Composition-Dealer Invoice Format

A composition-dealer invoice template is tailored for businesses registered under the GST composition scheme, simplifying their tax and billing requirements.

- Lists goods or services without charging GST.

- Ensures compliance with GST composition scheme rules.

- Simplifies tax filing with minimal paperwork.

Download Customizable Composition-Dealer Invoice Format

Create Your First Customize Composition-Dealer Invoice Template With CaptainBiz

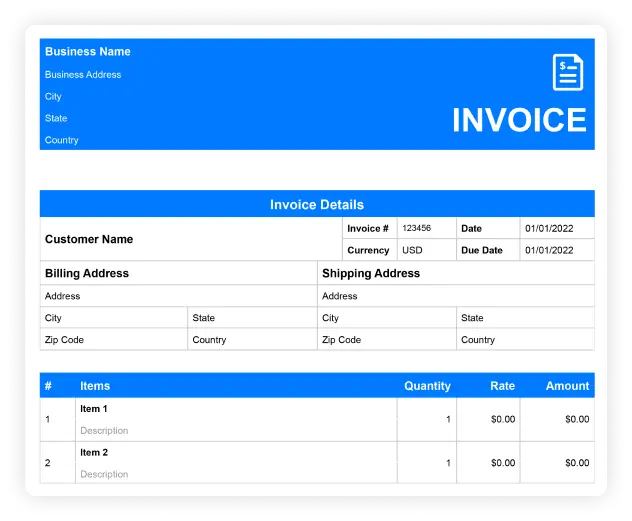

What Should Be Included in Composition-Dealer Bill Format

Supplier and Recipient Information:

Clearly mention the supplier’s and customer’s contact details to ensure compliance with GST regulations.

Invoice Number and Date:

Assign a unique invoice number and date to keep financial records organized and for easy reference during tax filings.

Description of Goods/Services:

Provide a detailed description of goods or services, quantity, and unit price, ensuring transparency in billing.

Total Amount:

Include the total payable amount without GST, adhering to the composition scheme’s requirements.

Composition Dealer Declaration:

State that the seller is a composition dealer, and no input tax credit can be claimed, fulfilling the legal obligation.

Payment Terms:

Specify the payment terms, due dates, and preferred methods to ensure timely payments.

So what are you waiting for?

Frequently Asked Questions (FAQs)

A composition-dealer invoice template is used by businesses under the GST composition scheme to bill customers without charging GST.

It should include supplier and recipient details, invoice number, goods/services description, total payable amount, and a composition dealer declaration.

The declaration informs customers that no GST is charged and they cannot claim input tax credit, ensuring transparency.

No, composition-dealer invoices do not include GST as per the GST composition scheme rules.

It simplifies tax compliance, reduces paperwork, and ensures transparency in billing without the complexities of regular GST filing.