensures they sell what people are looking for. It’s like a plan to make shopping easier for everyone involved, ensuring a smooth and satisfying experience.

Here is fundamental steps involved in the sales order process:

- Initiate Order: The customer communicates their desired purchase and quantity to the business.

- Inventory Verification: The business checks its stock to confirm the availability of the requested items.

- Order Preparation: If the items are in stock, the business readies them for delivery or pickup.

- Delivery/Collection: The customer receives the purchased items either through delivery or by picking them up.

- Payment: The customer provides payment to the business for the received goods.

The impact of a good sales order process on a business is like making everything run smoothly. When the process works well, the business can be sure to have what customers want, get it ready efficiently, and make money. It’s like a well-organized plan that helps the business and keeps customers happy.

Overview of GST in Sales Order Management

Examining GST in Sales Order Management is like figuring out how taxes work in the process of selling things. It involves understanding how GST rules apply when a business receives orders for goods or services. This overview helps businesses handle sales orders while ensuring compliance with tax regulations, maintaining organization and legal adherence. It’s akin to ensuring the financial aspect of selling things is managed correctly and aligns with the overall business plan.

Let’s understand how GST is integrated into the sales order management system:

-

Identifying GST in Orders:

When a customer makes an order, the system recognizes that GST needs to be applied.

-

Calculating GST:

The system figures out how much GST needs to be added to the total cost of the order.

-

Including GST in Invoices:

The system makes sure that the GST amount is included in the invoice that the customer receives.

-

Recording GST Transactions:

Every time an order is made, the system keeps a record of the GST collected.

-

Reporting to Authorities:

The system helps in creating reports that show how much GST the business has collected. This information is then shared with the tax authorities.

-

Ensuring Compliance:

By integrating GST into the sales order system, the business ensures it follows the tax rules correctly, avoiding any issues with the law.

Specific rules and regulations related to GST in the context of sales orders are like guidelines that businesses need to follow when dealing with orders. Here’s how it works:

-

GST Rates:

- Different items can have different GST rates; some may be higher, others lower, as specified in the rules, and businesses must apply the correct rate for each item.

- Also Read: What Is The GST Rate Structure For Sales And Purchases? A Comprehensive Summary

-

Threshold Limits:

- There are limits on a business’s total sales before GST registration is required; crossing this limit means following GST rules, including applying GST to sales orders.

-

Reverse Charge Mechanism:

- In specific cases outlined in GST regulations, the customer, not the seller, may be responsible for paying GST; this is known as the reverse charge mechanism.

-

Input Tax Credit:

- Businesses can reduce the GST paid on sales orders by claiming Input Tax Credit, subtracting the GST paid on purchases from the GST collected on sales.

-

Invoicing Requirements:

- Invoices must adhere to specific GST regulations, including details like GSTIN, GST amount, and other necessary information.

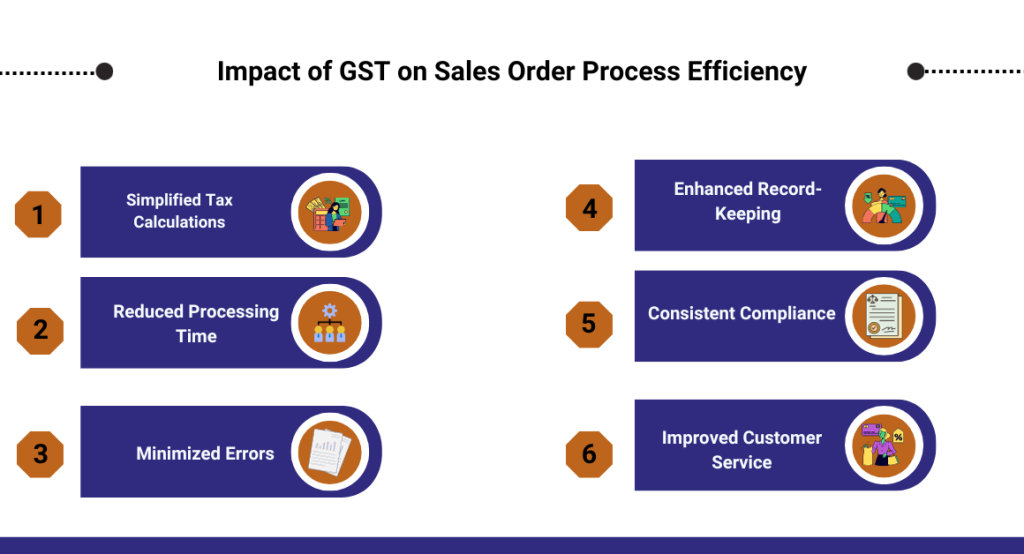

Impact of GST on Sales Order Process Efficiency

The introduction of GST has significantly impacted the efficiency of the sales order process in various ways:

