Self Invoice Format

A self-invoice template is used by businesses to record transactions for services or goods when they are both the buyer and the seller.

- Facilitates internal invoicing for transactions.

- Ensures accurate record-keeping for VAT or tax purposes.

- Tracks goods or services sold within the company.

Download Customizable Self Invoice Format

Create Your First Customize Self Invoice Template With CaptainBiz

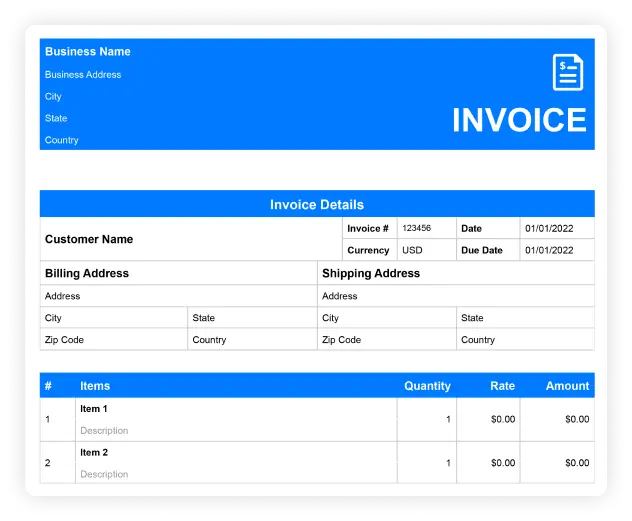

What Should Be Included in Self Bill Format

Business Information:

Include the business name, address, and contact details to clearly identify the entity issuing the self-invoice.

Goods or Services Sold:

Provide a detailed description of the goods or services sold internally, including the quantities and associated costs to ensure accurate record-keeping.

VAT or Tax Details:

Include applicable VAT or tax details, ensuring compliance with tax regulations and facilitating easy reporting.

Invoice Number and Date:

Assign a unique invoice number and date to track the transaction and ensure it is recorded correctly for internal auditing.

Total Amount and Payment Terms:

Clearly specify the total amount due, even if no actual payment is made, to ensure proper financial tracking.

Additional Notes (if applicable):

Include any relevant information, such as the purpose of the self-invoice or notes regarding the transaction.

So what are you waiting for?

Frequently Asked Questions (FAQs)

A self-invoice template is used by businesses to document internal transactions where they are both the buyer and the seller.

It should include business details, a description of goods or services, VAT or tax information, and the total amount for accurate internal records.

Including VAT in a self-invoice ensures compliance with tax regulations and helps businesses accurately report their internal transactions.

Yes, self-invoices can be used to document services rendered within a company, ensuring proper record-keeping and accounting.

It ensures accurate tracking of internal transactions, simplifies tax reporting, and supports organized financial management.