Maintaining compliance with rules is one of the GST billing software benefits in the complicated system of taxes. When it comes to the concept of the Goods and Services Tax (GST), compliance is not just about meeting one’s legal requirements but also about avoiding fines. When going through these conditions, GST billing software appears to be an essential tool since it offers capabilities that speed up operations and prevent risks. The following details the essential role that plays in avoiding GST penalties with software and maintaining that compliance is carried out without any problems.

Understanding GST Penalties

Understanding the consequences of failing to comply with the Goods and Services Tax (GST) is necessary before getting into the capabilities of GST billing software and GST billing software benefits.

The Goods and Services Tax (GST) penalties may vary from fines to legal implications, which can have an effect on both money and reputation. Using technology in a proactive manner becomes necessary for organizations in order to avoid these risks.

An automatic compliance check is one of the benefits of GST billing software that may help companies avoid penalties. GST billing software benefits continually monitors transactions and identifies any errors. Invoice compliance and accuracy checks, prompt GST return submission, and smooth interaction with accounting systems are a few of the top features of GST billing solutions. By eliminating human mistakes and maintaining accurate and timely submission, automated compliance greatly influences GST.

When choosing GST software, businesses should look for solutions that offer real-time tax updates, data security, and customizable reporting to meet their specific needs and enhance compliance efforts.

Penalties for GST under the GST Act

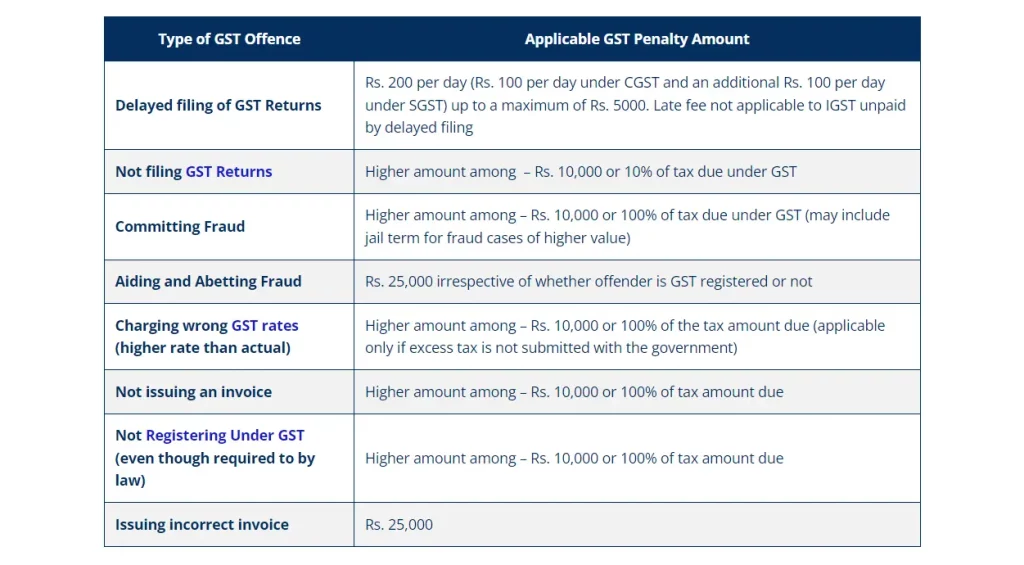

Tax penalties Among the many factors that determine the severity of penalties for infractions of the GST Act 2017 are the gravity of the offense. For a few major violations of the legislation, the penalties are outlined below:

Here is a list of the potential mistakes that might occur while using GST Billing Software, which can result in fines under the Goods and Services Tax (GST) of any sort.

- A failure to produce an invoice reference number (IRN) is deemed to be a failure to issue an invoice on time.

- If an invoice is not registered on the IRP, then that particular invoice would not be considered an authorized tax invoice for any and all matters relating to the Goods and Services Tax (GST), and as a result, it would be subject to a penalty of ₹10,000 for each instance of non-compliance.

- Initiating the transportation of goods without a valid tax invoice that contains an IRN may result in the detention of both the products and the vehicles, as well as the assessment of the normal penalty.

- In the absence of a legitimate tax invoice, customers have the option of refusing to accept the products and/or making payments. This is because the lack of a legal tax invoice would have an effect on the recipient’s ability to get ITC.