-

Simplified Tax Calculations:

- GST simplifies tax calculations, replacing complex taxes with a unified system for easier computation on sales orders.

- Also Read: Simplify Your Tax Calculations: Exploring An Easy GST Calculator

-

Reduced Processing Time:

- Clear and standardized GST rules reduce the time spent navigating complex structures, leading to faster processing of sales orders.

-

Minimized Errors:

- Streamlined GST rules lower the chances of errors in tax calculations, ensuring more accurate financial transactions and reducing the need for corrections.

-

Enhanced Record-Keeping:

- GST implementation encourages better record-keeping, requiring organized transaction records and improving efficiency in managing sales orders.

-

Consistent Compliance:

- GST brings consistency to tax compliance, making it easier for businesses to adhere to a single set of rules and reducing the risk of non-compliance issues.

Changes in Documentation and Record-Keeping Due to GST

The implementation of GST has brought about substantial changes in documentation and record-keeping practices for businesses. Here’s a detailed overview of these changes:

-

Introduction of GSTIN on Invoices:

- Businesses must now include their unique GST Identification Number (GSTIN) on invoices for effective transaction tracking.

-

Revised Invoice Formats:

- Invoices have been updated to comply with GST regulations, requiring specific details like GSTINs, invoice numbers, item descriptions, quantities, values, and applicable taxes.

-

Tax Classification and HSN Codes:

- Goods and services must be classified under specific tax rates, with businesses mentioning Harmonized System of Nomenclature (HSN) codes for uniform taxation classification.

-

Reverse Charge Mechanism (RCM) Declaration:

- In cases of the reverse charge mechanism, businesses need to explicitly state this on invoices, shifting tax payment responsibility from supplier to recipient.

-

Place of Supply Mention:

- Invoices must clearly specify the place of supply for goods and services to determine accurate tax jurisdiction.

-

Credit and Debit Notes Compliance:

- Issuance of credit and debit notes must adhere to GST rules, containing necessary details for accurate transaction adjustments.

-

Electronic Way Bill (E-Way Bill) Documentation:

- For goods movement beyond a specified value, an E-Way Bill is mandatory, including details like GSTINs, invoice numbers, and HSN codes.

- Also read: Procedures And Documentation For Handling Expired E-Waybills

-

Maintaining Detailed Records for Input Tax Credit (ITC):

- To claim Input Tax Credit, businesses must keep comprehensive records of purchases, ensuring accurate documentation of input taxes for offsetting against tax liability.

-

Periodic Return Filing:

- Regular electronic filing of returns summarizing transactions is mandated by GST, with the accuracy of provided information crucial for compliance.

-

Record-Keeping Requirements:

- Businesses are obligated to maintain meticulous records, including invoices and vouchers, as the foundation for audits and compliance checks, retaining them for a specified period.

Role of Technology in Adapting to GST in Sales Orders

The role of technology in adapting to GST in sales orders is like using smart tools and systems to make sure businesses can smoothly follow the new tax rules. Here’s how it works:

-

Automated Calculations:

- Technology automates GST calculations for each sales order, reducing errors and speeding up the process.

-

Integrated Systems:

- Businesses use technology to integrate sales order systems with GST rules, ensuring automatic application of correct GST rates.

-

Electronic Invoicing:

- Technology enables the creation of electronic invoices with all necessary GST details, saving time and ensuring accurate documentation.

-

Record-Keeping Software:

- Advanced record-keeping software facilitated by technology helps businesses maintain organized records, aiding compliance with GST regulations.

-

Reporting Tools:

- Technology is used to generate reports on GST collections and payments, essential for transparent reporting to tax authorities.

Training and Education for GST-Compliant Sales Order Processing

Employee training is essential for understanding and adhering to GST regulations in the sales order process. It ensures accurate tax calculations, proper documentation, and overall compliance with the GST framework, with various programs implemented for education on GST-compliant sales order processing.

