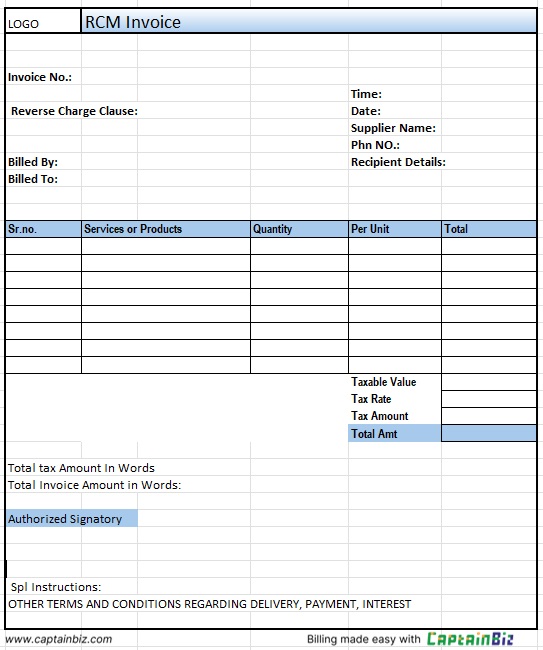

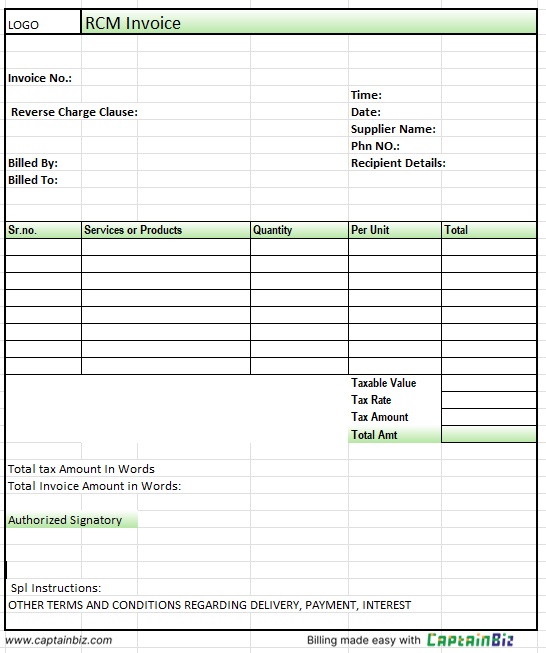

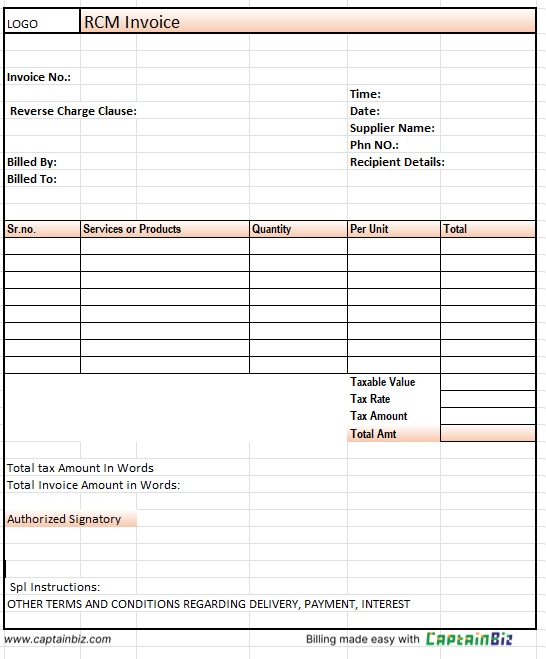

RCM Invoice Format

An RCM (Reverse Charge Mechanism) invoice template helps businesses comply with tax regulations by detailing taxes that need to be paid by the recipient.

- Specifies reverse charge taxes for compliance.

- Includes detailed tax breakdowns for easy filing.

- Customizable for various business transactions.

Download Customizable RCM Invoice Format

Create Your First Customize RCM Invoice Template With CaptainBiz

What Should Be Included in RCM Bill Format

Supplier and Recipient Information:

Clearly state both the supplier’s and recipient’s information for accurate identification and tax compliance.

Tax Breakdown:

Provide a detailed list of goods or services subject to reverse charge, along with applicable tax rates and amounts.

Invoice Number and Date:

Assign a unique invoice number and issue date to maintain accurate records for tax filings.

Payment Terms and Due Date:

Clearly outline the payment terms and who is responsible for paying the tax under the reverse charge mechanism.

Tax Details and Reverse Charge Clause:

Include a specific clause regarding the reverse charge mechanism and specify the applicable taxes to ensure compliance with tax regulations.

Additional Notes or Terms:

Include any special terms regarding the tax liability, services provided, or future transactions to clarify the invoicing process.

So what are you waiting for?

Frequently Asked Questions (FAQs)

An RCM invoice template is used to bill goods or services where the tax liability is transferred to the recipient under the reverse charge mechanism.

It should include supplier and recipient information, a breakdown of taxes, payment terms, and a reverse charge clause.

The reverse charge mechanism ensures that the recipient is liable for the tax, helping businesses comply with specific tax regulations.

Yes, RCM invoices can be customized for different goods or services subject to the reverse charge mechanism.

It helps businesses comply with tax laws, ensuring that the correct party pays the taxes and streamlining the invoicing process.