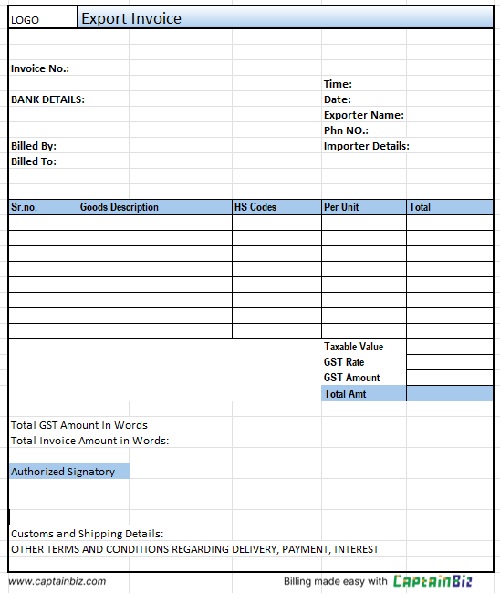

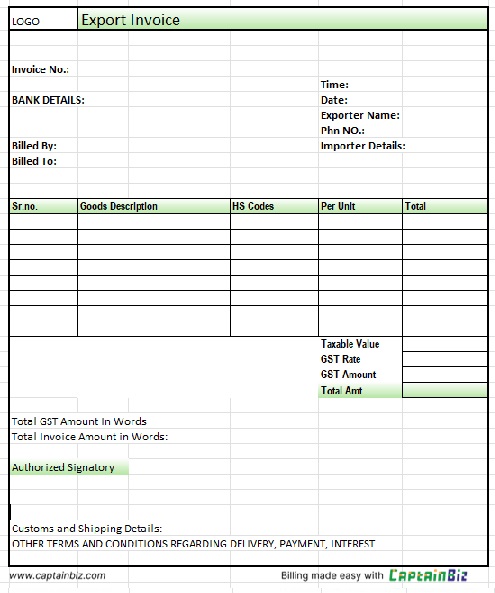

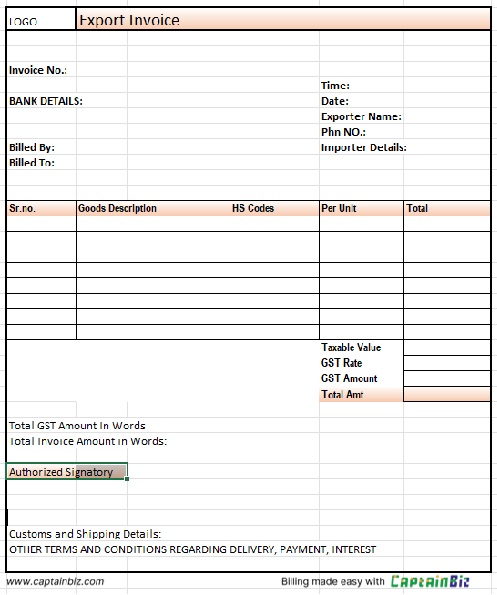

Export Invoice Format

An export invoice template is tailored for international transactions, ensuring that all details regarding shipping, customs, and payments are included.

- Complies with international trade regulations.

- Includes shipping, customs, and tax information.

- Lists goods with harmonized system (HS) codes.

Download Customizable Export Invoice Format

Create Your First Customize Export Invoice Template With CaptainBiz

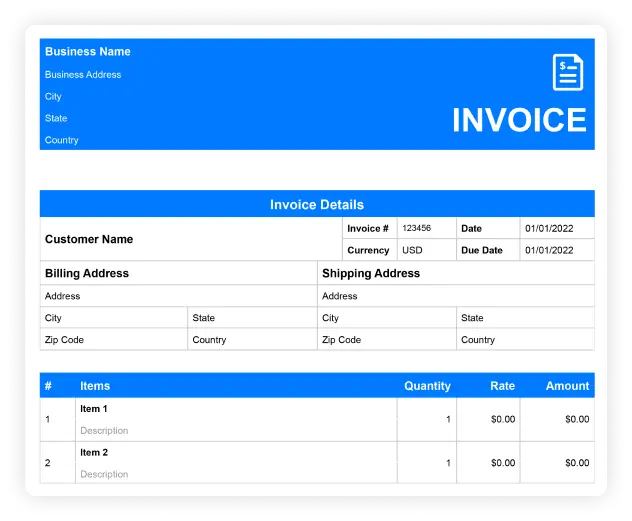

What Should Be Included in Export Invoice Template

Exporter and Importer Information:

Include detailed contact information for both the exporter and importer to ensure accurate documentation.

Goods Description and HS Codes:

Provide a detailed list of the goods being shipped, including quantities, weights, and harmonized system (HS) codes for customs.

Invoice Number and Date:

Assign a unique invoice number along with the date of issue for record-keeping and tracking.

Customs and Shipping Details:

Include shipping methods, delivery terms (Incoterms), and any customs clearance information required for international shipping.

Payment Terms:

Specify the payment methods, due dates, and terms, along with any currency conversion details.

Taxes and Duties:

Outline any applicable taxes or duties that need to be paid by the importer, ensuring compliance with local regulations.

So what are you waiting for?

Frequently Asked Questions (FAQs)

An export invoice template is used for international transactions, ensuring that all necessary information for shipping, customs, and taxes is included.

It ensures smooth customs clearance, accurate billing, and compliance with international trade regulations, helping businesses avoid delays.

It should include the exporter’s and importer’s information, a description of the goods, HS codes, shipping details, and payment terms.

Yes, export invoices can include details of currency conversion and allow payment in various currencies, based on the trade agreement.

They include harmonized system (HS) codes, shipping terms (Incoterms), and tax details required for customs and trade regulations.