-

Online Workshops and Webinars:

- Businesses organize online sessions to train employees on GST rules, covering topics like rates, invoicing, and record-keeping.

-

Internal Training Modules:

- Companies create internal modules tailored to their sales order processes, providing practical examples and case studies for GST compliance.

-

Collaboration with GST Experts:

- Businesses partner with GST experts for specialized training, gaining insights into GST laws and guidance for ensuring compliance in sales orders.

-

Regular Updates and Refresher Courses:

- To keep employees informed about changes in GST regulations, businesses conduct regular updates and refresher courses, ensuring ongoing compliance education.

Challenges and Solutions in Implementing GST in Sales Orders

| Challenges in Implementing GST in Sales Orders | Solutions |

| 1. Understanding Complex GST Rules: Employees may find the intricacies of GST regulations challenging, leading to errors in tax calculations and compliance. | Solution: Implement training programs and workshops to enhance employee understanding of GST rules, ensuring ongoing education and use of online resources for clarification and staying updated on regulatory changes. |

| 2. Integration of GST into Existing Systems: Adapting existing sales order systems to incorporate GST rules can be technically challenging. | Solution: Invest in technology upgrades or specialized GST software that smoothly integrates with sales order systems, collaborating with IT professionals for a seamless transition and minimal disruptions. |

| 3. Ensuring Accurate Tax Calculations: The complexity of GST rates for different goods and services can result in miscalculations, leading to potential compliance issues | Solution: Implement automated systems for precise GST calculations based on item-specific rates, conducting regular audits to ensure accuracy and promptly addressing any discrepancies. |

| 4. Inefficient Record-Keeping Practices: Inadequate record-keeping may result in difficulties during audits and can lead to non-compliance with GST requirements. | Solution: Use advanced record-keeping software aligned with GST regulations, establish clear documentation procedures, and conduct periodic internal audits to ensure accurate and up-to-date records. |

Conclusion

Understanding the impact of GST on the sales order process is crucial for businesses, influencing efficiency, documentation, and overall operations. Adapting to GST involves a holistic approach with technology, training, and proactive responses to regulatory changes. Businesses, by comprehending and addressing this impact, can navigate complexities, ensure compliance, and maintain a streamlined and efficient workflow in the dynamic taxation landscape, benefiting customer satisfaction and revenue generation.

FAQ’s

-

What is GST, and why is it significant in business operations?

- GST, or Goods and Services Tax, is a consumption-based tax that replaces various indirect taxes, streamlining business transactions and promoting a unified tax structure.

-

What are the basics of the sales order process?

- The sales order process involves the creation, confirmation, and fulfillment of customer orders, starting from order placement to product delivery.

-

How does GST impact sales order management?

- GST introduces taxation at each stage of the supply chain, influencing pricing strategies, invoicing, and overall sales order handling.

-

How does GST affect the efficiency of the sales order process?

- GST can enhance efficiency by reducing tax cascading, simplifying compliance, and promoting accurate tax calculations throughout the sales order cycle.

-

What changes occur in documentation and record-keeping due to GST?

- GST necessitates updated documentation and record-keeping practices, including GSTIN on invoices and maintaining detailed records for input tax credit.

-

What role does technology play in adapting to GST in sales orders?

- Technology facilitates seamless integration of GST compliance into sales order processes, automating calculations, and ensuring accuracy in tax reporting.

-

What training and education are essential for GST-compliant sales order processing?

- Adequate training is crucial for staff to understand GST regulations, update processes, and ensure accurate implementation of GST requirements in sales orders.

-

What challenges arise in implementing GST in sales orders, and how can they be addressed?

- Challenges include system integration, staff adaptation, and compliance complexities; addressing them requires robust software solutions, continuous training, and proactive compliance monitoring.

-

How does GST impact cross-border sales order transactions?

- Cross-border transactions require careful consideration of GST implications, including understanding the applicability of Integrated GST (IGST) and proper documentation for exports and imports.

-

How can businesses stay abreast of evolving GST regulations affecting sales orders?

- Regularly updating staff on changing GST regulations, leveraging technology for real-time compliance checks, and engaging with tax experts help businesses navigate and adapt to evolving GST scenarios in sales orders.