- A check that would prevent the creation of an electronic way bill in the absence of an IRN is also something that the government plans on implementing in the future.

GST-related offenses

Within the framework of the Goods and Services Tax (GST) system, there are a total of 21 distinct offenses that may result in penalties. Of course, there are offenses that, although not on the list, attract GST penalties that are determined on an individual basis in relation to each individual example.

Also Read: Penalty And Offences Under GST

What is the impact of automated compliance on GST?

Businesses and tax authorities are both profoundly affected by the impact of automated compliance on GST. Automated compliance provides multiple benefits by using modern technology to simplify operations and guarantee compliance with rules.

- Automated compliance monitors all transactions in real-time and compares them to regulatory requirements, ensuring proper tax returns. As a result, the possibility of human error is reduced.

- By automating mundane but necessary tasks like data entry, invoice validation, and return filing, businesses free up resources to focus on what they do best. This helps to save money by making tax administration easier.

- Because automated systems maintain a full audit trail and record of transactions, tax authorities have extensive access to corporations’ tax activities. This promotes openness and responsibility. This transparency ensures that all parties involved are following the GST regulations and helps prevent fraud.

Best features of GST billing tools

There are many important features available, but some of the basic and best features of GST billing tools are listed below. These best features of GST billing tools empower businesses to stay compliant and avoid penalties. Let’s explore how these features work together to bolster GST compliance and mitigate risks.

Feature 1: Automated Compliance Checks

The capability of GST billing software to automate compliance checks is one of the most notable advantages of working with this program.

Through the use of complex algorithms, these solutions perform constant monitoring of transactions, therefore identifying any possible errors or non-compliance concerns.

Because of this proactive strategy, organizations are able to quickly solve problems, hence reducing the possibility of paying penalties.

Feature 2: Invoice Accuracy and Compliance

Invoices that are inaccurate or do not comply with the GST regulations are ideal targets for penalties. The most up-to-date billing software comes pre-loaded with features that guarantee the correctness and conformity of bills.

By performing tasks such as automatically generating GSTINs and checking invoice information against regulatory requirements, these solutions protect businesses from incurring fines that are the result of incorrect paperwork.

Feature 3: Timely Filing of GST Returns

When companies fail to file their GST returns on time, they risk incurring significant fines, which adds an unneeded burden to their financial situation.

Software that handles GST billing helps simplify the filing process by issuing regular reminders and allowing the submission of returns in a smooth manner. By automating this necessary procedure, organizations protect themselves from the consequences that come with being late.

Feature 4: Seamless Integration with Accounting Systems

Effective compliance with the Goods and Services Tax (GST) requires billing and accounting systems to be in sync with one another.

The most advanced billing software provides a smooth interaction with accounting systems, which guarantees an exact representation of GST transactions. Not only does this integration improve productivity, but it also reduces the possibility of errors that might result in penalties.

Feature 5: Audit Trail and Documentation

It is essential to have extensive documentation in the case of an audit since it serves as the foundation of defense against penalties.

The GST billing software has a detailed audit trail that tracks every transaction and alteration that occurs.

A degree of openness of this scale not only speeds up the auditing process but also promotes the trust of companies, which decreases the chance that they would be facing monetary penalties.

Feature 6: Real-Time Tax Updates

It is difficult for companies to remain in compliance with the Goods and Services Tax (GST) laws since they are subject to regular modifications. When it comes to tax rates, laws, and compliance needs, advanced billing software provides real-time updates.

By keeping up with these changes, companies may guarantee that their billing procedures continue to comply with the regulations, therefore reducing the potential of facing fines due to information that is no longer current.

Feature 7: Data Security and Confidentiality

GST billing software prioritizes data security, employing strong encryption techniques to safeguard information. Furthermore, these technologies conform to high confidentiality rules, which protect sensitive information by guaranteeing that only authorized workers may access it.

In order to reduce the possibility of suffering penalties as a consequence of data breaches or illegal access, organizations must ensure that the integrity and confidentiality of their data are maintained.

Feature 8: Customizable Reporting and Analytics

When it comes to properly tracking their GST compliance status, companies really need to have access to insightful monitoring and analytics.

The most advanced billing software provides businesses with the ability to produce reports that are customizable to meet their particular requirements.

Businesses are able to discover possible areas for improvement and proactively address compliance concerns with the help of these reports, which give important insights into compliance indicators.

Businesses have the ability to improve their compliance efforts and lower the risk of incurring fines if they maximize the use of these reporting options.

Also Read: Top Features To Look For In GST Billing Software For Indian Businesses

Guide to Choosing the Right GST Software for Business

For effective tax administration and compliance, it is necessary to choose the correct GST software for your company. If you want to make an appropriate choice, here is a simple instruction:

Figure out what you need.

Before you buy GST software, make a list of all the things your company needs. Things to think about include tax preparation, inventory management, and invoicing.

Ease of use

Look for software that has a simple interface and is straightforward to use. Your tax procedures will become more streamlined and error-free as a result of this.

Conformity

Check that the program abides by your country’s GST rules. It should be capable of correctly filing tax returns and creating invoices that comply with GST.

Integrity

When looking for software, such as accounting software, be sure it can work well with what you already have. With this, we can simplify operations and make better use of our precious time.

Costing

Think about how much the software will cost you, including any subscription payments. Find the greatest value for your money by comparing multiple options.

Check out user reviews and testimonials to get a feel for the software’s performance and dependability.

Choosing the right GST software for businesses should be scalable, meaning it can expand along with your company. Both the volume of transactions and the frequency of tax updates should be manageable.

If you follow these guidelines, you should have no trouble choosing the right GST software for businesses and keep verifying that the software vendor provides sufficient training and support. With this, you can get the most out of the software and fix any problems that may arise in line with tax laws.

Also Read: Choosing The Right GST Billing Software: A Comparative Review

Why File Your GST Return with Us?

Businesses may automate their GST compliance and tax administration with the help of CaptainBiz.

Let us tell you what you can expect from us :

- Complete GST Compliance with easy and automated filing and avoiding GST penalties with software

- Verified and tested GST Solutions for accurate automated data Management

- Expert and training support

- Efficient ITC Reconciliation

Wrapping It Up

There are not many accounting software programs that are properly aware of the variety of requirements that businesses have. For the purpose of developing an all-inclusive GST software, it is necessary to have a comprehensive understanding of the available facilities.

To guarantee that the accounting elements described above have a track to success that is free of problems is of the utmost priority. Significance.

Accounting software that uses the Goods and Services Tax (GST) is one of the major pioneers in India. As an Indian invoicing software company, our mission is to help small companies fulfill their diverse accounting needs.

FAQs

-

What are GST billing software benefits?

Accounting system integration, real-time tax updates, audit trails, integration with accounting software, automated compliance checks, and accurate invoices are all features of GST billing software.

-

Can GST billing software help businesses avoid penalties?

Businesses may remain compliant and avoid fines with the aid of GST billing software. The software automates compliance checks, ensures invoice correctness, facilitates quick return submission, and maintains audit trails.

-

Which features are required for GST billing software?

Find software with automatic compliance checks, invoice accuracy, and compliance, fast GST return submission, easy accounting system interface, real-time tax changes, data security, and configurable reporting.

-

What is the effect of automatic compliance on GST?

When it comes to GST compliance, automation is key. It helps to decrease mistakes, boost efficiency, increase transparency, and guarantee timely submission.

-

What are GST non-compliance penalties?

Fines, car and goods seizure, and input tax credit denial are all possible outcomes of GST non-compliance, the severity of which determines the exact penalty.

-

Does GST billing software ensure invoice accuracy? How?

Automated GSTIN auto-population, regulatory standard validation, and GST-compliant invoice generation are all features of GST billing software that contribute to its high level of accuracy and compliance.

-

How can GST billing software speed up GST returns?

By automating the filing process, sending reminders, and streamlining the submission method, GST billing software helps businesses file their returns on time and avoid penalties.

-

How does GST billing software work with accounting?

By integrating with accounting systems, GST billing software accurately reflects GST transactions, improving efficiency and minimizing the chance of inconsistencies.

-

How is the security of data protected by GST billing software?

By using powerful encryption methods and completely adhering to confidentiality rules, GST billing software makes data security a top priority, limiting access to sensitive information to authorized persons only.

-

How can companies go about selecting the best GST software?

Before settling on GST software, businesses should take stock of their requirements, think about how easy it will be to use, analyze the cost, see what other users have to say, make sure it can scale, and make sure it complies with GST standards.